Question: Please solve and show your steps. Thank you! Ms . Prince wants to create a scholarship in honor of her parents at the law school

Please solve and show your steps. Thank you!

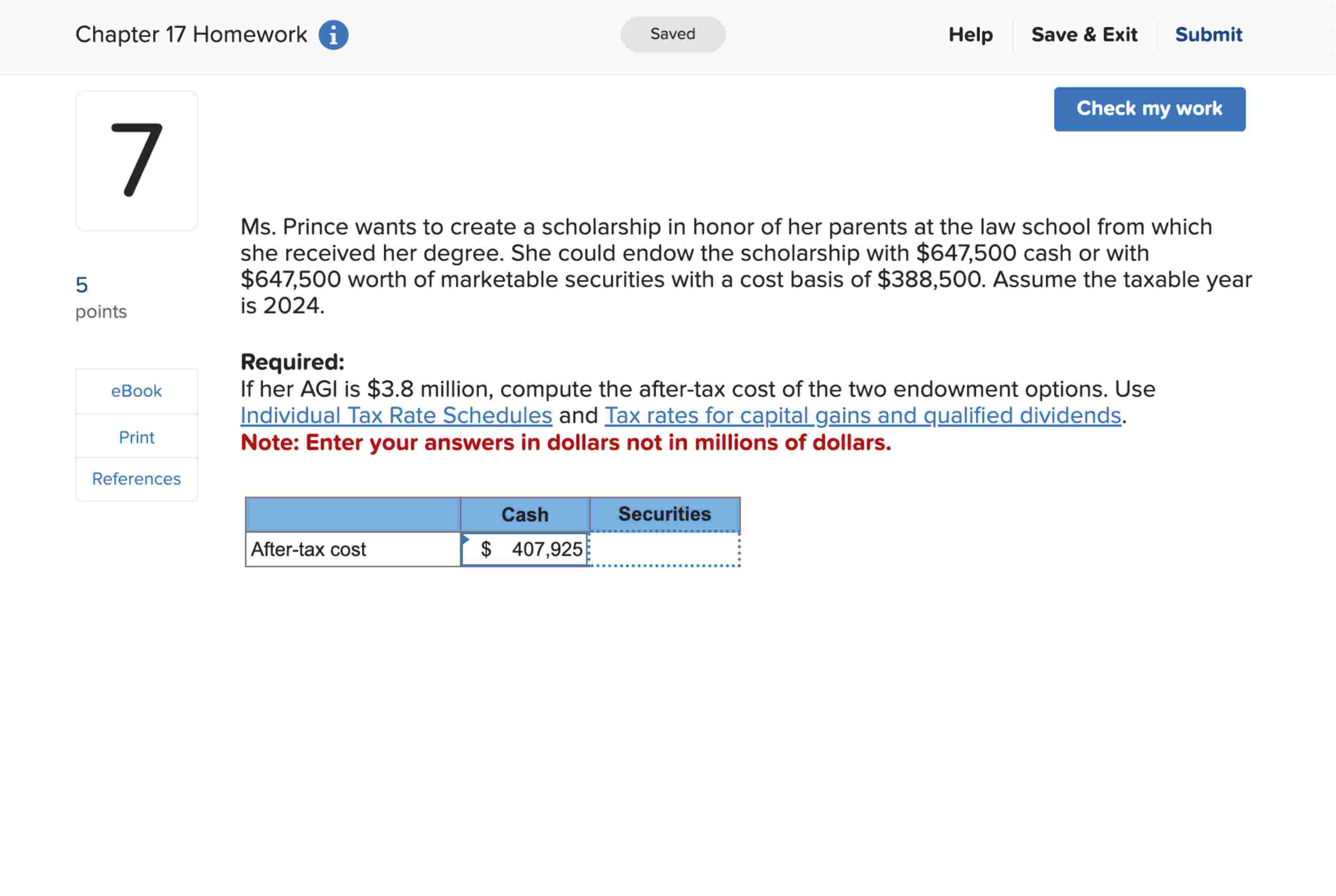

Ms Prince wants to create a scholarship in honor of her parents at the law school from which

she received her degree. She could endow the scholarship with $ cash or with

$ worth of marketable securities with a cost basis of $ Assume the taxable year

is

Required:

If her AGI is $ million, compute the aftertax cost of the two endowment options. Use

Individual Tax Rate Schedules and Tax rates for capital gains and qualified dividends.

Note: Enter your answers in dollars not in millions of dollars.

I am just not understanding what rates to use and when.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock