Question: please provide full calculation steps. thank you You wake up on 1 January 2021 with a large fortune and you make directly an appointment with

please provide full calculation steps. thank you

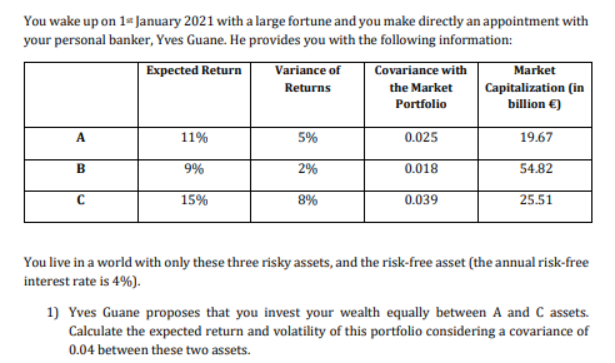

You wake up on 1 January 2021 with a large fortune and you make directly an appointment with your personal banker, Yves Guane. He provides you with the following information: Expected Return Variance of Covariance with Market Returns the Market Capitalization in Portfolio billion ) 11% 5% 0.025 19.67 B 9% 2% 0.018 54.82 15% 8% 0.039 25.51 You live in a world with only these three risky assets, and the risk-free asset (the annual risk-free interest rate is 4%). 1) Yves Guane proposes that you invest your wealth equally between A and C assets. Calculate the expected return and volatility of this portfolio considering a covariance of 0.04 between these two assets

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts