Question: Please provide details for answer. Ms. Prince wants to create a scholarship in honor of her parents at the law school from which she received

Please provide details for answer.

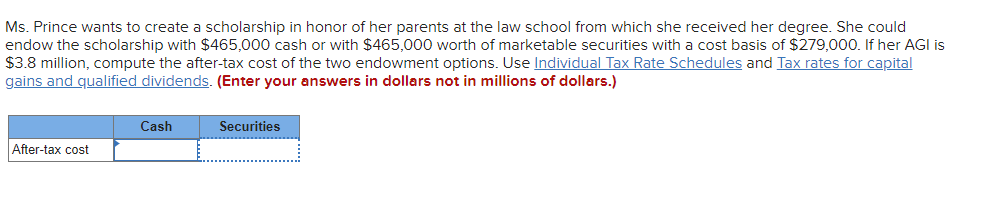

Ms. Prince wants to create a scholarship in honor of her parents at the law school from which she received her degree. She could endow the scholarship with $465,000 cash or with $465,000 worth of marketable securities with a cost basis of $279,000. If her AGI is $3.8 million, compute the after-tax cost of the two endowment options. Use Individual Tax Rate Schedules and Tax rates for capital gains and qualified dividends. (Enter your answers in dollars not in millions of dollars.) Cash Securities After-tax cost

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock