Question: Please provide full answer in excel. eBook The real rate of interest has been estimated to be 3 percent, and the expected long-term annual inflation

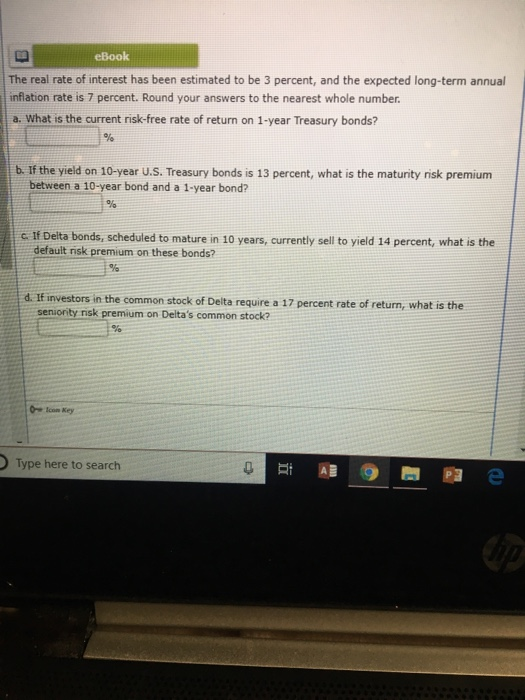

eBook The real rate of interest has been estimated to be 3 percent, and the expected long-term annual inflation rate is 7 percent. Round your answers to the nearest whole number. a. What is the current risk-free rate of return on 1-year Treasury bonds? b. If the yield on 10-year u.S. Treasury bonds is 13 percent, what is the maturity risk premium between a 10-year bond and a 1-year bond? If Delta bonds, scheduled to mature in 10 years, currently sell to yield 14 percent, what is the default risk premium on these bonds? d. If investors in the common stock of Delta require a 17 percent rate of return, what is the senionity risk premium on Delta's common stock? 0re lcon Key Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts