Question: please quick solve A corporation had year end 2017 and 2018 retained earnings balances of $230,000 and $360,000, respectively. In 2018 the firm paid $110,000

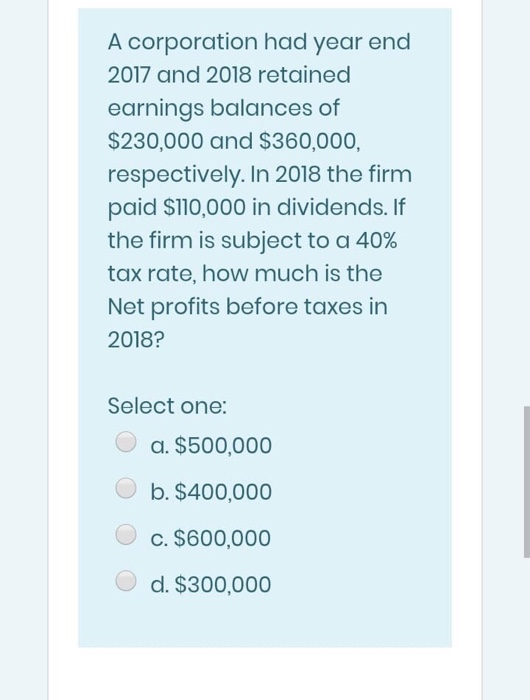

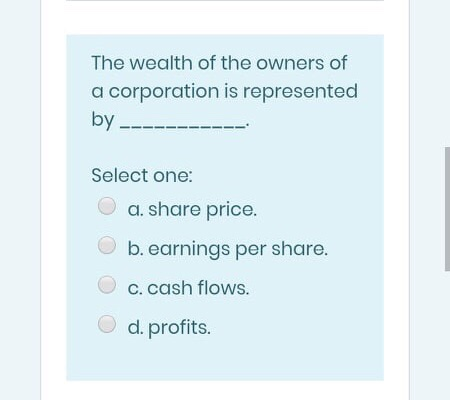

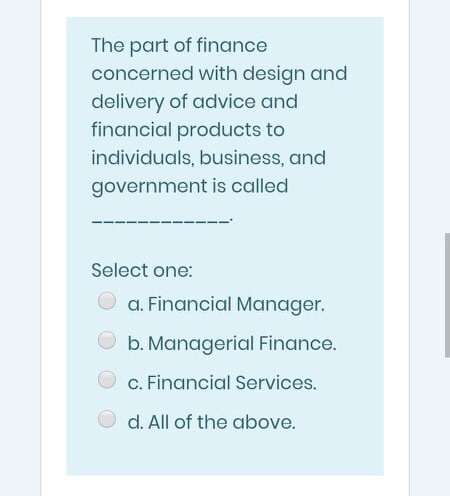

A corporation had year end 2017 and 2018 retained earnings balances of $230,000 and $360,000, respectively. In 2018 the firm paid $110,000 in dividends. If the firm is subject to a 40% tax rate, how much is the Net profits before taxes in 2018? Select one: a. $500,000 b. $400,000 c. $600,000 d. $300,000 The wealth of the owners of a corporation is represented by - Select one: a. share price. b. earnings per share. c. cash flows. O d. profits. The part of finance concerned with design and delivery of advice and financial products to individuals, business, and government is called Select one: a. Financial Manager. b. Managerial Finance. c. Financial Services. d. All of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts