Question: Please question attached. Cheers, Ruby Role and Context You are a newly hired financial analyst with Cascade Water Company (CWC), a company operating in most

Please question attached. Cheers, Ruby

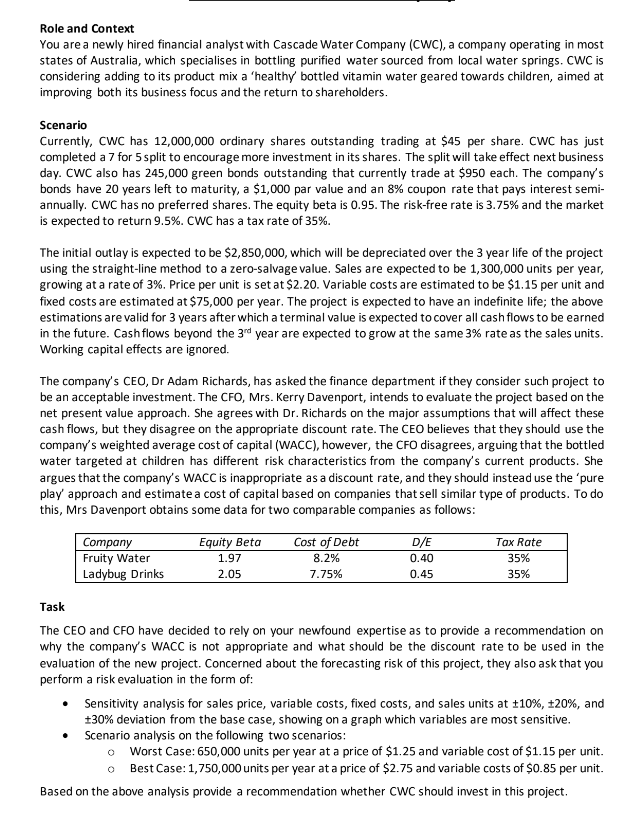

Role and Context You are a newly hired financial analyst with Cascade Water Company (CWC), a company operating in most states of Australia, which specialises in bottling purified water sourced from local water springs. CWC is considering adding to its product mix a 'healthy' bottled vitamin water geared towards children, aimed at improving both its business focus and the return to shareholders. Scenario Currently, CWC has 12,000,000 ordinary shares outstanding trading at 545 per share. CWC has just completed a 7 for Ssplit to encourage more investment in its shares. The split will take effect next business day. CWC also has 245,000 green bonds outstanding that currently trade at 5950 each. The company's bonds have 20 vears left to maturity, a 51,000 par value and an 8% coupon rate that pays interest semi- annually. CWC has no preferred shares. The eqguity beta is 0.95. The risk-free rate is 3.75% and the market is expected to return 9.5%. CWUC has a tax rate of 35%. The initial outlay is expected to be 52,850,000, which will be depreciated over the 3 year life of the project using the straight-line method to a zero-salvage value, Sales are expected to be 1,300,000 units per year, growing at a rate of 3%. Price per unit is set at $2.20. Variable costs are estimated to be $1.15 per unit and fixed costs are estimated at $75,000 per year. The project is expected to have an indefinite life; the above estimations are valid for 3 years after which a terminal value is expected to cover all cash flows to be earned in the future. Cashflows beyond the 3 year are expected to grow at the same 3% rate as the sales units. Working capital effects are ignored. The company's CEQ, Dr Adam Richards, has asked the finance department if they consider such project to be an acceptable investment. The CFO, Mrs. Kerry Davenport, intends to evaluate the project based onthe net present value approach. She agrees with Dr. Richards on the major assumptions that will affect these cash flows, but they disagree on the appropriate discount rate. The CEOQ believes that they should use the company''s weighted average cost of capital [WACC), however, the CFO disagrees, arguing that the bottled water targeted at children has different risk characteristics from the company's current products. She argues that the company's WACC is inappropriate asa discount rate, and they should instead use the \"pure play" approach and estimate a cost of capital based on companies that sell similar type of products. To do this, Mrs Davenport obtains some data for two comparable companies as follows: Company Equity Beta Cost of Debt Fruity Water 1.97 8.2% Ladybug Drinks 2.05 7.75% Task The CEQ and CFD have decided to rely on your newfound expertise as to provide a recommendation on why the company''s WACC is not appropriate and what should be the discount rate to be used in the evaluation of the new project. Concerned about the forecasting risk of this project, they also ask that you perform a risk evaluation in the form of: * Sensitivity analysis for sales price, variable costs, fixed costs, and sales units at 10%, 20%, and 30% deviation from the base case, showing on a graph which variables are most sensitive. Scenario analysis on the following two scenarios: o Worst Case: 650,000 units per year at a price of $1.25 and variable cost of 1.15 per unit. o BestCase: 1,750,000 units per year at a price of $2.75 and variable costs of $0.85 per unit. Based on the above analysis provide a recommendation whether CWC should invest in this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts