Question: please provide step by step answer Suppose you borrowed $10,000 at an interest rate of 12% compounded monthly over 48 months. At the end of

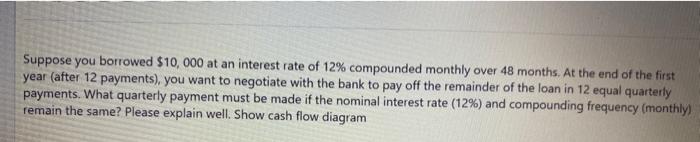

Suppose you borrowed $10,000 at an interest rate of 12% compounded monthly over 48 months. At the end of the first year (after 12 payments), you want to negotiate with the bank to pay off the remainder of the loan in 12 equal quarterly payments. What quarterly payment must be made if the nominal interest rate (12\%) and compounding frequency (monthly) remain the same? Please explain well. Show cash flow diagram

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts