Question: Please provide step by step explaination a Dave has $100,000 to invest in 10 mutual fund alternatives with the following restrictions. For diversification, no more

Please provide step by step explaination

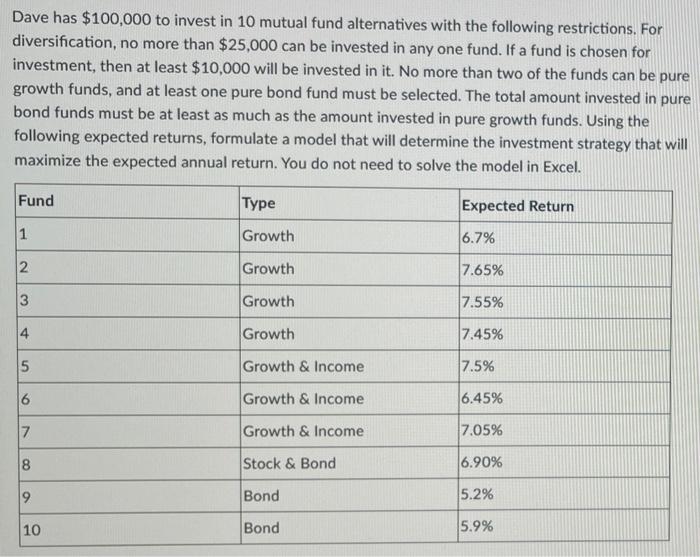

a Dave has $100,000 to invest in 10 mutual fund alternatives with the following restrictions. For diversification, no more than $25,000 can be invested in any one fund. If a fund is chosen for investment, then at least $10,000 will be invested in it. No more than two of the funds can be pure growth funds, and at least one pure bond fund must be selected. The total amount invested in pure bond funds must be at least as much as the amount invested in pure growth funds. Using the following expected returns, formulate a model that will determine the investment strategy that will maximize the expected annual return. You do not need to solve the model in Excel. a Fund Type Expected Return 1 Growth 6.7% 2 Growth 7.65% 3 Growth 7.55% 4 Growth 7.45% 5 Growth & Income 7.5% 6 Growth & Income 6.45% 7 Growth & Income 7.05% 8 Stock & Bond 6.90% 9 Bond 5.2% 10 Bond 5.9%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock