Question: Please provide equations for how to solve this problem set! Long Term Liabilities Bonds Payable The price a bond will sell for is determined by

Please provide equations for how to solve this problem set!

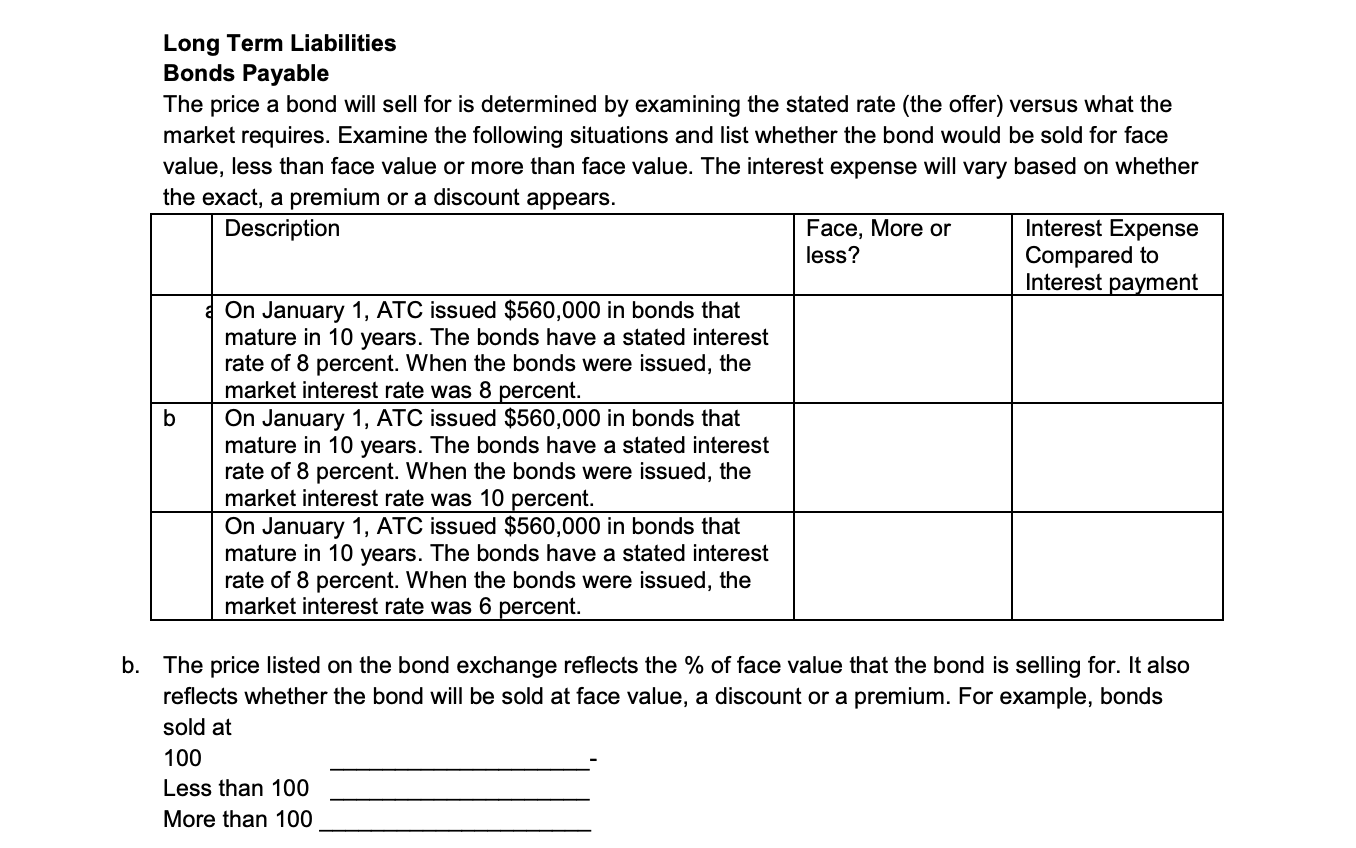

Long Term Liabilities Bonds Payable The price a bond will sell for is determined by examining the stated rate (the offer) versus what the market requires. Examine the following situations and list whether the bond would be sold for face value, less than face value or more than face value. The interest expense will vary based on whether the exact, a premium or a discount appears. Description Face. More or Interest Expense less? Compared to Interest ca ment On January 1 ATC issued $560, 000' In bonds that mature in 10 years. The bonds have a stated interest rate of 8 percent. When the bonds were issued, the market interest rate was 8 uercent. On January 1, ATC issued $560,000 in bonds that mature in 10 years. The bonds have a stated interest rate of 8 percent. When the bonds were issued, the market interest rate was 10 ercent. On January 1, ATC issued $560,000 in bonds that mature in 10 years. The bonds have a stated interest rate of 8 percent. When the bonds were issued, the market interest rate was 6 oercent. b. The price listed on the bond exchange reects the % of face value that the bond is selling for. It also reects whether the bond will be sold at face value, a discount or a premium. For example, bonds sold at 100 - Less than 100 More than 100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts