Question: Please provide the correct answer to question 10 and show all work. Thank You 10. FOMO company is looking to buy YOLO and used DCF

Please provide the correct answer to question 10 and show all work. Thank You

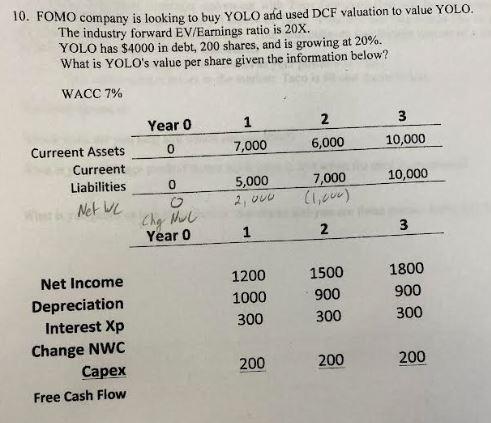

10. FOMO company is looking to buy YOLO and used DCF valuation to value YOLO. The industry forward EV/Earnings ratio is 20%. YOLO has $4000 in debt, 200 shares, and is growing at 20%. What is YOLO's value per share given the information below? WACC 7% 2 3 1 Year 0 0 7,000 6,000 10,000 Curreent Assets Curreent Liabilities Net we 5,000 10,000 0 o 7,000 (lice) 2,000 Cho thuc 2 3 Year 0 1200 1000 300 1500 900 300 1800 900 300 Net Income Depreciation Interest Xp Change NWC Capex Free Cash Flow 200 200 200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts