Question: Please provide steps on how to solve this using formula/financial calculator inputs, thank you. Zhang Technologies is looking to issue $1,000 par value, 7% annual

Please provide steps on how to solve this using formula/financial calculator inputs, thank you.

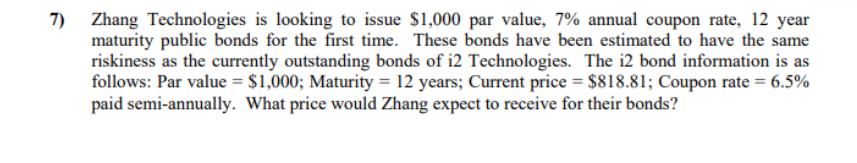

Zhang Technologies is looking to issue $1,000 par value, 7% annual coupon rate, 12 year maturity public bonds for the first time. These bonds have been estimated to have the same riskiness as the currently outstanding bonds of i2 Technologies. The i2 bond information is as follows: Par value =$1,000; Maturity =12 years; Current price =$818.81; Coupon rate =6.5% paid semi-annually. What price would Zhang expect to receive for their bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts