Question: Please provide help with valuation, explaining deferred tax treatment, projection of terminal cash flows and use of EBITDA multiple GCL Industries is an industrial conglomerate

Please provide help with valuation, explaining deferred tax treatment, projection of terminal cash flows and use of EBITDA multiple

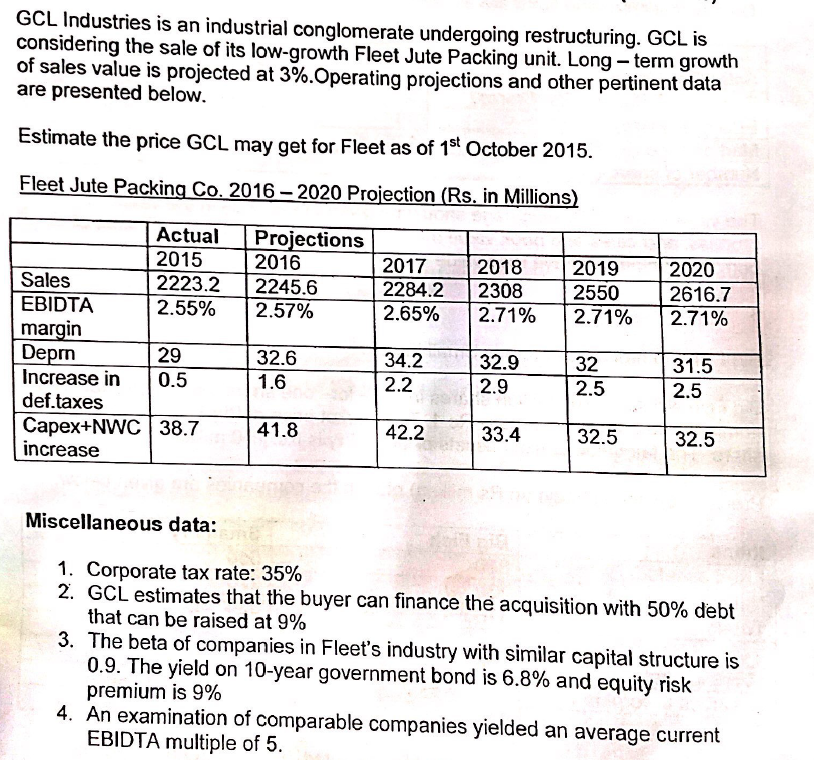

GCL Industries is an industrial conglomerate undergoing restructuring. GCL is considering the sale of its low-growth Fleet Jute Packing unit. Long-term growth of sales value is projected at 3%.Operating projections and other pertinent data are presented below. Estimate the price GCL may get for Fleet as of 1st October 2015. Fleet Jute Packing Co. 2016 - 2020 Projection (Rs. in Millions) Projections 2016 2245.6 2.57% 2017 2284.2 2.65% 2018 2308 2.71% 2019 2550 2.71% 2020 2616.7 2.71% Actual 2015 Sales 2223.2 EBIDTA 2.55% margin Deprn 29 Increase in 0.5 def.taxes Capex+NWC 38.7 increase 32.6 1.6 34. 2 2.2 32. 932 2.9 2.5 31.5 2.5 41.8 42.2 33.4 32.5 32.5 Miscellaneous data: 1. Corporate tax rate: 35% 2. GCL estimates that the buyer can finance the acquisition with 50% debt that can be raised at 9% 3. The beta of companies in Fleet's industry with similar capital structure is 0.9. The yield on 10-year government bond is 6.8% and equity risk premium is 9% 4. An examination of comparable companies yielded an average current EBIDTA multiple of 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts