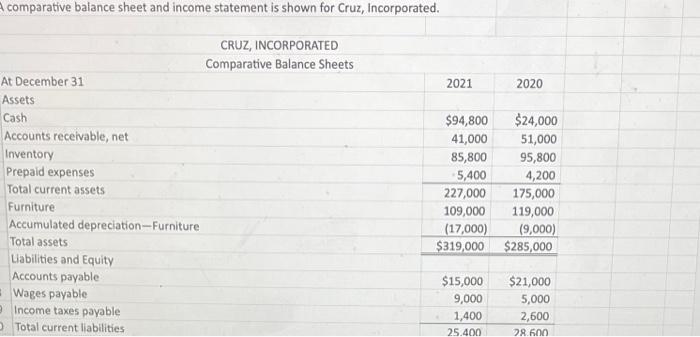

Question: please provide excel formulas A comparative balance sheet and income statement is shown for Cruz, Incorporated. CRUZ, INCORPORATED Comparative Balance Sheets At December 31 Assets

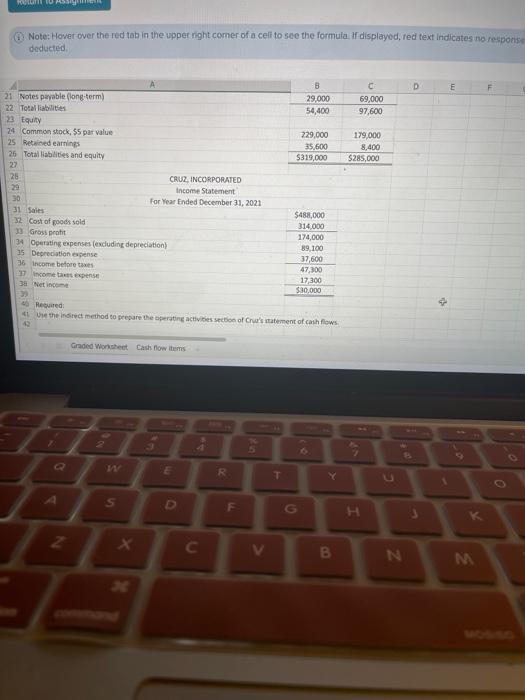

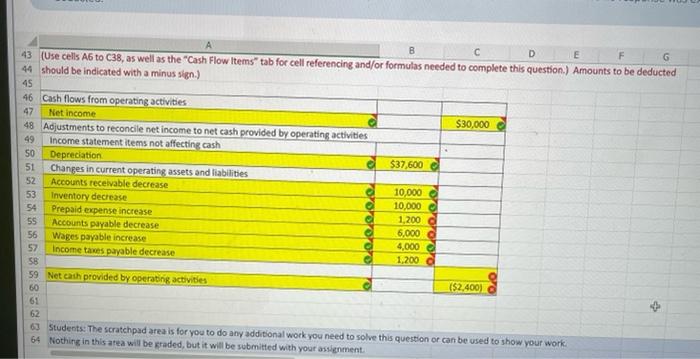

A comparative balance sheet and income statement is shown for Cruz, Incorporated. CRUZ, INCORPORATED Comparative Balance Sheets At December 31 Assets Cash Accounts receivable, net Inventory Prepaid expenses Total current assets Furniture Accumulated depreciation-Furniture Total assets Liabilities and Equity Accounts payable =Wages payable Income taxes payable Total current liabilities 2021 $94,800 41,000 85,800 5,400 227,000 109,000 (17,000) $319,000 $15,000 9,000 1,400 25.400 2020 $24,000 51,000 95,800 4,200 175,000 119,000 (9,000) $285,000 $21,000 5,000 2,600 28.600 Room To Assig Note: Hover over the red tab in the upper right corner of a cell to see the formula. If displayed, red text indicates no responser deducted. 21 Notes payable (long-term) 22 Total liabilities 23 Equity 24 Common stock, $5 par value 25 Retained earnings 26 Total liabilities and equity 27 26 29 30 31 Sales 32 Cost of goods sold 33 Gross profit 34 Operating expenses (excluding depreciation) 35 Depreciation expense 7 Q Z 36 Income before taxes 37 Income taxes expense 38 Net income 3) 40 Required: 41 Use the indirect method to prepare the operating activities section of Cruz's statement of cash flows. 42 Graded Worksheet Cash flow items W CRUZ, INCORPORATED Income Statement For Year Ended December 31, 2021 S X X E D 4 C R F T 5 V T B 29,000 54,400 229,000 35,600 $319,000 $488,000 314,000 174,000 89,100 37,600 47,300 17,300 $30,000 G 6 B C 69,000 97,600 179,000 8,400 $285,000 7 H Z N D 3 1 E M B C D E F G 43 (Use cells A6 to C38, as well as the "Cash Flow Items" tab for cell referencing and/or formulas needed to complete this question.) Amounts to be deducted 44 should be indicated with a minus sign.) 45 46 Cash flows from operating activities 47 Net income 48 Adjustments to reconcile net income to net cash provided by operating activities 49 Income statement items not affecting cash 50 51 52 53 54 55 56 57 58 59 Net cash provided by operating activities 60 61 Depreciation Changes in current operating assets and liabilities Accounts receivable decrease Inventory decrease Prepaid expense increase Accounts payable decrease Wages payable increase Income taxes payable decrease e O e e d e $37,600 10,000 10,000 e 1,200 C 6,000 4,000 1,200 d $30,000 ($2,400) 62 63 Students: The scratchpad area is for you to do any additional work you need to solve this question or can be used to show your work. 64 Nothing in this area will be graded, but it will be submitted with your assignment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts