Question: I need the steps for calculating the following problem on a financial calculator (BA II Plus), please. I already have the answers but I specifically

I need the steps for calculating the following problem on a financial calculator (BA II Plus), please. I already have the answers but I specifically need to know the steps to simplify the work using the financial calculator. Thank you! BA II Plus is a financial calculator. I need to function steps: N, I/Y, PV, PMT, FV

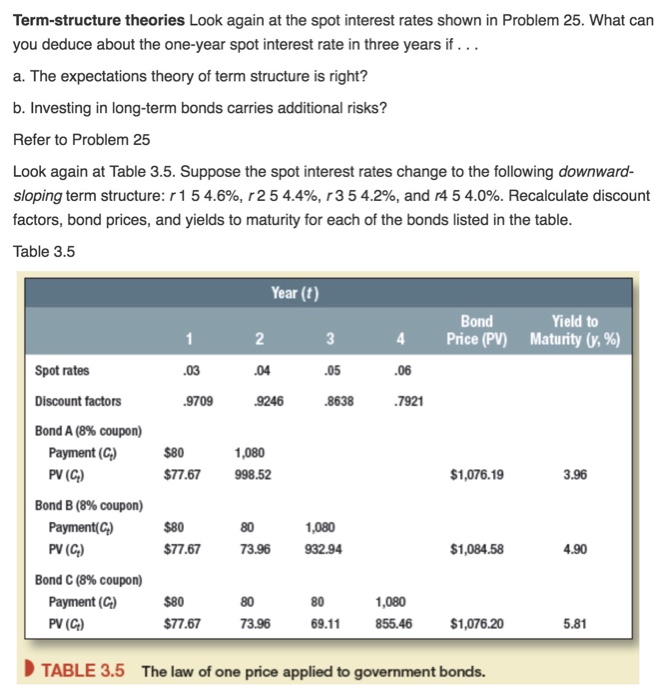

Term-structure theories Look again at the spot interest rates shown in Problem 25. What can you deduce about the one-year spot interest rate in three years if. .. a. The expectations theory of term structure is right? b. Investing in long-term bonds carries additional risks? Refer to Problem 25 Look again at Table 3.5. Suppose the spot interest rates change to the following downward- sloping term structure: r 1 5 4.696, r 2 5 4.4%, r 3 5 4.296, and r4 5 4.0%. Recalculate discount factors, bond prices, and yields to maturity for each of the bonds listed in the table Table 3.5 Year (t) 2 .04 9246 Bond Price (PV) Yield to Maturity (y, %) Spot rates Discount factors Bond A (8% coupon) .05 9709 8638 7921 Payment (C PV (C) $80 77.67 998.52 1,080 $1,076.19 3.96 Bond B (8% coupon) Payment(C) PV (C) $80 $77.67 80 1,080 73.96 93294 $1,084.58 4.90 Bond C (896 coupon) Payment (C PV (C) $80 $77.67 80 80 69.11855.46 1,080 73.96 $1,076.20 5.81 TABLE 3.5 The law of one price applied to government bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts