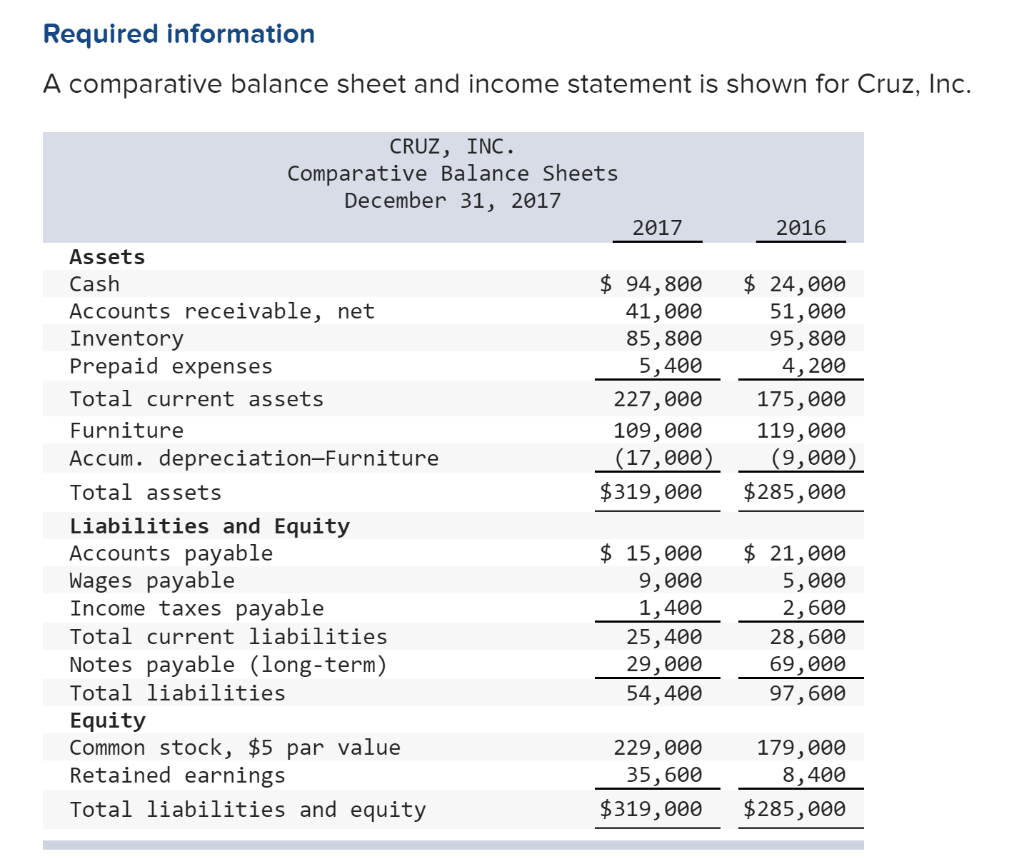

Question: Required information A comparative balance sheet and income statement is shown for Cruz, Inc. CRUZ, INC. Comparative Balance Sheets December 31, 2017 2017 2016 Assets

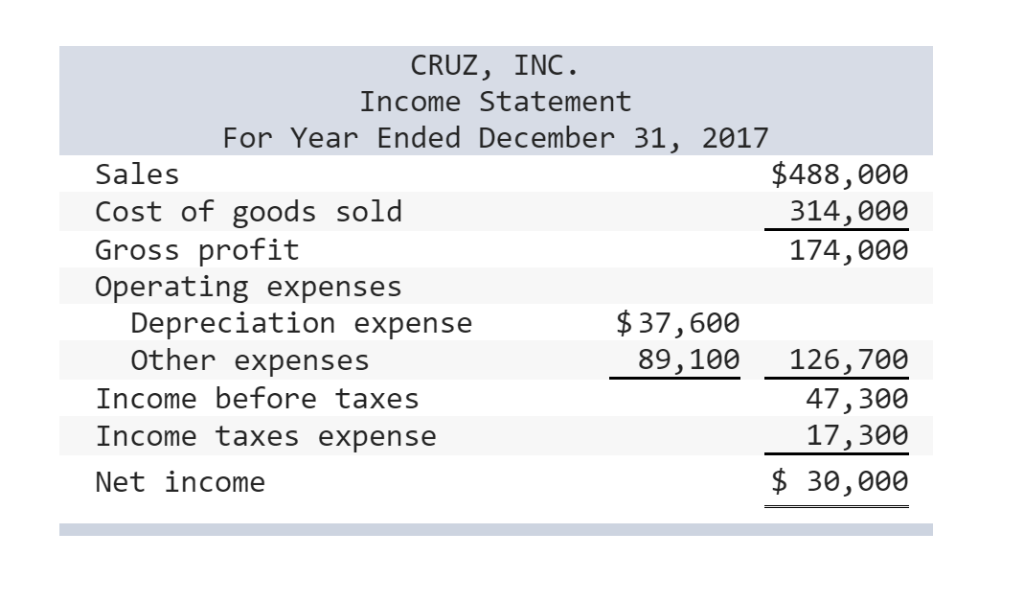

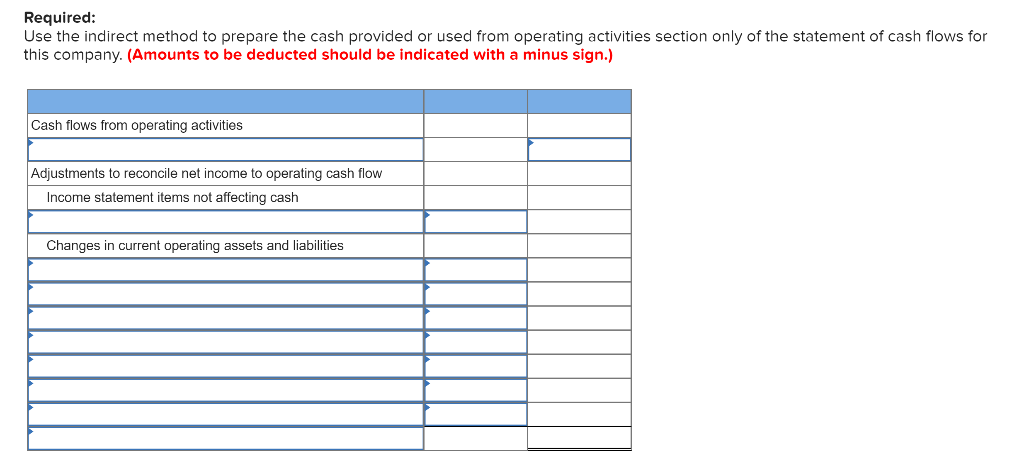

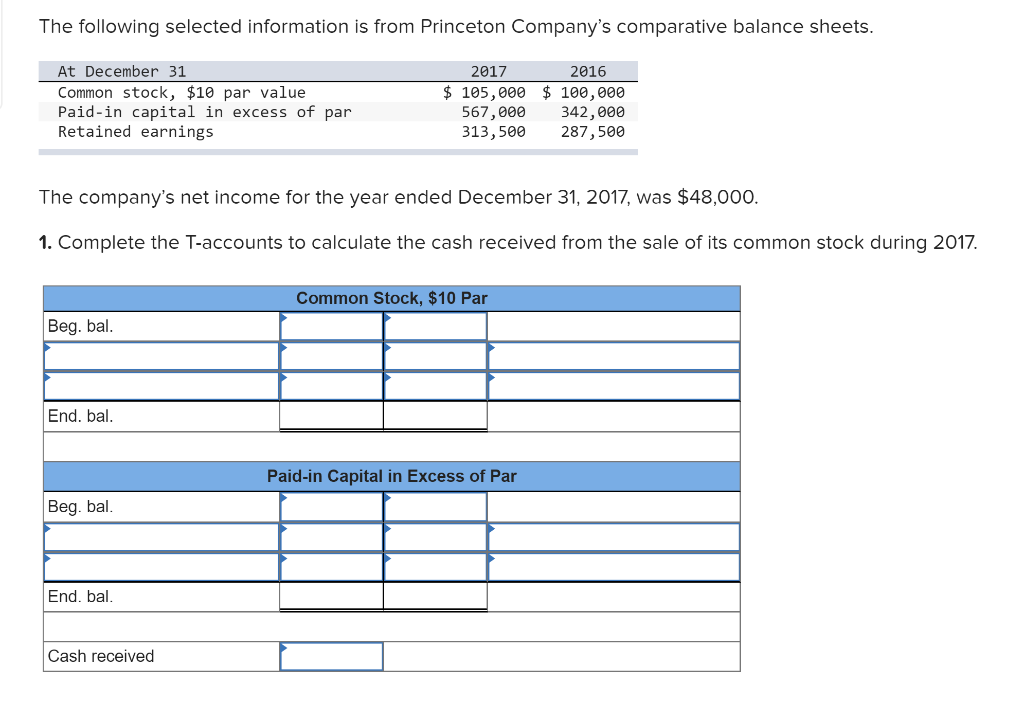

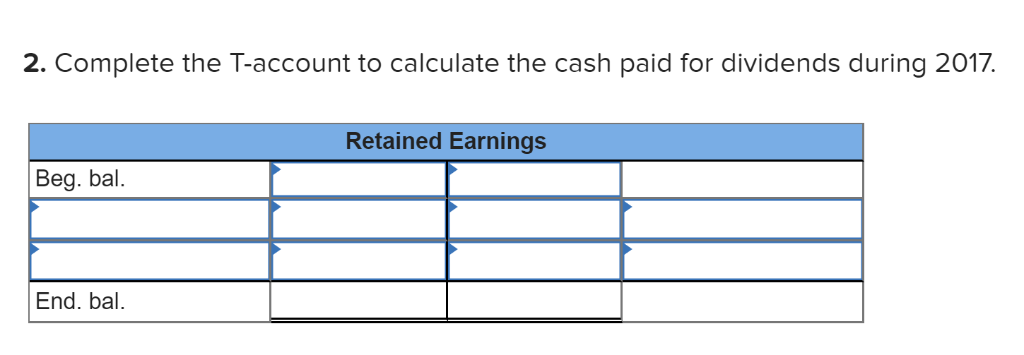

Required information A comparative balance sheet and income statement is shown for Cruz, Inc. CRUZ, INC. Comparative Balance Sheets December 31, 2017 2017 2016 Assets $24,000 51,000 Cash 94,800 41,000 85,800 5,400 Accounts receivable, net Inventory 95,800 4,200 Prepaid expenses Total current assets 175,000 227,000 Furniture 119,000 (9,000) 109,000 (17,000) Accum. depreciation-Furniture $319,000 $285,000 Total assets Liabilities and Equity Accounts payable Wages payable Income taxes payable $15,000 $ 21,000 5,000 2,600 9,000 1,400 25,400 29,000 Total current liabilities 28,600 69,000 Notes payable (long-term) Total liabilities 54,400 97,600 Equity Common stock, $5 par value Retained earnings 229,000 35,600 179,000 8,400 Total liabilities and equity $319,000 $285,000 CRUZ, INC. Income Statement For Year Ended December 31, 2017 $488,000 314,000 174,000 Sales Cost of goods sold Gross profit Operating expenses Depreciation expense Other expenses $37,600 89,100 126,700 47,300 17,300 Income before taxes Income taxes expense 30,000 Net income Required: Use the indirect method to prepare the cash provided or used from operating activities section only of the statement of cash flows for this company. (Amounts to be deducted should be indicated with a minus sign.) Cash flows from operating activities Adjustments to reconcile net income to operating cash flow Income statement items not affecting cash Changes in current operating assets and liabilities The following selected information is from Princeton Company's comparative balance sheets. At December 31 2017 2016 $105,000 $ 100,000 567,000 313,500 Common stock, $10 par value Paid-in capital in excess of par Retained earnings 342,000 287,500 The company's net income for the year ended December 31, 2017, was $48,000. 1. Complete the T-accounts to calculate the cash received from the sale of its common stock during 2017. Common Stock, $10 Par Beg. bal. End. bal Paid-in Capital in Excess of Par Beg. ba End. bal Cash received 2. Complete the T-account to calculate the cash paid for dividends during 2017 Retained Earnings Beg. bal. End. bal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts