Question: Please provide Excel work sheets with and without formulas. I will not be able to complete this problem without them. If provided a thumbs up

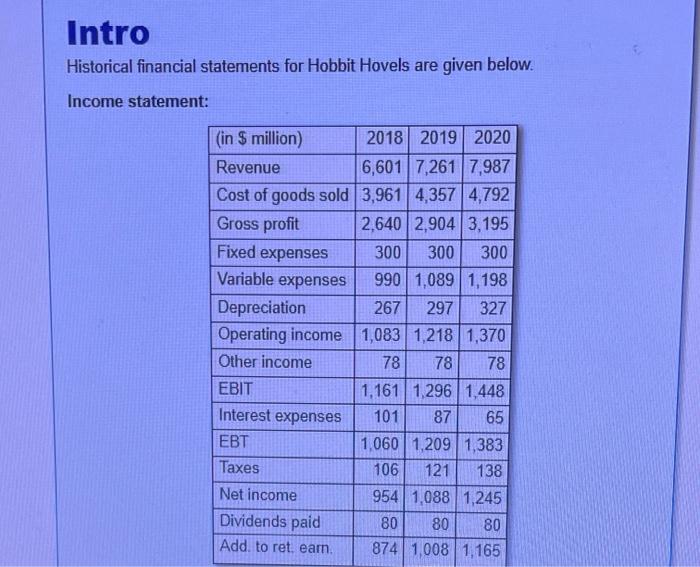

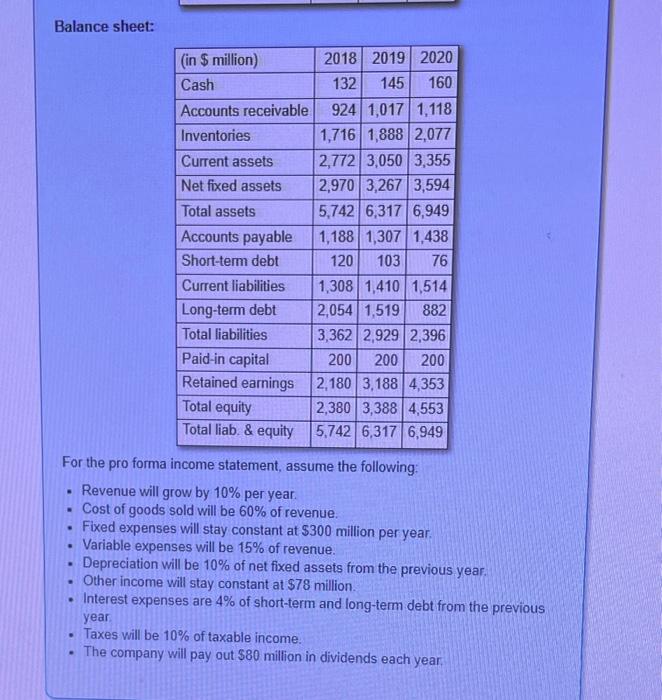

Intro Historical financial statements for Hobbit Hovels are given below. Income statement: (in $ million) 2018 2019 2020 Revenue 6,601 7,261 7,987 Cost of goods sold 3,961 4.357 4,792 Gross profit 2,640 2,904 3,195 Fixed expenses 300 300 300 Variable expenses 990 1,089 1,198 Depreciation 267 297 327 Operating income 1,083 1,218 1,370 Other income 78 78 78 EBIT 1,161 1.2961,448 Interest expenses 101 87 65 | 1,060 1,2091,383 Taxes 106 121 138 Net income 954 1,088 1,245 Dividends paid 80 80 80 Add to ret. earn 8741,008 1,165 Balance sheet: (in $ million) 2018 2019 2020 Cash 132 145 160 Accounts receivable 924 1,017 1,118 Inventories 1,716 1,888 2,077 Current assets 2,772 3,050 3,355 Net fixed assets 2,9703,2673,594 Total assets 5,742 6,3176,949 Accounts payable 1,188 1,307 1,438 Short-term debt 120 103 76 Current liabilities 1,308 1.410 1,514 Long-term debt 2,054 1,519 882 Total liabilities 3,362 2,9292,396 Paid-in capital 200 200 200 Retained earnings 2,180 3,188 4,353 Total equity 2,380 3,388 4,553 Total liab. & equity 5.742 6,3176,949 . For the pro forma income statement, assume the following: Revenue will grow by 10% per year. Cost of goods sold will be 60% of revenue. Fixed expenses will stay constant at $300 million per year. Variable expenses will be 15% of revenue. Depreciation will be 10% of net fixed assets from the previous year. Other income will stay constant at $78 million. Interest expenses are 4% of short-term and long-term debt from the previous year Taxes will be 10% of taxable income. The company will pay out $80 million in dividends each year. . IB. Attempt 1/10 for 10 pts. Part 1 What will be the expected net income in 2021 (in $ million)? 0+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts