Question: please put the final answer on this sheet after showing me the calculation for each case,thank you Question (3): Sami and his wife are both

please put the final answer on this sheet after showing me the calculation for each case,thank you

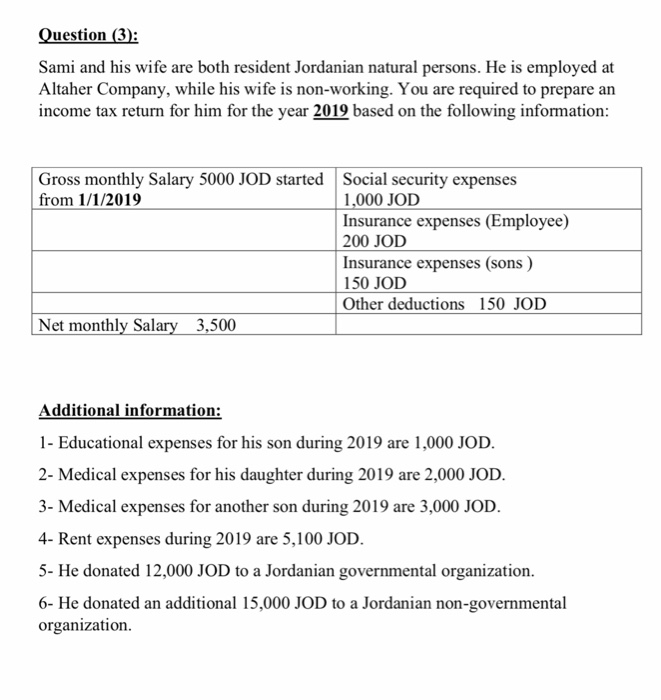

please put the final answer on this sheet after showing me the calculation for each case,thank youQuestion (3): Sami and his wife are both resident Jordanian natural persons. He is employed at Altaher Company, while his wife is non-working. You are required to prepare an income tax return for him for the year 2019 based on the following information: Gross monthly Salary 5000 JOD started from 1/1/2019 Social security expenses 1.000 JOD Insurance expenses (Employee) 200 JOD Insurance expenses (sons) Other deductions 150 JOD Additional information: 1- Educational expenses for his son during 2019 are 1,000 JOD. 2- Medical expenses for his daughter during 2019 are 2,000 JOD. 3- Medical expenses for another son during 2019 are 3,000 JOD. 4- Rent expenses during 2019 are 5,100 JOD. 5- He donated 12,000 JOD to a Jordanian governmental organization. 6- He donated an additional 15,000 JOD to a Jordanian non-governmental organization. Answer (03): ITEMS Question (3): Sami and his wife are both resident Jordanian natural persons. He is employed at Altaher Company, while his wife is non-working. You are required to prepare an income tax return for him for the year 2019 based on the following information: Gross monthly Salary 5000 JOD started from 1/1/2019 Social security expenses 1.000 JOD Insurance expenses (Employee) 200 JOD Insurance expenses (sons) Other deductions 150 JOD Additional information: 1- Educational expenses for his son during 2019 are 1,000 JOD. 2- Medical expenses for his daughter during 2019 are 2,000 JOD. 3- Medical expenses for another son during 2019 are 3,000 JOD. 4- Rent expenses during 2019 are 5,100 JOD. 5- He donated 12,000 JOD to a Jordanian governmental organization. 6- He donated an additional 15,000 JOD to a Jordanian non-governmental organization. Answer (03): ITEMS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts