Question: Please qualitatively and quantitatively analyze the problem then answer parts A, B and C 1. You enter into a receivers swap receiving 6.50% on 12

Please qualitatively and quantitatively analyze the problem then answer parts A, B and C

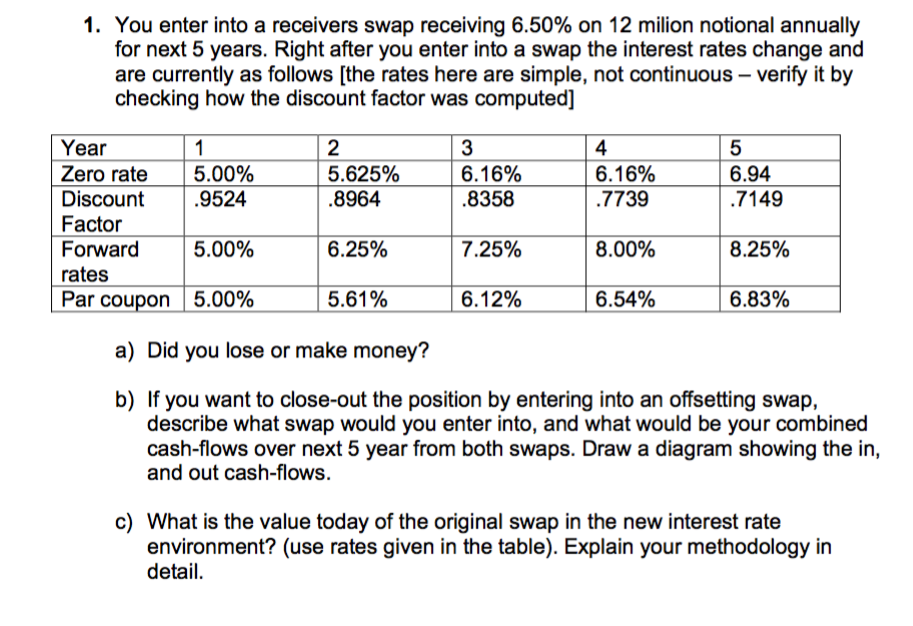

1. You enter into a receivers swap receiving 6.50% on 12 milion notional annually for next 5 years. Right after you enter into a swap the interest rates change and are currently as follows [the rates here are simple, not continuous - verify it by checking how the discount factor was computed] Year 2 5.625% .8964 6.16% .8358 6.16% .7739 6.94 .7149 Zero rate 5.00% Discount .9524 Factor Forward 5.00% rates Par coupon 5.00% 6.25% 7.25% 8.00% 8.25% 5.61% 6.12% 6.54% 6.83% a) Did you lose or make money? b) If you want to close-out the position by entering into an offsetting swap, describe what swap would you enter into, and what would be your combined cash-flows over next 5 year from both swaps. Draw a diagram showing the in, and out cash-flows. c) What is the value today of the original swap in the new interest rate environment? (use rates given in the table). Explain your methodology in detail. 1. You enter into a receivers swap receiving 6.50% on 12 milion notional annually for next 5 years. Right after you enter into a swap the interest rates change and are currently as follows [the rates here are simple, not continuous - verify it by checking how the discount factor was computed] Year 2 5.625% .8964 6.16% .8358 6.16% .7739 6.94 .7149 Zero rate 5.00% Discount .9524 Factor Forward 5.00% rates Par coupon 5.00% 6.25% 7.25% 8.00% 8.25% 5.61% 6.12% 6.54% 6.83% a) Did you lose or make money? b) If you want to close-out the position by entering into an offsetting swap, describe what swap would you enter into, and what would be your combined cash-flows over next 5 year from both swaps. Draw a diagram showing the in, and out cash-flows. c) What is the value today of the original swap in the new interest rate environment? (use rates given in the table). Explain your methodology in detail

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts