Question: please provide step by step solutions Problem 3. a. Grapicsco Co. acquired a 3-D printer for $20,000 on January 2013 . The printer had an

please provide step by step solutions

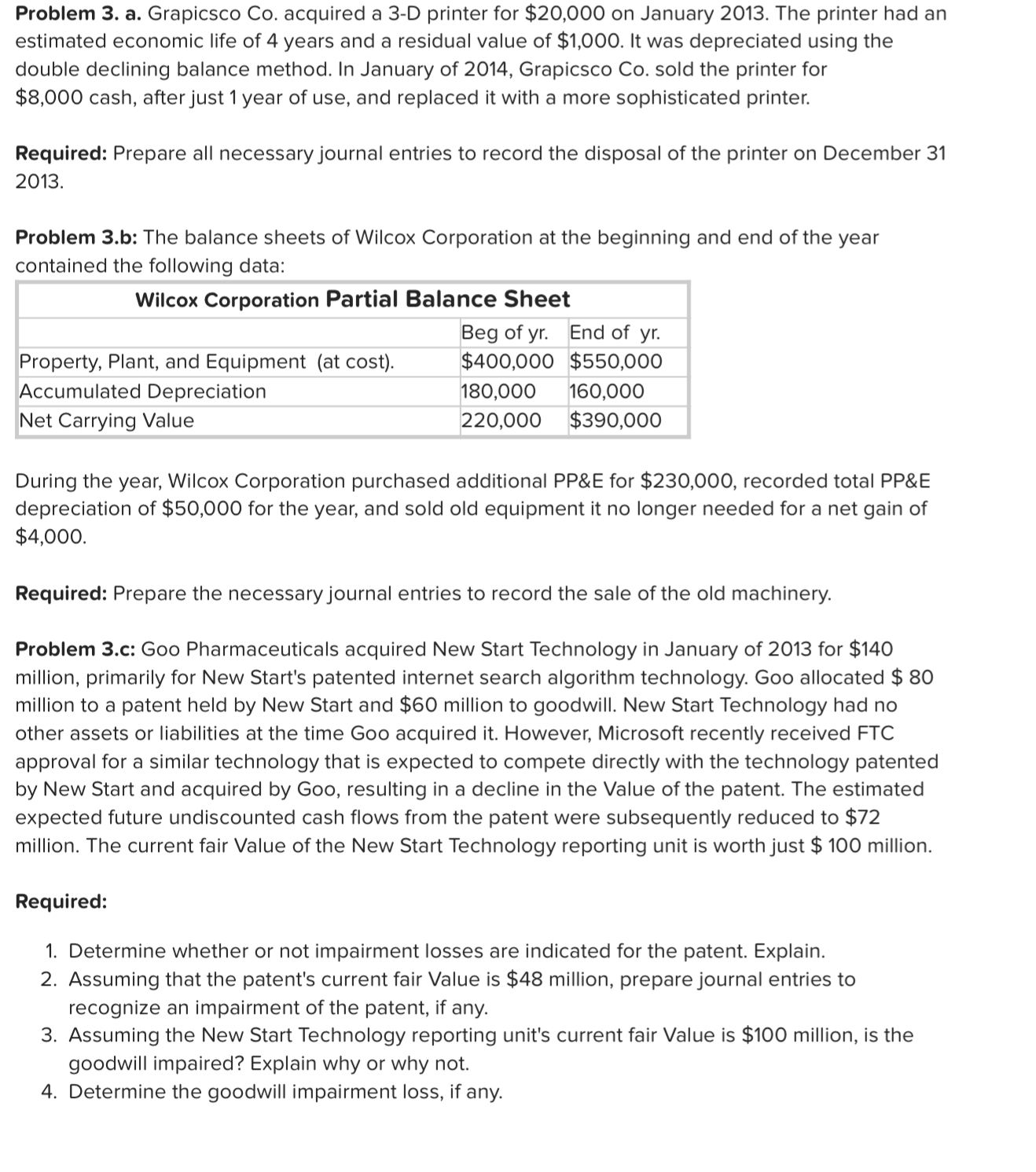

Problem 3. a. Grapicsco Co. acquired a 3-D printer for $20,000 on January 2013 . The printer had an estimated economic life of 4 years and a residual value of $1,000. It was depreciated using the double declining balance method. In January of 2014, Grapicsco Co. sold the printer for $8,000 cash, after just 1 year of use, and replaced it with a more sophisticated printer. Required: Prepare all necessary journal entries to record the disposal of the printer on December 31 2013. Problem 3.b: The balance sheets of Wilcox Corporation at the beginning and end of the year contained the following data: During the year, Wilcox Corporation purchased additional PP\&E for $230,000, recorded total PP\&E depreciation of $50,000 for the year, and sold old equipment it no longer needed for a net gain of $4,000. Required: Prepare the necessary journal entries to record the sale of the old machinery. Problem 3.c: Goo Pharmaceuticals acquired New Start Technology in January of 2013 for \$140 million, primarily for New Start's patented internet search algorithm technology. Goo allocated \$80 million to a patent held by New Start and $60 million to goodwill. New Start Technology had no other assets or liabilities at the time Goo acquired it. However, Microsoft recently received FTC approval for a similar technology that is expected to compete directly with the technology patented by New Start and acquired by Goo, resulting in a decline in the Value of the patent. The estimated expected future undiscounted cash flows from the patent were subsequently reduced to $72 million. The current fair Value of the New Start Technology reporting unit is worth just \$100 million. Required: 1. Determine whether or not impairment losses are indicated for the patent. Explain. 2. Assuming that the patent's current fair Value is $48 million, prepare journal entries to recognize an impairment of the patent, if any. 3. Assuming the New Start Technology reporting unit's current fair Value is $100 million, is the goodwill impaired? Explain why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts