Question: Please provide explanations for True or False statements Case 6: Fieldcrest Cannon, Inc. v. Meyer, 1997 U.S. App. LEXIS 29152 (7 Cir. 1997). (Mallor, 16

Please provide explanations for True or False statements

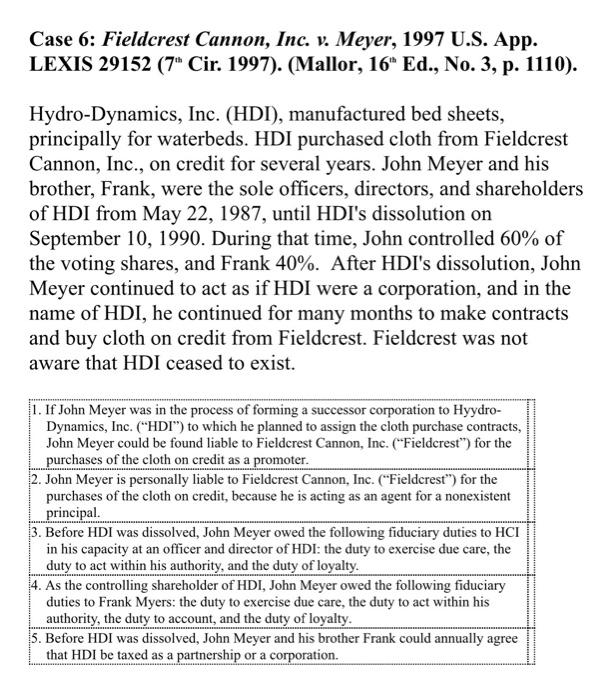

Case 6: Fieldcrest Cannon, Inc. v. Meyer, 1997 U.S. App. LEXIS 29152 (7" Cir. 1997). (Mallor, 16 Ed., No. 3, p. 1110). Hydro-Dynamics, Inc. (HDI), manufactured bed sheets, principally for waterbeds. HDI purchased cloth from Fieldcrest Cannon, Inc., on credit for several years. John Meyer and his brother, Frank, were the sole officers, directors, and shareholders of HDI from May 22, 1987, until HDI's dissolution on September 10, 1990. During that time, John controlled 60% of the voting shares, and Frank 40%. After HDI's dissolution, John Meyer continued to act as if HDI were a corporation, and in the name of HDI, he continued for many months to make contracts and buy cloth on credit from Fieldcrest. Fieldcrest was not aware that HDI ceased to exist. 1. If John Meyer was in the process of forming a successor corporation to Hyydro- Dynamics, Inc. ("HDI") to which he planned to assign the cloth purchase contracts, John Meyer could be found liable to Fieldcrest Cannon, Inc. ("Fieldcrest") for the purchases of the cloth on credit as a promoter. 2. John Meyer is personally liable to Fieldcrest Cannon, Inc. ("Fieldcrest) for the purchases of the cloth on credit, because he is acting as an agent for a nonexistent principal. 3. Before HDI was dissolved, John Meyer owed the following fiduciary duties to HCI in his capacity at an officer and director of HDI: the duty to exercise due care, the duty to act within his authority, and the duty of loyalty. 4. As the controlling shareholder of HDI, John Meyer owed the following fiduciary duties to Frank Myers: the duty to exercise due care, the duty to act within his authority, the duty to account, and the duty of loyalty. 5. Before HDI was dissolved, John Meyer and his brother Frank could annually agree that HDI be taxed as a partnership or a corporation

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock