Question: Please provide step by step question so i can better understand. Thank you! ABC has a net deferred tax liability of $1226.7 at the beginning

Please provide step by step question so i can better understand. Thank you!

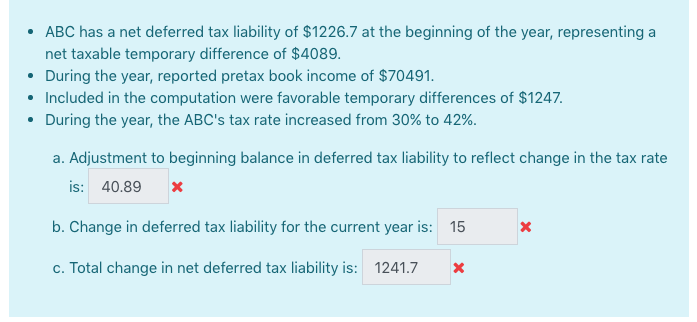

ABC has a net deferred tax liability of $1226.7 at the beginning of the year, representing a net taxable temporary difference of $4089. During the year, reported pretax book income of $70491. Included in the computation were favorable temporary differences of $1247. During the year, the ABC's tax rate increased from 30% to 42%. a. Adjustment to beginning balance in deferred tax liability to reflect change in the tax rate is: 40.89 X X b. Change in deferred tax liability for the current year is: 15 c. Total change in net deferred tax liability is: 1241.7 X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts