Question: undefined Problem 8-38 Replacement Decision (L04) A forklift will last for only 2 more years. It costs $5,000 a year to maintain. For $20,000 you

undefined

undefined

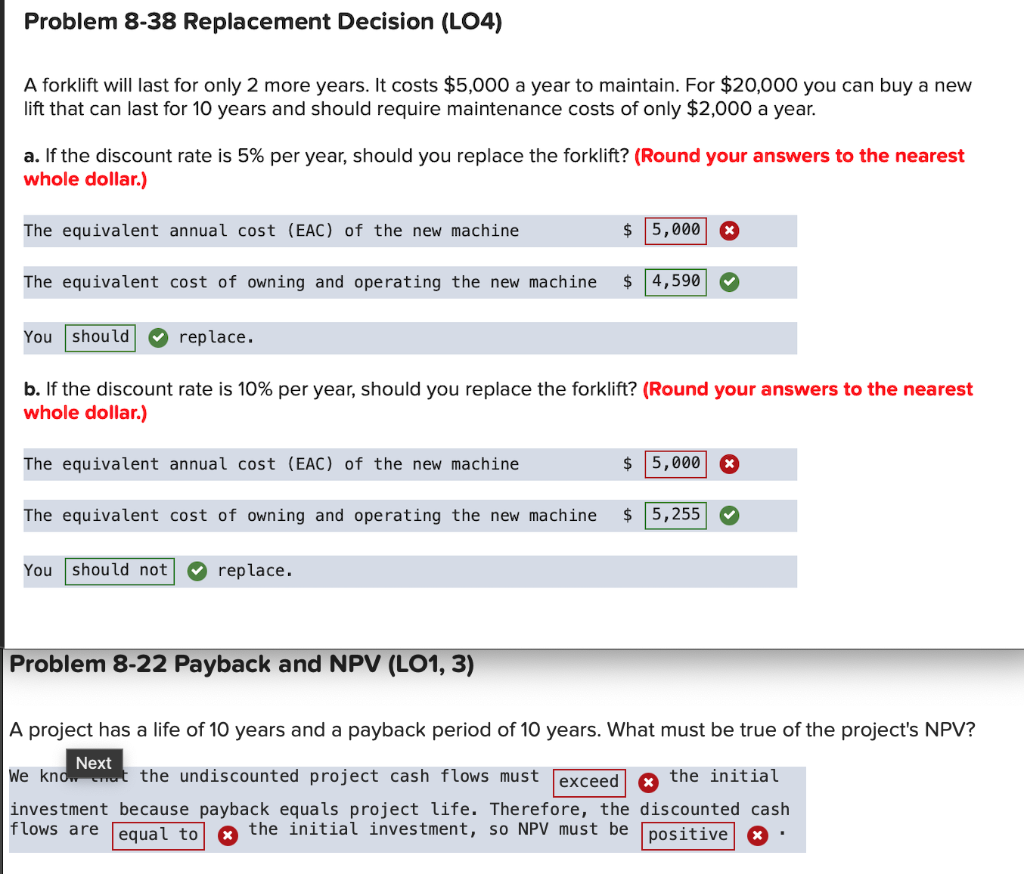

Problem 8-38 Replacement Decision (L04) A forklift will last for only 2 more years. It costs $5,000 a year to maintain. For $20,000 you can buy a new lift that can last for 10 years and should require maintenance costs of only $2,000 a year. a. If the discount rate is 5% per year, should you replace the forklift? (Round your answers to the nearest whole dollar.) The equivalent annual cost (EAC) of the new machine $ 5,000 x The equivalent cost of owning and operating the new machine $ 4,590 You should replace. b. If the discount rate is 10% per year, should you replace the forklift? (Round your answers to the nearest whole dollar.) The equivalent annual cost (EAC) of the new machine 5,00 X The equivalent cost of owning and operating the new machine $ 5,255 You should not replace. Problem 8-22 Payback and NPV (LO1, 3) A project has a life of 10 years and a payback period of 10 years. What must be true of the project's NPV? Next We know that the undiscounted project cash flows must exceed x the initial investment because payback equals project life. Therefore, the discounted cash the initial investment, so NPV must be positive flows are equal to Problem 8-38 Replacement Decision (L04) A forklift will last for only 2 more years. It costs $5,000 a year to maintain. For $20,000 you can buy a new lift that can last for 10 years and should require maintenance costs of only $2,000 a year. a. If the discount rate is 5% per year, should you replace the forklift? (Round your answers to the nearest whole dollar.) The equivalent annual cost (EAC) of the new machine $ 5,000 x The equivalent cost of owning and operating the new machine $ 4,590 You should replace. b. If the discount rate is 10% per year, should you replace the forklift? (Round your answers to the nearest whole dollar.) The equivalent annual cost (EAC) of the new machine 5,00 X The equivalent cost of owning and operating the new machine $ 5,255 You should not replace. Problem 8-22 Payback and NPV (LO1, 3) A project has a life of 10 years and a payback period of 10 years. What must be true of the project's NPV? Next We know that the undiscounted project cash flows must exceed x the initial investment because payback equals project life. Therefore, the discounted cash the initial investment, so NPV must be positive flows are equal to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts