Question: Please provide the full solution, thank you! Question 4 (a) Lunar Merah Sdn Bhd needs financing for the business expansion. Mr Zamri, the financial manager

Please provide the full solution, thank you!

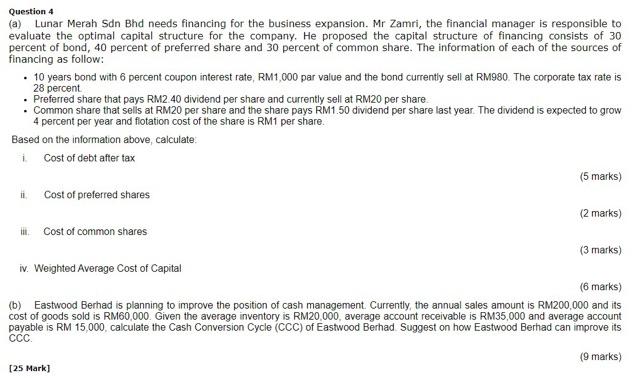

Question 4 (a) Lunar Merah Sdn Bhd needs financing for the business expansion. Mr Zamri, the financial manager is responsible to evaluate the optimal capital structure for the company. He proposed the capital structure of financing consists of 30 percent of bond, 40 percent of preferred share and 30 percent of common share. The information of each of the sources of financing as follow: 10 years bond with 6 percent coupon interest rate, RM1,000 par value and the bond currently sell at RM980. The corporate tax rate is 28 percent . Preferred share that pays RM2.40 dividend per share and currently sell at RM20 per share . Common share that sells at RM20 per share and the share pays RM1.50 dividend per share last year. The dividend is expected to grow 4 percent per year and flotation cost of the share is RM1 per share. Based on the information above, calculate i Cost of debt after tax (5 marks) Cost of preferred shares (2 marks) Cost of common shares (3 marks) iv. Weighted Average Cost of Capital (6 marks) (b) Eastwood Berhad is planning to improve the position of cash management Currently, the annual sales amount is RM200,000 and its cost of goods sold is RM60.000. Given the average inventory is RM20 000, average account receivable is RM35,000 and average account payable is RM 15,000, calculate the Cash Conversion Cycle (CCC) of Eastwood Berhad Suggest on how Eastwood Berhad can improve its CCC (9 marks) [25 Mark) 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts