Question: Please provide Excel work sheets with and without formulas. I will not be able to complete this problem without them. If provided a thumbs up

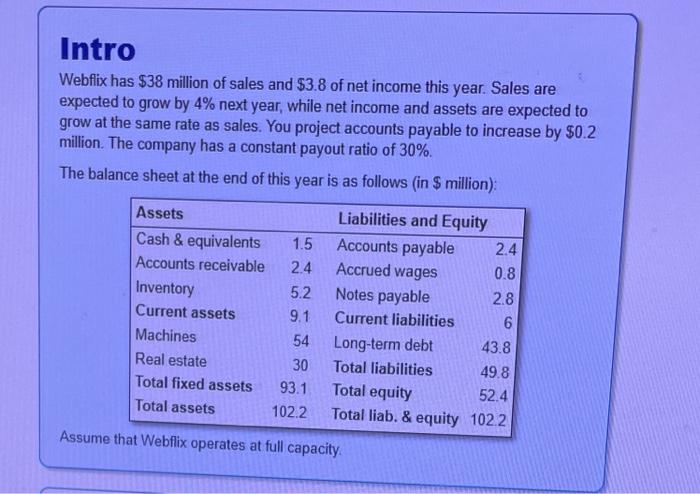

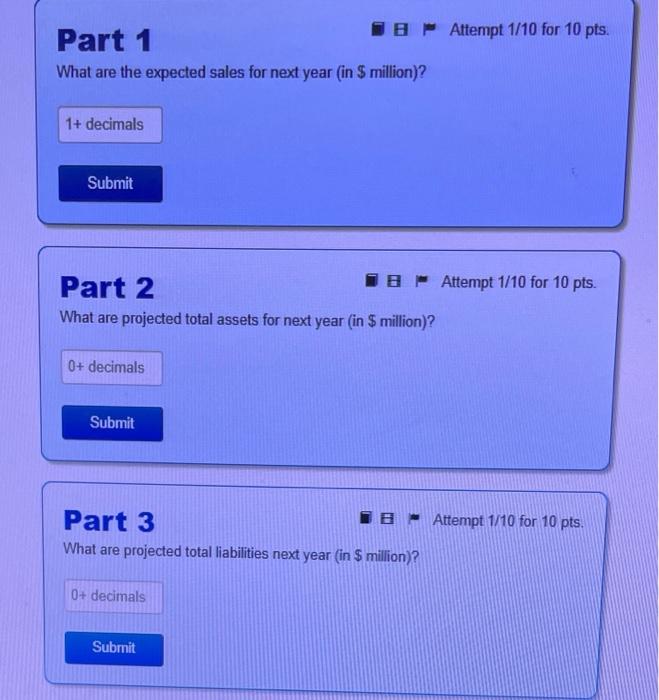

Intro Webflix has $38 million of sales and $3.8 of net income this year. Sales are expected to grow by 4% next year, while net income and assets are expected to grow at the same rate as sales. You project accounts payable to increase by $0.2 million. The company has a constant payout ratio of 30%. The balance sheet at the end of this year is as follows (in $ million) Assets Cash & equivalents Accounts receivable Inventory Current assets Machines Real estate Total fixed assets Total assets 1.5 2.4 5.2 9.1 54 30 93.1 102.2 Liabilities and Equity Accounts payable 2.4 Accrued wages 0.8 Notes payable 2.8 Current liabilities 6 Long-term debt 43.8 Total liabilities 49.8 Total equity 52.4 Total liab. & equity 102.2 Assume that Webflix operates at full capacity Part 1 JB Attempt 1/10 for 10 pts. What are the expected sales for next year (in $ million)? 1+ decimals Submit Part 2 SE Attempt 1/10 for 10 pts. What are projected total assets for next year (in $ million)? 0+ decimals Submit Part 3 Te Attempt 1/10 for 10 pts. What are projected total liabilities next year (in $ million)? 0+ decimals Submit Part 4 IE- Attempt 1/10 for 10 pts. What is projected equity next year (in $ million)? 0+ decimals Submit Part 5 IB Attempt 1/10 for 10 pts What is the external financing needed (EFN) for next year (in $ million)? 2+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts