Question: Please provide the decision variables, objective function, and constraints. Ideally on paper and not excel. Bill Cooper is an investment advisor specializing in making recommendations

Please provide the decision variables, objective function, and constraints. Ideally on paper and not excel.

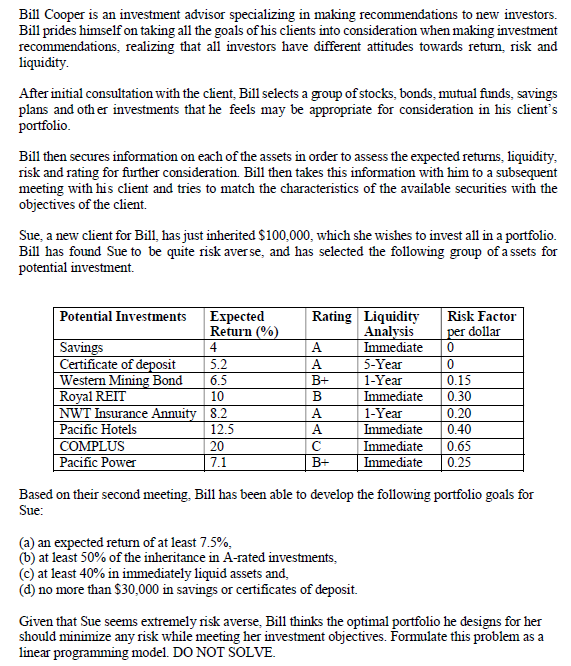

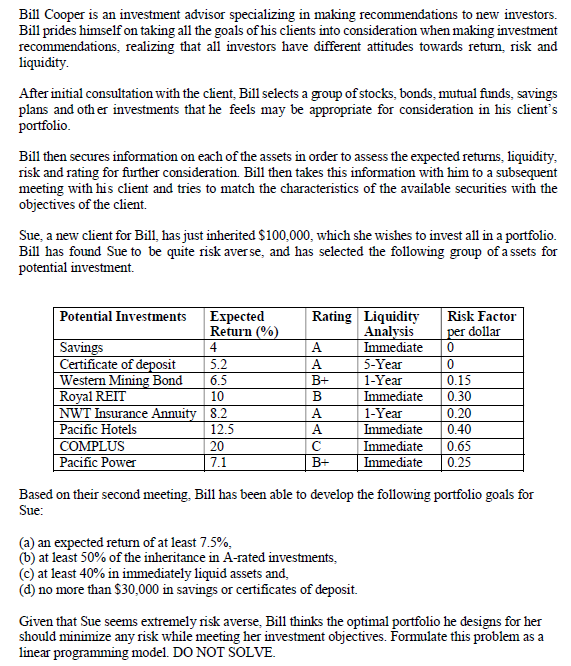

Bill Cooper is an investment advisor specializing in making recommendations to new investors. Bill prides himself on taking all the goals of his clients into consideration when making investment recommendations, realizing that all investors have different attitudes towards return, risk and liquidity. After initial consultation with the client, Bill selects a group of stocks, bonds, mutual funds, savings plans and other investments that he feels may be appropriate for consideration in his client's portfolio Bill then secures information on each of the assets in order to assess the expected returns, liquidity, risk and rating for further consideration. Bill then takes this information with him to a subsequent meeting with his client and tries to match the characteristics of the available securities with the objectives of the client. Sue, a new client for Bill, has just inherited $100,000, which she wishes to invest all in a portfolio. Bill has found Sue to be quite risk aver se, and has selected the following group of a ssets for potential investment. Potential Investments Expected Return (%) Risk Factor per dollar 0 5.2 6.5 mm 10 Savings Certificate of deposit Western Mining Bond Royal REIT NWT Insurance Annuity Pacific Hotels COMPLUS Pacific Power Rating Liquidity Analysis Immediate 5-Year 1-Year Immediate 1-Year A Immediate c Immediate B+ Immediate 8.2 12.5 0.15 0.30 | 0.20 0.40 0.65 0.25 20 7.1 Based on their second meeting, Bill has been able to develop the following portfolio goals for Sue: (a) an expected return of at least 7.5%, (6) at least 50% of the inheritance in A-rated investments, (c) at least 40% in immediately liquid assets and, (d) no more than $30,000 in savings or certificates of deposit. Given that Sue seems extremely risk averse, Bill thinks the optimal portfolio he designs for her should minimize any risk while meeting her investment objectives. Formulate this problem as a linear programming model. DO NOT SOLVE