Question: Please provide what needs to be inputted into the calculator for N, I ,PV, PMT, FV for questions 11-15. I already know the answers I

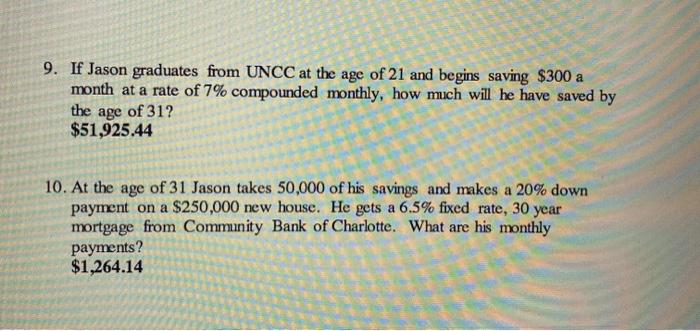

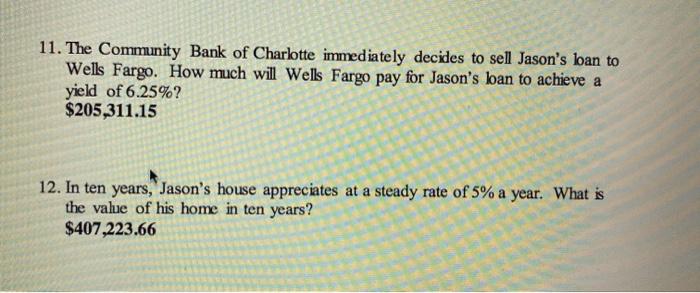

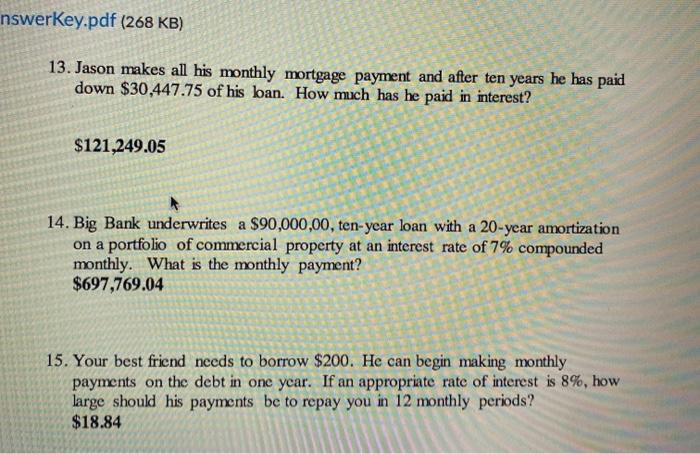

9. If Jason graduates from UNCC at the age of 21 and begins saving $300 a month at a rate of 7% compounded monthly, how much will he have saved by the age of 312 $51,925.44 10. At the age of 31 Jason takes 50,000 of his savings and makes a 20% down payment on a $250,000 new house. He gets a 6.5% fixed rate, 30 year mortgage from Community Bank of Charlotte. What are his monthly payments? $1,264.14 11. The Community Bank of Charlotte immediately decides to sell Jason's loan to Wells Fargo. How much will Wells Fargo pay for Jason's loan to achieve a yield of 6.25%? $205,311.15 12. In ten years, Jason's house appreciates at a steady rate of 5% a year. What is the value of his home in ten years? $407,223.66 nswerkey.pdf (268 KB) 13. Jason makes all his monthly mortgage payment and after ten years he has paid down $30,447.75 of his ban. How much has be paid in interest? $121,249.05 14. Big Bank underwrites a $90,000,00, ten-year loan with a 20-year amortization on a portfolio of commercial property at an interest rate of 7% compounded monthly. What is the monthly payment? $697,769.04 15. Your best friend needs to borrow $200. He can begin making monthly payments on the debt in one year. If an appropriate rate of interest is 8%, how large should his payments be to repay you in 12 monthly periods? $18.84

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts