Question: Please, if possible use Excel formulas, cell references, & horizontal timelines to show all work. The real rate of interest has been estimated to be

Please, if possible use Excel formulas, cell references, & horizontal timelines to show all work.

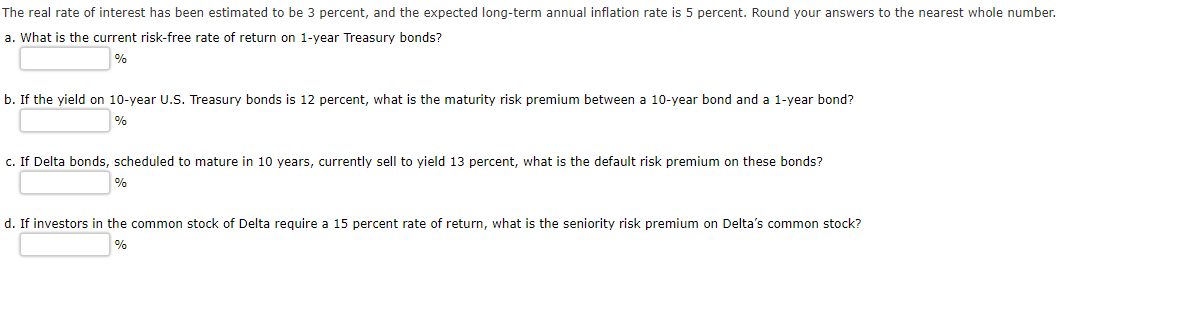

The real rate of interest has been estimated to be 3 percent, and the expected long-term annual inflation rate is 5 percent. Round your answers to the nearest whole number.

- What is the current risk-free rate of return on 1-year Treasury bonds? %

- If the yield on 10-year U.S. Treasury bonds is 12 percent, what is the maturity risk premium between a 10-year bond and a 1-year bond? %

- If Delta bonds, scheduled to mature in 10 years, currently sell to yield 13 percent, what is the default risk premium on these bonds? %

- If investors in the common stock of Delta require a 15 percent rate of return, what is the seniority risk premium on Deltas common stock? %

The real rate of interest has been estimated to be 3 percent, and the expected long-term annual inflation rate is 5 percent. Round your answers to the nearest whole number. a. What is the current risk-free rate of return on 1 -year Treasury bonds? % b. If the yield on 10-year U.S. Treasury bonds is 12 percent, what is the maturity risk premium between a 10 -year bond and a 1 -year bond? % c. If Delta bonds, scheduled to mature in 10 years, currently sell to yield 13 percent, what is the default risk premium on these bonds? % d. If investors in the common stock of Delta require a 15 percent rate of return, what is the seniority risk premium on Delta's common stock? %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts