Question: Please provide steps on how to do it step by step. Answer is there but only looking for steps. Thankyou Expansion project NPV Get the

Please provide steps on how to do it step by step.

Answer is there but only looking for steps.

Thankyou

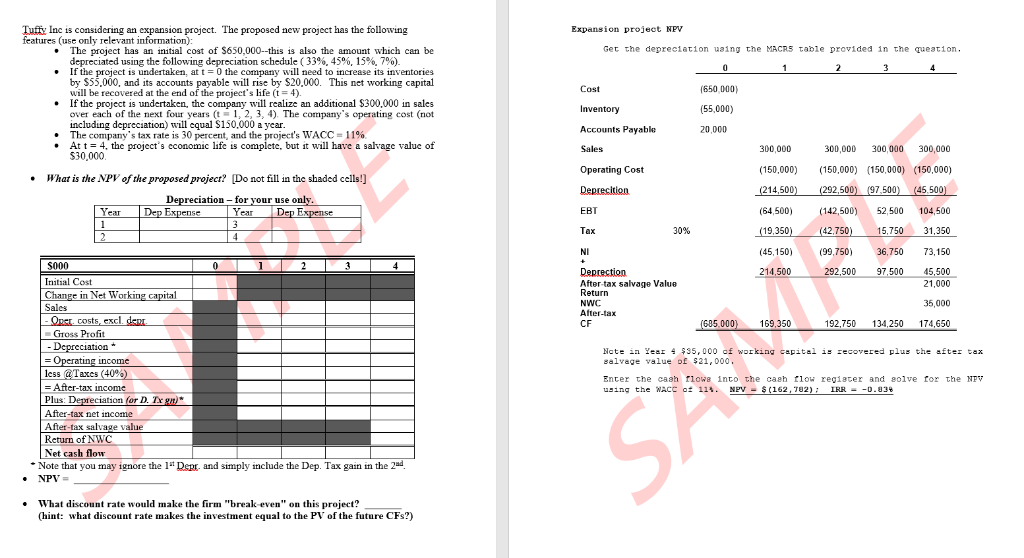

Expansion project NPV Get the depreciation using the MACRS table provided in the question. Cost Tuffy Inc is considering an expansion project. The proposed new project has the following features (use only relevant information) The project has an instal cost of $650,000--this is also the amount which can be depreciated using the following depreciation schedule ( 33%, 45%, 15% 79). If the project is undertaken at t=0 the company will need to increase its inventories by S55,000, and its accounts payable will rise by $20,000. This networking capital will be recovered at the end of the project's life (t = 4). If the project is undertaken, the company will realize an additional $300,000 in sales over each of the next four years (t 1, 2, 3, 4). The company's operating cost (not including depreciation will equal $150.000 a year. The company's tax rate is 30 percent, and the project's WACC 11% At t = 4, the project's cconomic life is complete, but it will have a salvage value of $30,000 Inventory Accounts Payable 1650 000) (55,000) 20 000 Sales Operating Cost What is the NPV of the proposed project? (Do not fill in the shaded cells!) 300,000 300,000 300,000 (150,000) (150,000) (150,000) (292,500) (97.500) (45,500) (142,500) 52.500 104,500 Deprecition (214,500) Year Depreciation Dep Expense for your use only. Year Dep Expense EBT (54,500) Tax 30% (19.350) (42.750) 15,750 31,350 (45,150) 214,500 (99,750) 292,500 36.750 97,500 73,150 45,500 21,000 Deprection After tax salvage Value Return NWC After-tax 35,000 CF (685.000 169.350 192,750 134,250 174,650 S000 Initial Cost Change in Net Working capital Sales - Over, costs, excl. der Gross Profit - Depreciation = Operating income less a Taxes (40%) = After-tax income Plus: Depreciation for D. Txg)* After-tax net income After-tax salvage value Return of NWC Net cash flow . Note that you may ignore the 1" Dept and simply include the Dep. Tax gain in the ad NPV = Note in Year 4 $35,000 of working capital is recovered plus the after tex salvage value of $21,000. Enter the cash flows into the cash flow register and solve for the NEY using the WACC of 111. NPV -S(162, 702) IRR -0.83 What discount rate would make the firm "break even on this project? (hint: what discount rate makes the investment equal to the PV of the future CES?)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts