Question: Please provide tables with the right calculations no explanation needed thankyou Paulson Company issues 6%. four-year bonds. on January 1 of this year. with a

Please provide tables with the right calculations no explanation needed thankyou

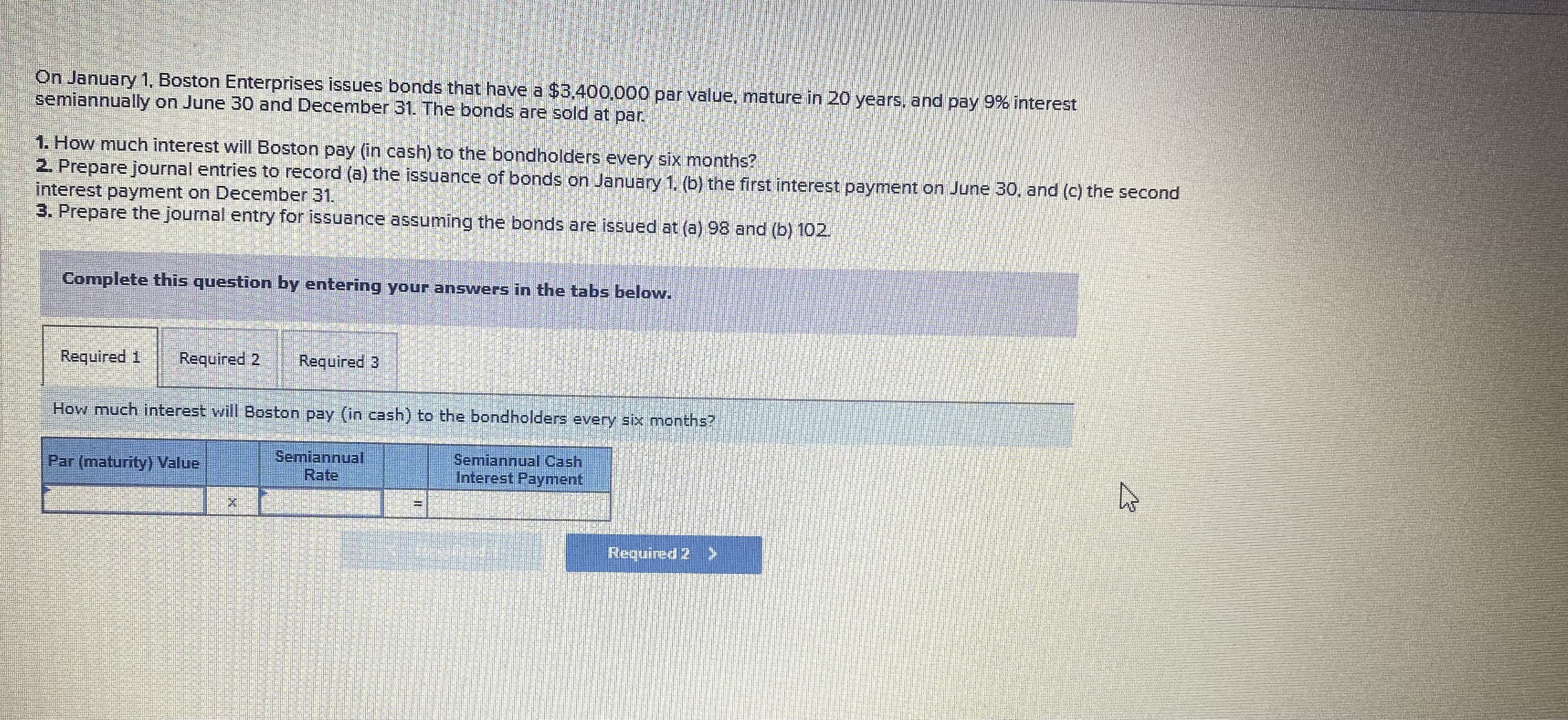

Paulson Company issues 6%. four-year bonds. on January 1 of this year. with a par value of $200.000 and semiannual interest payments. Semiannual Period-End Unamortized Discount Carrying Value January 1, issuance $13, 466 $186, 534 June 30, first payment 11, 782 188, 218 December 31, second payment 10,098 189,902 Use the above straight-line bond amortization table and prepare journal entries for the following. (a) The issuance of bonds on January 1. b) The first interest payment on June 30. (c) The second interest payment on December 31. View transaction list Journal entry worksheet 3 Record the issuance of the bonds on January 1. Note: Enter debits before credits. Date General Journal Debit Credit January 01\fHelp No-Toxic-Toys currently has $200.000 of equity and is planning an $80,000 expansion to meet increasing demand for its product. The company currently earns $50.000 in net income. and the expansion will yield $25,000 in additional income before any interest expense. The company has three options: (1) do not expand, (2) expand and issue $80,000 in debt that requires payments of 8% annual interest, or (3) expand and raise $80,000 from equity financing. For each option, compute (a) net income and (b) return on equity (Net Income : Equity). Ignore any income tax effects. (Round "Return on equity" to 1 decimal place.) 3 Don't Expand Debt Financing Equity Financing Income before interest expense Interest expense Net income Equity % % % Return on equityBrussels Enterprises issues bonds at par dated January 1. 2020, that have a $3.400,000 par value, mature in four years. and pay 9% interest semiannually on June 30 and December 31. 1. Record the entry for the issuance of bonds for cash on January 1. 2. Record the entry for the first semiannual interest payment and the second semiannual interest payment. 3. Record the entry for the maturity of the bonds on December 31, 2023 (assume semiannual interest is already recorded). View transaction list Journal entry worksheet 3 Record the issuance of bonds for cash on January 1. Note: Enter debite before credits. Credit Date General Journal Debit January 01 Record entry Clear coby Whew general jou\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts