Question: Please provide step by step question so i can better understand. Thank you! Assume a company has pretax book income of $97598 included in the

Please provide step by step question so i can better understand. Thank you!

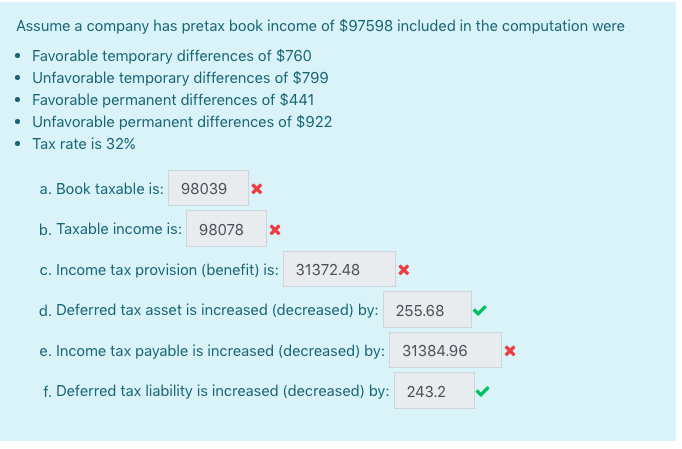

Assume a company has pretax book income of $97598 included in the computation were Favorable temporary differences of $760 Unfavorable temporary differences of $799 Favorable permanent differences of $441 Unfavorable permanent differences of $922 Tax rate is 32% a. Book taxable is: 98039 b. Taxable income is: 98078 X c. Income tax provision (benefit) is: 31372.48 d. Deferred tax asset is increased (decreased) by: 255.68 e. Income tax payable is increased (decreased) by: 31384.96 X f. Deferred tax liability is increased (decreased) by: 243.2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts