Question: Please provide the CORRECT answer to this question. Please read the question CAREFULLY and DOUBLE CHECK your answer BEFORE posting it. I am not sure

Please provide the CORRECT answer to this question. Please read the question CAREFULLY and DOUBLE CHECK your answer BEFORE posting it. I am not sure if 1,828,822 is actually the correct answer as it could also be 2,500,000. Thank you!

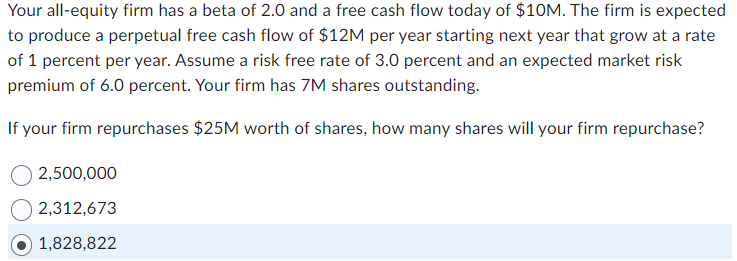

Your all-equity firm has a beta of 2.0 and a free cash flow today of $10M. The firm is expected to produce a perpetual free cash flow of $12M per year starting next year that grow at a rate of 1 percent per year. Assume a risk free rate of 3.0 percent and an expected market risk premium of 6.0 percent. Your firm has 7M shares outstanding. If your firm repurchases $25M worth of shares, how many shares will your firm repurchase? 2,500,0002,312,673 1,828,822

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts