Question: Please provide the answer in excel Using semiannual compounding, find the prices of the following bonds: a. A 9.3%, 15-year bond priced to yield 7.0%.

Please provide the answer in excel

Please provide the answer in excel

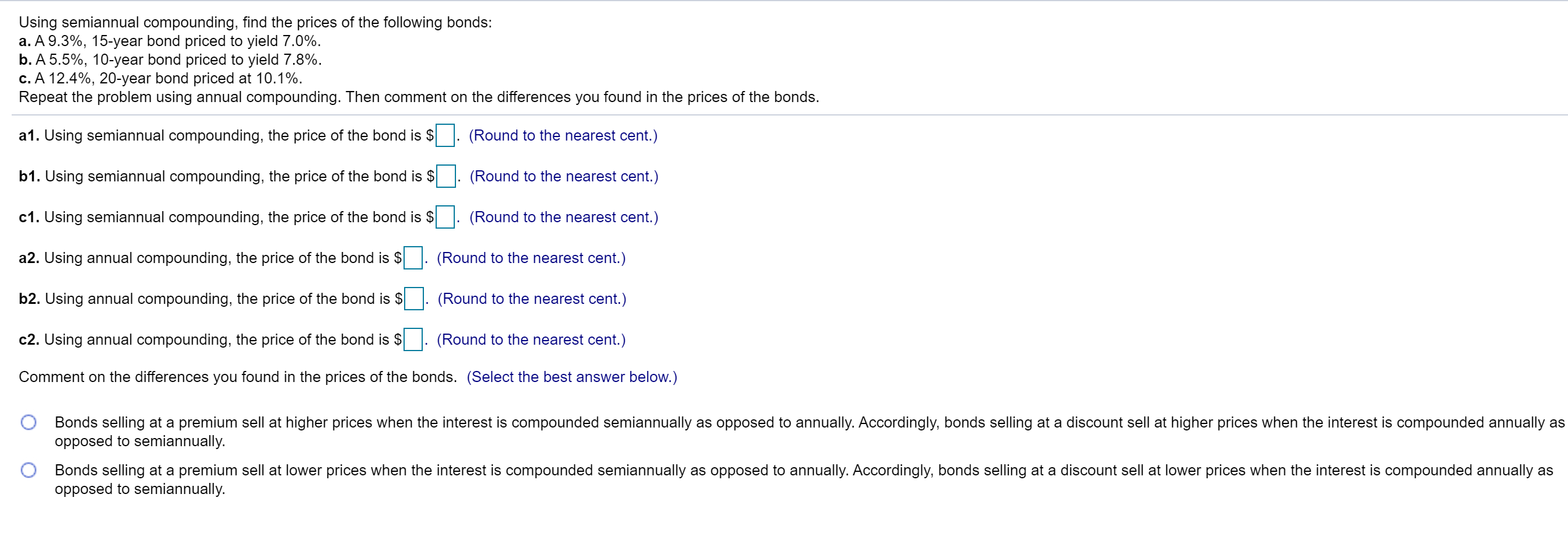

Using semiannual compounding, find the prices of the following bonds: a. A 9.3%, 15-year bond priced to yield 7.0%. b. A 5.5%, 10-year bond priced to yield 7.8%. c. A 12.4%, 20-year bond priced at 10.1%. Repeat the problem using annual compounding. Then comment on the differences you found in the prices of the bonds. a1. Using semiannual compounding, the price of the bond is $ . (Round to the nearest cent.) b1. Using semiannual compounding, the price of the bond is $ . (Round to the nearest cent.) c1. Using semiannual compounding, the price of the bond is $ . (Round to the nearest cent.) a2. Using annual compounding, the price of the bond is $]. (Round to the nearest cent.) b2. Using annual compounding, the price of the bond is $ . (Round to the nearest cent.) c2. Using annual compounding, the price of the bond is $ . (Round to the nearest cent.) Comment on the differences you found in the prices of the bonds. (Select the best answer below.) O Bonds selling at a premium sell at higher prices when the interest is compounded semiannually as opposed to annually. Accordingly, bonds selling at a discount sell at higher prices when the interest is compounded annually as opposed to semiannually. Bonds selling at a premium sell at lower prices when the interest is compounded semiannually as opposed to annually. Accordingly, bonds selling at a discount sell at lower prices when the interest is compounded annually as opposed to semiannually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts