Question: please provide the answer of A,B,C,D E,F. information is complete there is nothing miss in this question so do it provide the correct answer to

please provide the answer of A,B,C,D E,F. information is complete there is nothing miss in this question so do it

provide the correct answer to get thumbs up

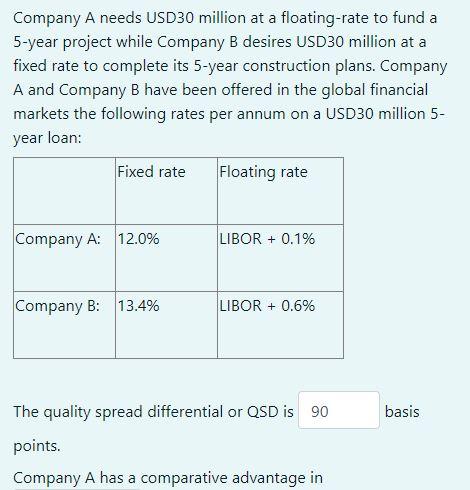

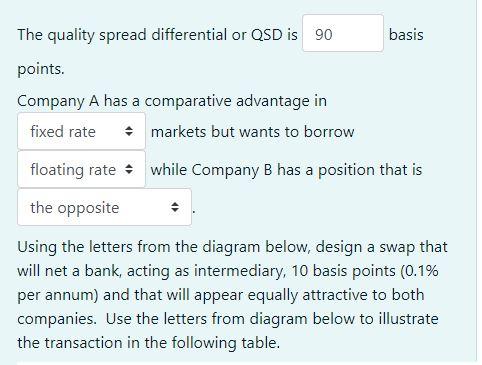

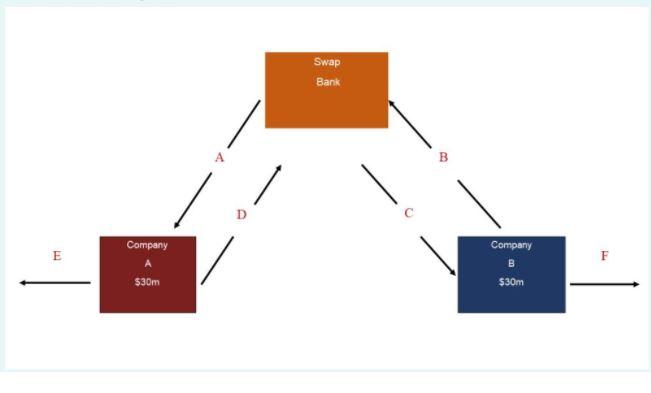

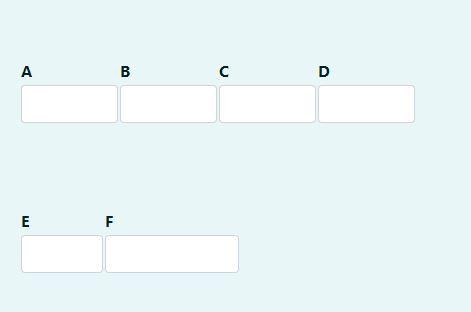

Company A needs USD30 million at a floating-rate to fund a 5-year project while Company B desires USD30 million at a fixed rate to complete its 5-year construction plans. Company A and Company B have been offered in the global financial markets the following rates per annum on a USD30 million 5- year loan: Fixed rate Floating rate Company A: 12.0% LIBOR + 0.1% Company B: 13.4% LIBOR + 0.6% The quality spread differential or QSD is 90 basis points. Company A has a comparative advantage in basis The quality spread differential or QSD is 90 points. Company A has a comparative advantage in fixed rate markets but wants to borrow floating rate while Company B has a position that is the opposite Using the letters from the diagram below, design a swap that will net a bank, acting as intermediary, 10 basis points (0.1% per annum) and that will appear equally attractive to both companies. Use the letters from diagram below to illustrate the transaction in the following table. Swap Bank B D Company Company E F $30m $30m B D E F Company A needs USD30 million at a floating-rate to fund a 5-year project while Company B desires USD30 million at a fixed rate to complete its 5-year construction plans. Company A and Company B have been offered in the global financial markets the following rates per annum on a USD30 million 5- year loan: Fixed rate Floating rate Company A: 12.0% LIBOR + 0.1% Company B: 13.4% LIBOR + 0.6% The quality spread differential or QSD is 90 basis points. Company A has a comparative advantage in basis The quality spread differential or QSD is 90 points. Company A has a comparative advantage in fixed rate markets but wants to borrow floating rate while Company B has a position that is the opposite Using the letters from the diagram below, design a swap that will net a bank, acting as intermediary, 10 basis points (0.1% per annum) and that will appear equally attractive to both companies. Use the letters from diagram below to illustrate the transaction in the following table. Swap Bank B D Company Company E F $30m $30m B D E F

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts