Question: please provide the formula used step by step, thanks. Question 2 Patrick Poh is a Singapore equities fund manager and manages a fund with total

please provide the formula used step by step, thanks.

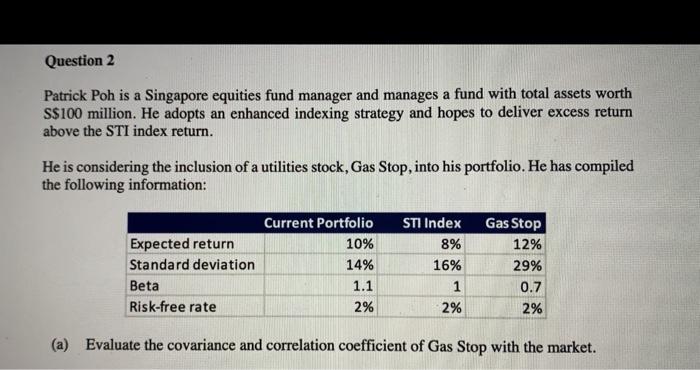

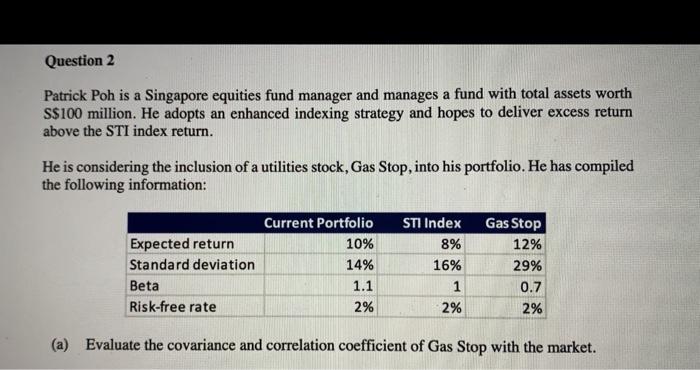

Question 2 Patrick Poh is a Singapore equities fund manager and manages a fund with total assets worth S$100 million. He adopts an enhanced indexing strategy and hopes to deliver excess return above the STI index return. He is considering the inclusion of a utilities stock, Gas Stop, into his portfolio. He has compiled the following information: Expected return Standard deviation Beta Risk-free rate Current Portfolio 10% 14% 1.1 2% STI Index 8% 16% 1 2% Gas Stop 12% 29% 0.7 2% (a) Evaluate the covariance and correlation coefficient of Gas Stop with the market

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock