Question: Please provide the correct answer for question 11 with work. Thank you 10. What is your value per share of Comet using a forward P/E

Please provide the correct answer for question 11 with work. Thank you

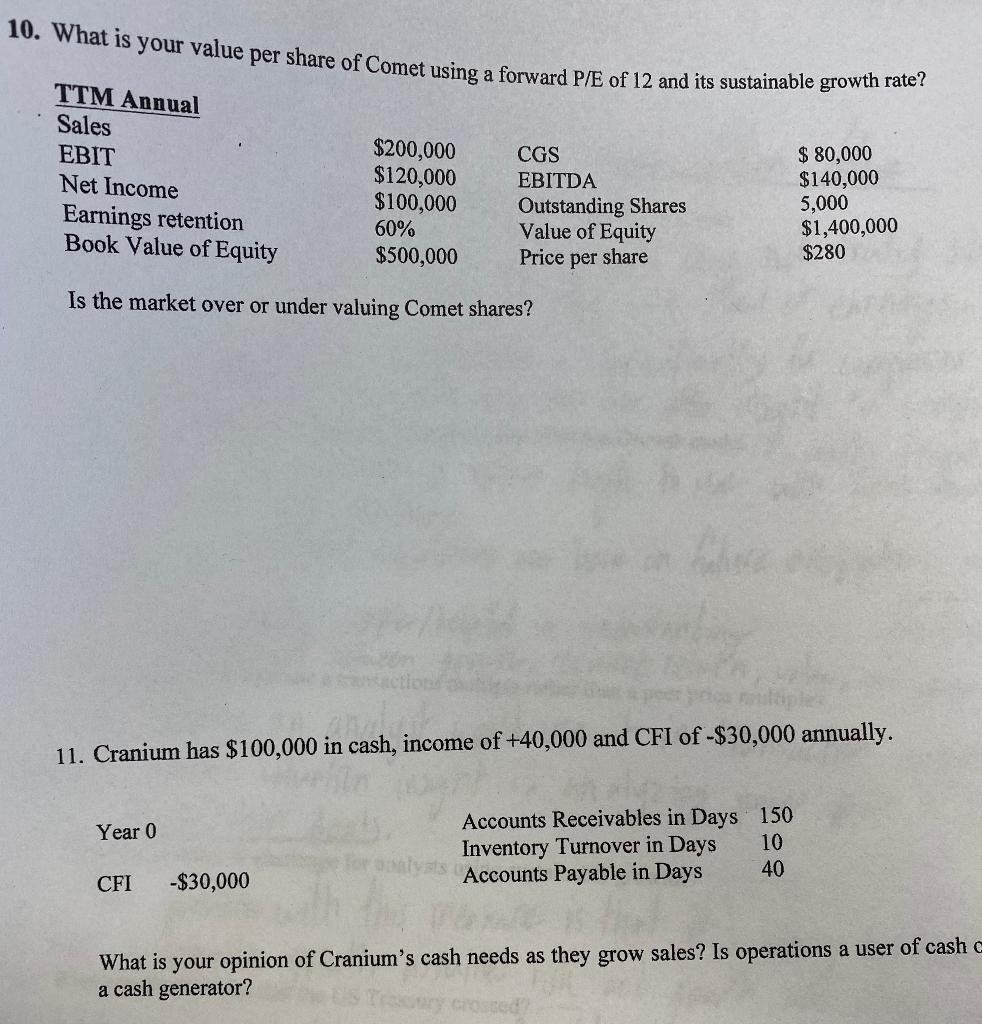

10. What is your value per share of Comet using a forward P/E of 12 and its sustainable growth rate? TTM Annual Sales EBIT Net Income Earnings retention Book Value of Equity $200,000 $120,000 $100,000 60% $500,000 CGS EBITDA Outstanding Shares Value of Equity Price per share $ 80,000 $140,000 5,000 $1,400,000 $280 Is the market over or under valuing Comet shares? 11. Cranium has $100,000 in cash, income of +40,000 and CFI of -$30,000 annually. Year 0 Accounts Receivables in Days 150 Inventory Turnover in Days 10 Accounts Payable in Days 40 CFI -$30,000 What is your opinion of Cranium's cash needs as they grow sales? Is operations a user of cash a cash generator

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts