Question: Please provide formulas. You must also include an excel analysis of daily returns of the active portfolio to the S&P over the 12 week trading

Please provide formulas.

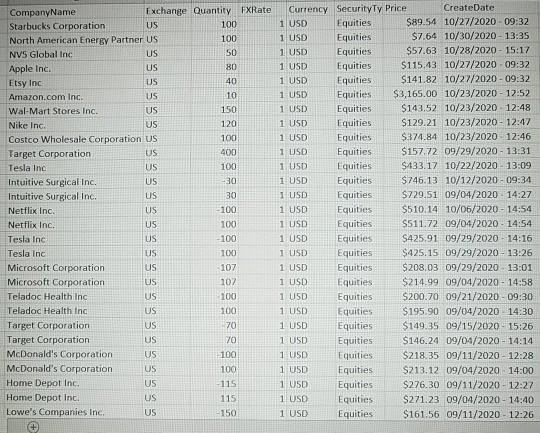

You must also include an excel analysis of daily returns of the active portfolio to the S&P over the 12 week trading period (downloads values from Stock-Trak to an Excel spreadsheet). Calculate and compare arithmetic and geometric means (daily and annualized). Calculate and compare volatility measures; i.e., standard deviation (daily and annualized), range. Compare other characteristics of the return series (i.e. skewness and kurtosis). Calculate and discuss the correlation between the active and passive portfolio and the S&P (does the correlation seem reasonable, given the trading in active portfolio?). Regression of Active (y-axis variable) vs. S&P portfolio (x-axis variable) returns. Regression of Passive (y-axis variable) vs. S&P portfolio (x-axis variable) returns. Intercept: What is the intercept's value and is the intercept significant at the 5% level? Note: that the intercept is similar to the Jensen's alpha What is the value of the beta coefficient and its interpretation? Calculate and compare the HPR over the trading period for the active and passive portfolios to the S&P 500. Does the relationship seem reasonable given the risk associated with each portfolio/index? Are markets efficient, nearly efficient or inefficient? (justify the response based on your trading) . Company Name Exchange Quantity FXRate Starbucks Corporation US 100 North American Energy Partner US 100 NVS Global Inc US 50 Apple Inc. US 80 Etsy Inc US 40 Amazon.com Inc. US 10 Wal-Mart Stores Inc. US 150 Nike Inc US 120 Costco Wholesale Corporation US 100 Target Corporation US 400 Tesla Inc US 100 Intuitive Surgical Inc. US 30 Intuitive Surgical Inc. US 30 Netflix Inc. US -100 Netflix Inc. US Tesla Inc US -100 Tesla Inc US 100 Microsoft Corporation US 107 Microsoft Corporation US 102 Teladoc Health Inc US 100 Teladoc Health Inc US 100 Target Corporation US 70 Target Corporation US 70 McDonald's Corporation US 100 McDonald's Corporation US 100 Home Depot Inc. US -115 Home Depot Inc. US 115 Lowe's Companies Inc. US - 150 Currency Security Ty Price CreateDate 1 USD Equities $89.54 10/27/2020-09:32 1 USD Equities $7.64 10/30/2020 - 13:35 1 USD Equities $57.63 10/28/2020 - 15:17 1 USD Equities $115.413 10/27/2020 09:32 1 USD Equities $141.82 10/27/2020 - 09:32 1 USD Equities $3,165.00 10/23/2020 - 12:52 1 USD Equities $143.52 10/23/2020 12:48 1 USD Equities $129.21 10/23/2020 - 12:47 1 USD Equities $374.84 10/23/2020 12:46 1 USD Equities $157.72 09/29/2020 - 13:31 1 USD Equities $433.17 10/22/2020 - 13:09 1 USD Equities $746.13 10/12/2020 - 09:34 1 USD Equities S729.51 09/04/2020 14:27 1 USD Equities $510 14 10/06/2020 - 14:54 1 USD Equities S511.72 09/04/2020 - 14:54 1 USD Equities $425.91 09/29/2020 - 14:16 1 USD Equities $425.15 09/29/2020 - 13:26 1 USD Equities $208.03 09/29/2020 13:01 1 USD Equities $214.99 09/04/2020 - 14:58 1 USD Equities $200.70 09/21/2020 - 09:30 1 USD Equities $195.90 09/04/2020 14:30 1 USD Equities $149.35 09/15/2020 - 15:26 1 USD Equities $146.24 09/04/2020 - 14:14 1 USD Equities $218.35 09/11/2020 - 12:28 1 USD Equities $213.12 09/04/2020 14:00 1 USD Equities $276.30 09/11/2020 - 12:27 1 USD Equities $271.23 09/04/2020 - 14:40 1 USD Equities $161.56 09/11/2020 12:26 100 You must also include an excel analysis of daily returns of the active portfolio to the S&P over the 12 week trading period (downloads values from Stock-Trak to an Excel spreadsheet). Calculate and compare arithmetic and geometric means (daily and annualized). Calculate and compare volatility measures; i.e., standard deviation (daily and annualized), range. Compare other characteristics of the return series (i.e. skewness and kurtosis). Calculate and discuss the correlation between the active and passive portfolio and the S&P (does the correlation seem reasonable, given the trading in active portfolio?). Regression of Active (y-axis variable) vs. S&P portfolio (x-axis variable) returns. Regression of Passive (y-axis variable) vs. S&P portfolio (x-axis variable) returns. Intercept: What is the intercept's value and is the intercept significant at the 5% level? Note: that the intercept is similar to the Jensen's alpha What is the value of the beta coefficient and its interpretation? Calculate and compare the HPR over the trading period for the active and passive portfolios to the S&P 500. Does the relationship seem reasonable given the risk associated with each portfolio/index? Are markets efficient, nearly efficient or inefficient? (justify the response based on your trading) . Company Name Exchange Quantity FXRate Starbucks Corporation US 100 North American Energy Partner US 100 NVS Global Inc US 50 Apple Inc. US 80 Etsy Inc US 40 Amazon.com Inc. US 10 Wal-Mart Stores Inc. US 150 Nike Inc US 120 Costco Wholesale Corporation US 100 Target Corporation US 400 Tesla Inc US 100 Intuitive Surgical Inc. US 30 Intuitive Surgical Inc. US 30 Netflix Inc. US -100 Netflix Inc. US Tesla Inc US -100 Tesla Inc US 100 Microsoft Corporation US 107 Microsoft Corporation US 102 Teladoc Health Inc US 100 Teladoc Health Inc US 100 Target Corporation US 70 Target Corporation US 70 McDonald's Corporation US 100 McDonald's Corporation US 100 Home Depot Inc. US -115 Home Depot Inc. US 115 Lowe's Companies Inc. US - 150 Currency Security Ty Price CreateDate 1 USD Equities $89.54 10/27/2020-09:32 1 USD Equities $7.64 10/30/2020 - 13:35 1 USD Equities $57.63 10/28/2020 - 15:17 1 USD Equities $115.413 10/27/2020 09:32 1 USD Equities $141.82 10/27/2020 - 09:32 1 USD Equities $3,165.00 10/23/2020 - 12:52 1 USD Equities $143.52 10/23/2020 12:48 1 USD Equities $129.21 10/23/2020 - 12:47 1 USD Equities $374.84 10/23/2020 12:46 1 USD Equities $157.72 09/29/2020 - 13:31 1 USD Equities $433.17 10/22/2020 - 13:09 1 USD Equities $746.13 10/12/2020 - 09:34 1 USD Equities S729.51 09/04/2020 14:27 1 USD Equities $510 14 10/06/2020 - 14:54 1 USD Equities S511.72 09/04/2020 - 14:54 1 USD Equities $425.91 09/29/2020 - 14:16 1 USD Equities $425.15 09/29/2020 - 13:26 1 USD Equities $208.03 09/29/2020 13:01 1 USD Equities $214.99 09/04/2020 - 14:58 1 USD Equities $200.70 09/21/2020 - 09:30 1 USD Equities $195.90 09/04/2020 14:30 1 USD Equities $149.35 09/15/2020 - 15:26 1 USD Equities $146.24 09/04/2020 - 14:14 1 USD Equities $218.35 09/11/2020 - 12:28 1 USD Equities $213.12 09/04/2020 14:00 1 USD Equities $276.30 09/11/2020 - 12:27 1 USD Equities $271.23 09/04/2020 - 14:40 1 USD Equities $161.56 09/11/2020 12:26 100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts