Question: please put the labels that should go along with the amounts Amir made taxable gifts as follows: $800,000 in 1975,$1.2 million in 1999 , and

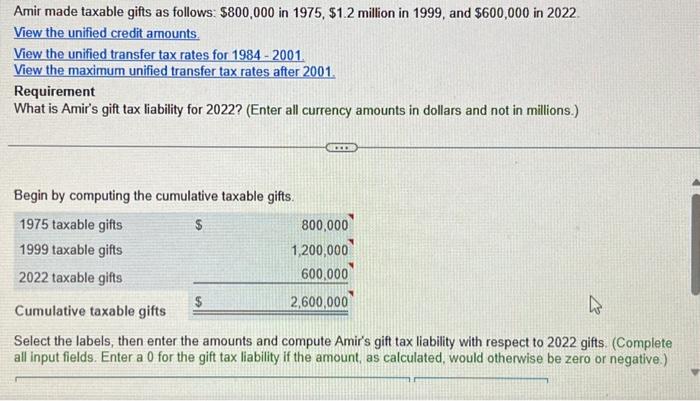

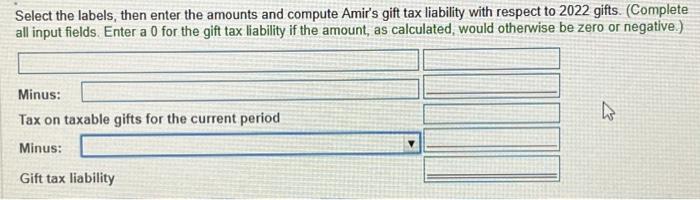

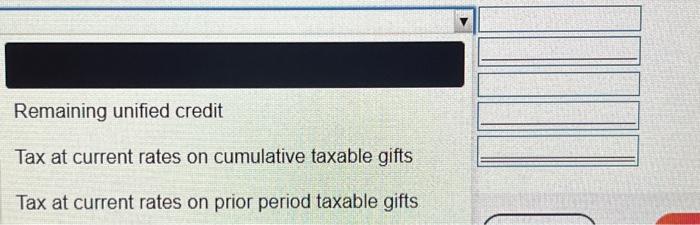

Amir made taxable gifts as follows: $800,000 in 1975,$1.2 million in 1999 , and $600,000 in 2022 . View the unified credit amounts. View the unified transfer tax rates for 1984 - 2001. View the maximum unified transfer tax rates after 2001. Requirement What is Amir's gift tax liability for 2022? (Enter all currency amounts in dollars and not in millions.) Begin by computing the cumulative taxable gifts. Select the labels, then enter the amounts and compute Amir's gift tax liability with respect to 2022 gifts. (Complete all input fields. Enter a 0 for the gift tax liability if the amount, as calculated, would otherwise be zero or negative.) Sel 2 gifts. (Complete Remaining unified credit Tax at current rates on cumulative taxable gifts Tax at current rates on prior period taxable gifts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts