Question: Please provide steps on how to get to the answer, thank you! Direct Method, Reciprocal Method, Overhead Rates Macalister Corporation is developing departmental overhead rates

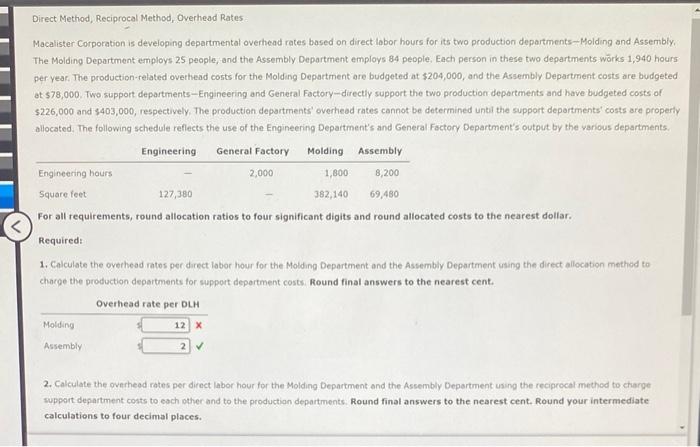

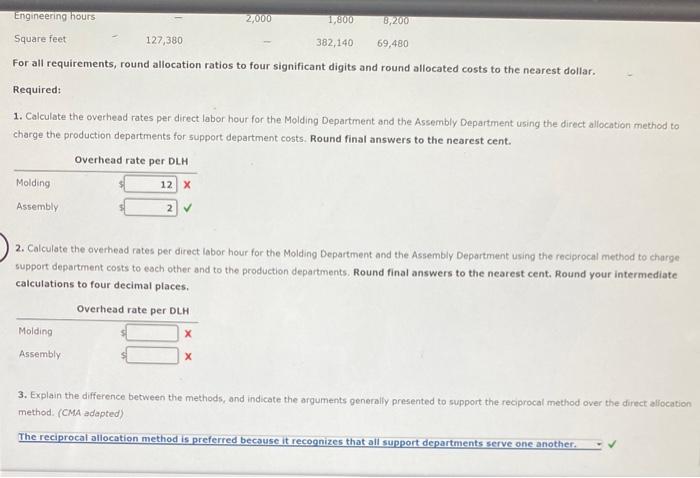

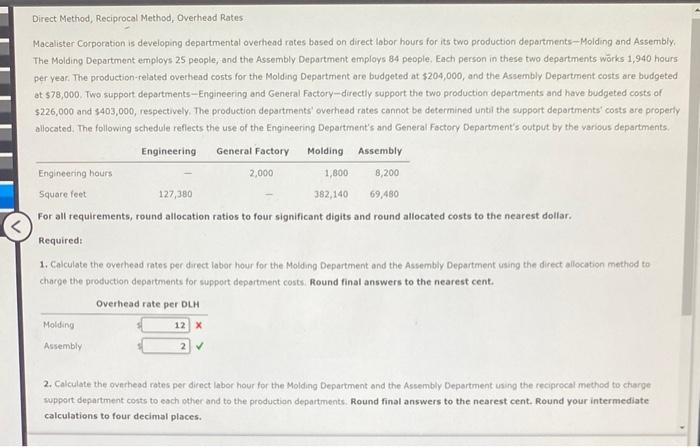

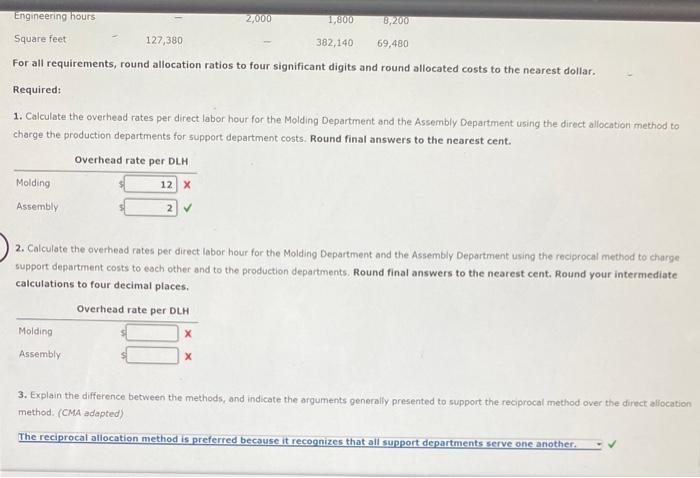

Direct Method, Reciprocal Method, Overhead Rates Macalister Corporation is developing departmental overhead rates bosed on direct labor hours for its two production departments-Molding and Assembly. The Molding Department employs 25 people, and the Assembly Department employs 84 people, Each person in these two departments wrks 1,940 hours per year. The production-related overhead costs for the Molding Department are budgeted at $204,000, and the Assembly Department costs are budgeted at $78,000. Two support departments-Engineering and General Factory-directly support the two production departments and have budgeted costs of $226,000 and $403,000, respectively. The production departments' overhead rates cannot be determined until the support departments' costs are property allocated. The following schedule reflects the use of the Engineering Department's and General Factory Department's output by the various departments. For all requirements, round allocation ratios to four significant digits and round allocated costs to the nearest dellar. Requireds 1. Calculate the overhead ratos per direct labor hour for the Molding Deportment and the Assembly Department using the direct allocation method to chacge the production departments for support deportment costs. Round final answers to the nearest cent. 2. Calculate the overheod rates per direct labor hour for the Molding Department and the Assembly Department usung the reciprocat method to charge support department costs to each other and to the productian departments. Round final answers to the nearest cent. Round your intermediate calculations to four decimal places. For all requirements, round allocation ratios to four significant digits and round allocated costs to the nearest dollar. Required: 1. Calculate the overheod rates per direct labor hour for the Molding Department and the Assembly Department using the direct allocation method to charge the production departments for support department costs. Round final answers to the nearest cent. 2. Calculate the overhead rates per direct labor hour for the Molding Department and the Assembly Deportment using the reciprocal method to charge support department costs to each other and to the production departments. Round final answers to the nearest cent. Round your intermediate calculations to four decimal places. 3. Explain the difference between the methods, and indicate the arguments generally presented to support the reciprocal method over the direct alfocation method. (CMA adapted) The reciprocal allocation method is preferred because it recognizes that all support departments serve one another

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts