Question: please put (true or false ) i need only sign true or false withought any explanation 1. A corporation may use straight-line depreciation in the

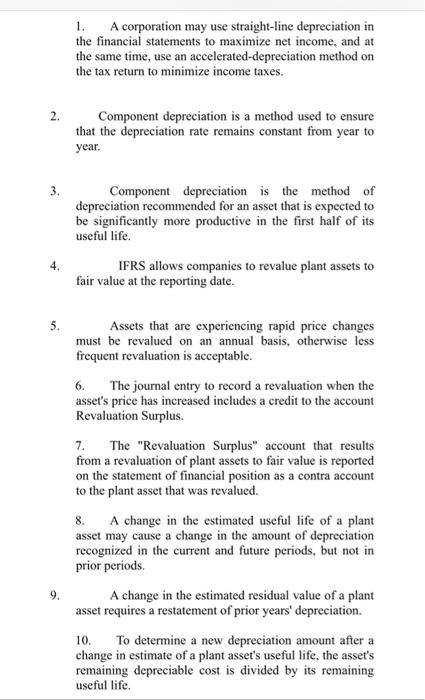

1. A corporation may use straight-line depreciation in the financial statements to maximize net income, and at the same time, use an accelerated-depreciation method on the tax return to minimize income taxes. 2. Component depreciation is a method used to ensure that the depreciation rate remains constant from year to year. 3. Component depreciation is the method of depreciation recommended for an asset that is expected to be significantly more productive in the first half of its useful life. IFRS allows companies to revalue plant assets to fair value at the reporting date. 5. Assets that are experiencing rapid price changes must be revalued on an annual basis, otherwise less frequent revaluation is acceptable. 6. The journal entry to record a revaluation when the asset's price has increased includes a credit to the account Revaluation Surplus. The "Revaluation Surplus" account that results from a revaluation of plant assets to fair value is reported on the statement of financial position as a contra account to the plant asset that was revalued. 8. A change in the estimated useful life of a plant asset may cause a change in the amount of depreciation recognized in the current and future periods, but not in prior periods. A change in the estimated residual value of a plant asset requires a restatement of prior years' depreciation. 10. To determine a new depreciation amount after a change in estimate of a plant asset's useful life, the asset's remaining depreciable cost is divided by its remaining useful life. 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts