Question: Please provide the answer with a screenshot Calculate Current ratio, RoE, Profit margin and one other financial ratio for the company below. Explain your results

Please provide the answer with a screenshot

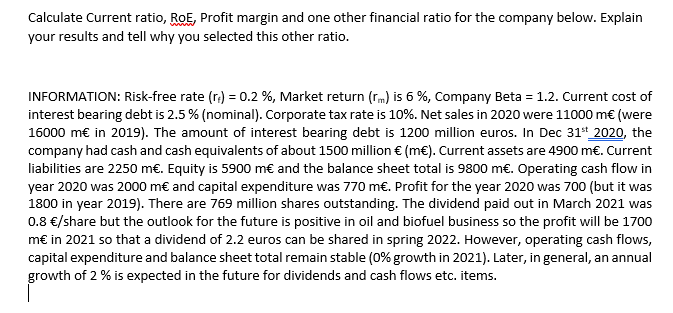

Calculate Current ratio, RoE, Profit margin and one other financial ratio for the company below. Explain your results and tell why you selected this other ratio. INFORMATION: Risk-free rate (re) = 0.2 %, Market return (rm) is 6 %, Company Beta = 1.2. Current cost of interest bearing debt is 2.5 % (nominal). Corporate tax rate is 10%. Net sales in 2020 were 11000 m (were 16000 m in 2019). The amount of interest bearing debt is 1200 million euros. In Dec 31* 2020, the company had cash and cash equivalents of about 1500 million (m). Current assets are 4900 m. Current liabilities are 2250 m. Equity is 5900 m and the balance sheet total is 9800 m. Operating cash flow in year 2020 was 2000 m and capital expenditure was 770 m. Profit for the year 2020 was 700 (but it was 1800 in year 2019). There are 769 million shares outstanding. The dividend paid out in March 2021 was 0.8 /share but the outlook for the future is positive in oil and biofuel business so the profit will be 1700 m in 2021 so that a dividend of 2.2 euros can be shared in spring 2022. However, operating cash flows, capital expenditure and balance sheet total remain stable (0% growth in 2021). Later, in general, an annual growth of 2% is expected in the future for dividends and cash flows etc. items. Calculate Current ratio, RoE, Profit margin and one other financial ratio for the company below. Explain your results and tell why you selected this other ratio. INFORMATION: Risk-free rate (re) = 0.2 %, Market return (rm) is 6 %, Company Beta = 1.2. Current cost of interest bearing debt is 2.5 % (nominal). Corporate tax rate is 10%. Net sales in 2020 were 11000 m (were 16000 m in 2019). The amount of interest bearing debt is 1200 million euros. In Dec 31* 2020, the company had cash and cash equivalents of about 1500 million (m). Current assets are 4900 m. Current liabilities are 2250 m. Equity is 5900 m and the balance sheet total is 9800 m. Operating cash flow in year 2020 was 2000 m and capital expenditure was 770 m. Profit for the year 2020 was 700 (but it was 1800 in year 2019). There are 769 million shares outstanding. The dividend paid out in March 2021 was 0.8 /share but the outlook for the future is positive in oil and biofuel business so the profit will be 1700 m in 2021 so that a dividend of 2.2 euros can be shared in spring 2022. However, operating cash flows, capital expenditure and balance sheet total remain stable (0% growth in 2021). Later, in general, an annual growth of 2% is expected in the future for dividends and cash flows etc. items

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts