Question: Please provide the correct answer, I will upvote the correct answer. Thank you! Use this information for Falcon Co. to answer the question that follow.

Please provide the correct answer, I will upvote the correct answer. Thank you!

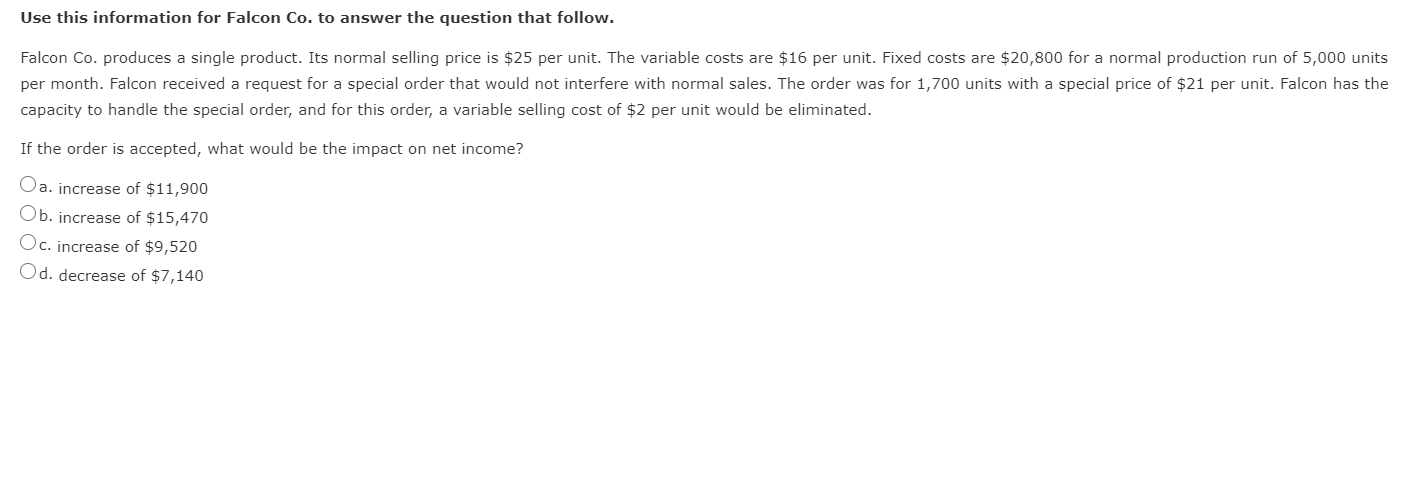

Use this information for Falcon Co. to answer the question that follow. Falcon Co. produces a single product. Its normal selling price is $25 per unit. The variable costs are $16 per unit. Fixed costs are $20,800 for a normal production run of 5,000 units per month. Falcon received a request for a special order that would not interfere with normal sales. The order was for 1,700 units with a special price of $21 per unit. Falcon has the capacity to handle the special order, and for this order, a variable selling cost of $2 per unit would be eliminated. If the order is accepted, what would be the impact on net income? O a. increase of $11,900 Ob. increase of $15,470 Oc. increase of $9,520 Od. decrease of $7,140

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts