Question: Please provide Excel explanation. Data 1: Per Finance Yahoo, the corporation DE's Analysis ==> Revenue Estimate, DE's sales growth would be 13.00% next year (2022).

Please provide Excel explanation.

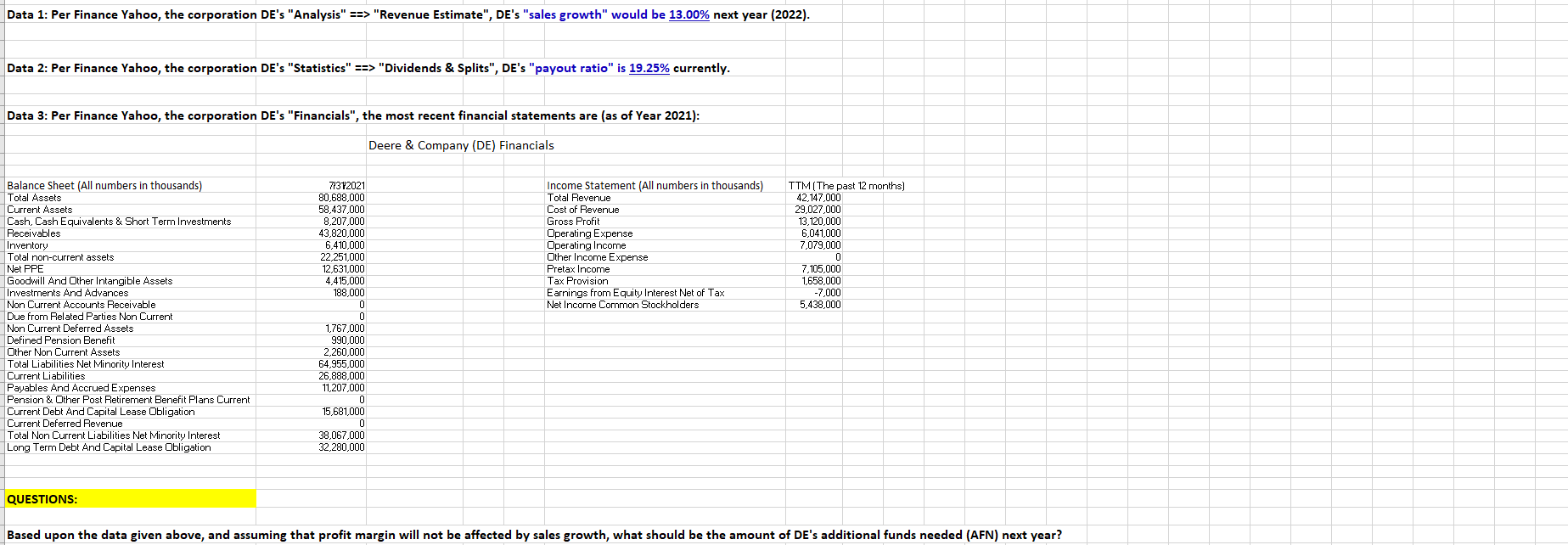

Data 1: Per Finance Yahoo, the corporation DE's "Analysis" ==> "Revenue Estimate", DE's "sales growth" would be 13.00% next year (2022). Data 2: Per Finance Yahoo, the corporation DE's "Statistics" ==> "Dividends & Splits", DE's "payout ratio" is 19.25% currently. Data 3: Per Finance Yahoo, the corporation DE's "Financials", the most recent financial statements are (as of Year 2021): Deere & Company (DE) Financials Income Statement All numbers in thousands) Total Revenue Cost of Revenue Gross Profit Operating Expense Operating Income Other Income Expense Pretax Income Tax Provision Earnings from Equity Interest Net of Tax Net Income Common Stockholders TTM(The past 12 months) 42,147,000 29,027,000 13, 120,000 6,041,000 7,079,000 0 7.105.000 1,658,000 -7,000 5,438,000 Balance Sheet (All numbers in thousands) Total Assets Current Assets Cash, Cash Equivalents & Short Term Investments Receivables Inventory Total non-current assets Net PPE Goodwill And Other Intangible Assets Investments And Advances Non Current Accounts Receivable Due from Related Parties Non Current Non Current Deferred Assets Defined Pension Benefit Other Non Current Assets Total Liabilities Net Minority Interest Current Liabilities Payables And Accrued Expenses Pension & Other Post Retirement Benefit Plans Current Current Debt And Capital Lease Obligation Current Deferred Revenue Total Non Current Liabilities Net Minority Interest Long Term Debt And Capital Lease Obligation 7/312021 80,688,000 58,437,000 8,207,000 43.820.000 6,410,000 22,251,000 12,631,000 4,415,000 188.000 0 0 1,767,000 990,000 2,260,000 64,955,000 26,888,000 11,207,000 0 15,681,000 0 38,067,000 32,280,000 QUESTIONS: Based upon the data given above, and assuming that profit margin will not be affected by sales growth, what should be the amount of DE's additional funds needed (AFN) next year? Data 1: Per Finance Yahoo, the corporation DE's "Analysis" ==> "Revenue Estimate", DE's "sales growth" would be 13.00% next year (2022). Data 2: Per Finance Yahoo, the corporation DE's "Statistics" ==> "Dividends & Splits", DE's "payout ratio" is 19.25% currently. Data 3: Per Finance Yahoo, the corporation DE's "Financials", the most recent financial statements are (as of Year 2021): Deere & Company (DE) Financials Income Statement All numbers in thousands) Total Revenue Cost of Revenue Gross Profit Operating Expense Operating Income Other Income Expense Pretax Income Tax Provision Earnings from Equity Interest Net of Tax Net Income Common Stockholders TTM(The past 12 months) 42,147,000 29,027,000 13, 120,000 6,041,000 7,079,000 0 7.105.000 1,658,000 -7,000 5,438,000 Balance Sheet (All numbers in thousands) Total Assets Current Assets Cash, Cash Equivalents & Short Term Investments Receivables Inventory Total non-current assets Net PPE Goodwill And Other Intangible Assets Investments And Advances Non Current Accounts Receivable Due from Related Parties Non Current Non Current Deferred Assets Defined Pension Benefit Other Non Current Assets Total Liabilities Net Minority Interest Current Liabilities Payables And Accrued Expenses Pension & Other Post Retirement Benefit Plans Current Current Debt And Capital Lease Obligation Current Deferred Revenue Total Non Current Liabilities Net Minority Interest Long Term Debt And Capital Lease Obligation 7/312021 80,688,000 58,437,000 8,207,000 43.820.000 6,410,000 22,251,000 12,631,000 4,415,000 188.000 0 0 1,767,000 990,000 2,260,000 64,955,000 26,888,000 11,207,000 0 15,681,000 0 38,067,000 32,280,000 QUESTIONS: Based upon the data given above, and assuming that profit margin will not be affected by sales growth, what should be the amount of DE's additional funds needed (AFN) next year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts