Question: Please Read All the Information provided: Scenario - We are to negotiate with Duke Company - Our Company here is Medusa Automotive Fabrics Negotiation Case

Please Read All the Information provided:

Scenario

- We are to negotiate with Duke Company

- Our Company here is Medusa

Automotive Fabrics

Negotiation Case Study Purchase Negotiation Case: Common Information

This simulation involves negotiating the purchase of an automotive fabric. The following information is common to all groups participating in the negotiation:

There are four potential manufacturers of textile products. These include the following:

Athena Corp. - Annual sales of approx. $ 40 million dollars, located in Bowling Green, Kentucky..

Cybaris Corp. - Annual sales of approx. $ 50 million dollars, located in Charlotte, NC.

Medusa Corp. - Annual sales of approx. $ 20 million dollars, located in Columbus, OH.

Orion Corp. - Annual sales of approx. $ 35 million dollars, located in Grand Rapids, MI.

There are four potential purchasers of textile products.

These companies are second tier automotive suppliers, who supply the major automotive companies located in Michigan, Ohio, and the Southeast. These companies have all purchased in small quantities from all of the suppliers, and include the following:

King Corporation, located in Greenville, SC, has requirements for 150,000 yards of fabric for 2001. The products will be required in 2002 and 2003 according to current plans, and volumes are expected to increase.

Queen Corporation, located in Knoxville, TN, requires 250,000 yards of the fabric for 2001, but volumes for 2002 and 2003 are uncertain.

Duke Corporation, located in Cleveland, OH, requires 100,000 yards of the product, and production volumes required are expected to increase by 50% or more in 2002 and 2003.

Duchess Corporation, located in Lansing, MI, requires 200,000 yards of the product, and volumes are expected to decrease somewhat in 2002 and 2003.

Prices for similar fabrics are in the $12.00 to $15.50 price range per yard. All identified suppliers are able to produce to specifications provided by the purchasing company. However, quality performance related to the product can vary greatly. Individual cost structures of the firms providing the fabrics can vary significantly. Suppliers provide widely different levels of service and technical support. All suppliers have to satisfy the same quality and delivery terms, payment terms, and transportation (FOB seller's plant). Industry capacity utilization is about 75 percent. All purchasing companies have purchased relatively small amounts from all of the suppliers previously, never totaling more than $100,000 per purchase.

Duke Information - This is the company we are trying to negotiate

-

-

This is our company : Medusa

Now the Question are:

1. How to negotiate with Duke Company to get the deal done.

2. What are the risk and rewards to consider in this case, and How the team can balance these risk and rewards.

Just answer these 2 questions Please and Thank you. The other guy who answered it first is wrong. This is my 2nd atemp. Thanks again

The 3 other Competitors posted in the wording sections.

Note: The very last picture Duchess, that is another company, ignore that. The last sentence which is the 1 hour is part of Medusa Company. Thanks

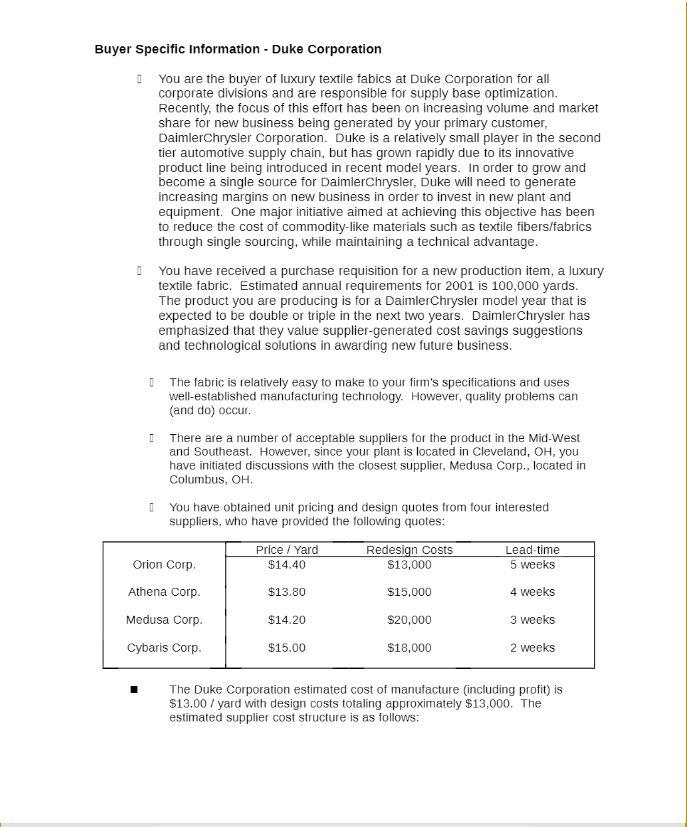

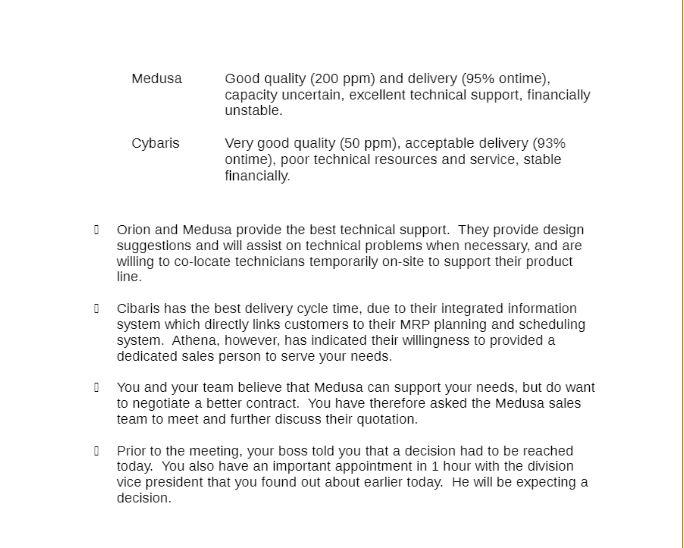

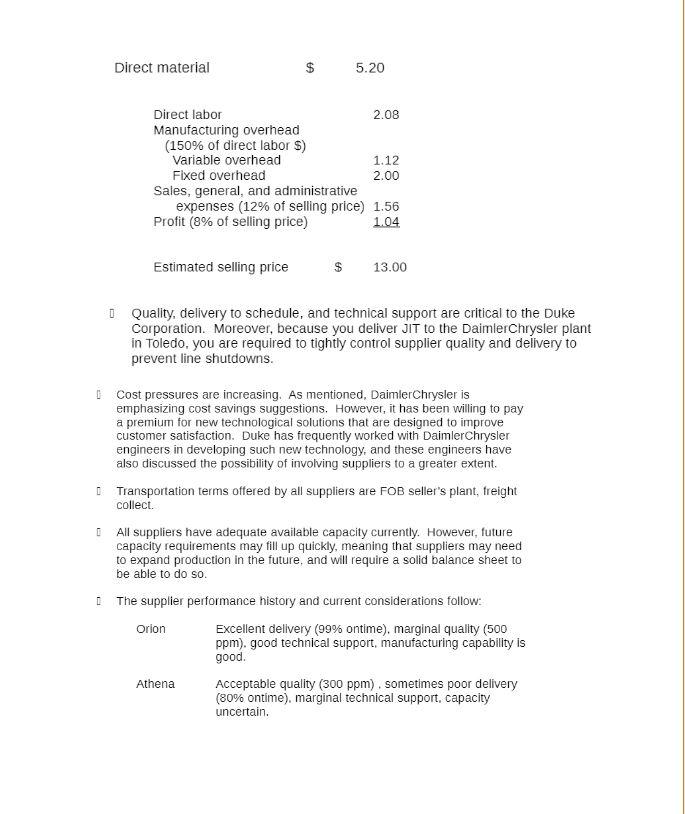

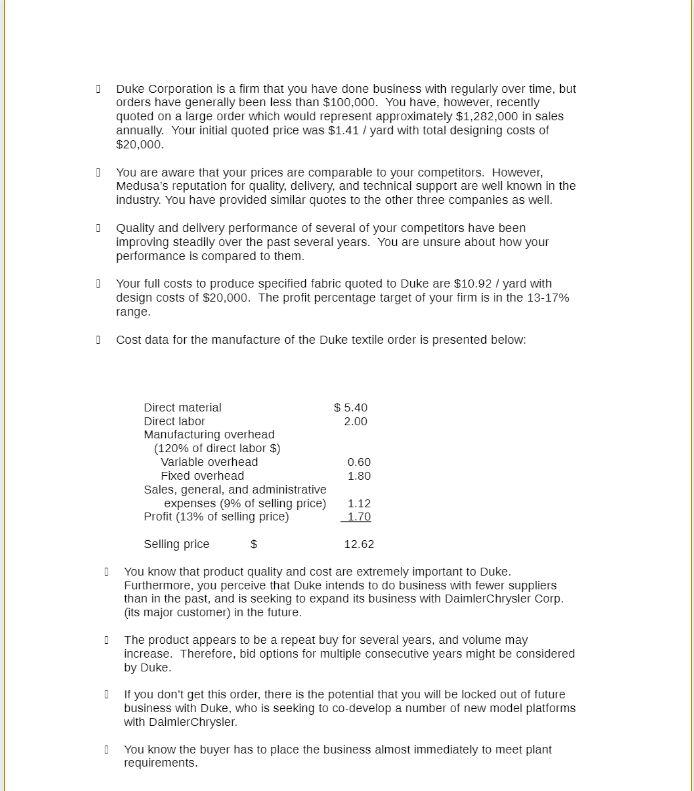

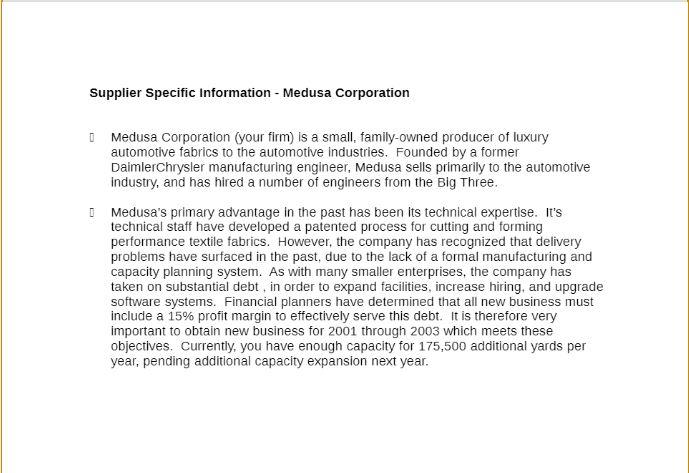

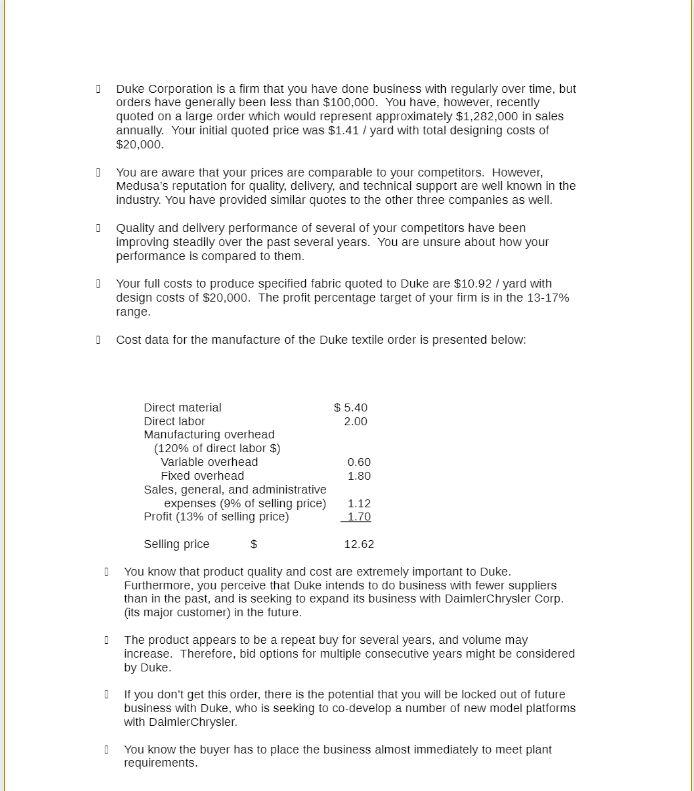

Buyer Specific Information - Duke Corporation 0 You are the buyer of luxury textile fabics at Duke Corporation for all corporate divisions and are responsible for supply base optimization. Recently, the focus of this effort has been on increasing volume and market share for new business being generated by your primary customer, DaimlerChrysler Corporation. Duke is a relatively small player in the second tier automotive supply chain, but has grown rapidly due to its innovative product line being introduced in recent model years. In order to grow and become a single source for DaimlerChrysler, Duke will need to generate increasing margins on new business in order to invest in new plant and equipment. One major initiative aimed at achieving this objective has been to reduce the cost of commodity-like materials such as textile fibers/fabrics through single sourcing, while maintaining a technical advantage. 1 You have received a purchase requisition for a new production item, a luxury textile fabric. Estimated annual requirements for 2001 is 100,000 yards. The product you are producing is for a DaimlerChrysler model year that is expected to be double or triple in the next two years. DaimlerChrysler has emphasized that they value supplier-generated cost savings suggestions and technological solutions in awarding new future business. The fabric is relatively easy to make to your firm's specifications and uses well-established manufacturing technology. However, quality problems can (and do) occur. I There are a number of acceptable suppliers for the product in the Mid-West and Southeast. However, since your plant is located in Cleveland, OH, you have initiated discussions with the closest supplier, Medusa Corp., located in Columbus, OH You have obtained unit pricing and design quotes from four interested suppliers, who have provided the following quotes: Price / Yard Redesign costs Lead-time Orion Corp $14.40 $13,000 5 weeks Athena Corp. $13.80 $15,000 4 weeks Medusa Corp. $14.20 $20,000 3 weeks Cybaris Corp. $15.00 $18,000 2 weeks The Duke Corporation estimated cost of manufacture (including profit) is $13.00 / yard with design costs totaling approximately $13,000. The estimated supplier cost structure is as follows: Medusa Good quality (200 ppm) and delivery (95% ontime), capacity uncertain, excellent technical support, financially unstable. Cybaris Very good quality (50 ppm), acceptable delivery (93% ontime), poor technical resources and service, stable financially. 0 Orion and Medusa provide the best technical support. They provide design suggestions and will assist on technical problems when necessary, and are willing to co-locate technicians temporarily on-site to support their product line. 0 Cibaris has the best delivery cycle time, due to their integrated information system which directly links customers to their MRP planning and scheduling system. Athena, however, has indicated their willingness to provided a dedicated sales person to serve your needs. 0 You and your team believe that Medusa can support your needs, but do want to negotiate a better contract. You have therefore asked the Medusa sales team to meet and further discuss their quotation. 0 Prior to the meeting, your boss told you that a decision had to be reached today. You also have an important appointment in 1 hour with the division vice president that you found out about earlier today. He will be expecting a decision. Direct material $ 5.20 Direct labor 2.08 Manufacturing overhead (150% of direct labor $) Variable overhead 1.12 Fixed overhead 2.00 Sales, general, and administrative expenses (12% of selling price) 1.56 Profit (8% of selling price) 1.04 Estimated selling price $ 13.00 Quality, delivery to schedule, and technical support are critical to the Duke Corporation. Moreover, because you deliver JIT to the DaimlerChrysler plant in Toledo, you are required to tightly control supplier quality and delivery to prevent line shutdowns. Cost pressures are increasing. As mentioned, DaimlerChrysler is emphasizing cost savings suggestions. However, it has been willing to pay a premium for new technological solutions that are designed to improve customer satisfaction. Duke has frequently worked with DaimlerChrysler engineers in developing such new technology, and these engineers have also discussed the possibility of involving suppliers to a greater extent. Transportation terms offered by all suppliers are FOB seller's plant, freight collect All suppliers have adequate available capacity currently. However, future capacity requirements may fill up quickly, meaning that suppliers may need to expand production in the future, and will require a solid balance sheet to be able to do so. The supplier performance history and current considerations follow: Orion Excellent delivery (99% ontime), marginal quality (500 ppm). good technical support, manufacturing capability is good. Athena Acceptable quality (300 ppm). sometimes poor delivery (80% ontime), marginal technical support, capacity uncertain. Duke Corporation is a firm that you have done business with regularly over time, but orders have generally been less than $100,000. You have, however, recently quoted on a large order which would represent approximately $1,282,000 in sales annually. Your initial quoted price was $1.41 / yard with total designing costs of $20,000 0 You are aware that your prices are comparable to your competitors. However, Medusa's reputation for quality, delivery, and technical support are well known in the industry. You have provided similar quotes to the other three companies as well. O Quality and delivery performance of several of your competitors have been improving steadily over the past several years. You are unsure about how your performance is compared to them. Your full costs to produce specified fabric quoted to Duke are $10.92 / yard with design costs of $20,000. The profit percentage target of your firm is in the 13-17% range. 0 cost data for the manufacture of the Duke textile order is presented below: Direct material $ 5.40 Direct labor 2.00 Manufacturing overhead (120% of direct labor $) Variable overhead 0.60 Fixed overhead 1.80 Sales, general, and administrative expenses (9% of selling price) 1.12 Profit (13% of selling price) 1.70 Selling price $ 12.62 You know that product quality and cost are extremely important to Duke. Furthermore, you perceive that Duke intends to do business with fewer suppliers than in the past , and is seeking to expand its business with DaimlerChrysler Corp. (its major customer) in the future. 1 The product appears to be a repeat buy for several years, and volume may increase. Therefore, bid options for multiple consecutive years might be considered by Duke. If you don't get this order, there is the potential that you will be locked out of future business with Duke, who is seeking to co-develop a number of new model platforms with DalmlerChrysler 0 You know the buyer has to place the business almost immediately to meet plant requirements. Supplier Specific Information - Medusa Corporation 0 Medusa Corporation your firm) is a small, family-owned producer of luxury a automotive fabrics to the automotive industries. Founded by a former DaimlerChrysler manufacturing engineer, Medusa sells primarily to the automotive industry, and has hired a number of engineers from the Big Three. 0 Medusa's primary advantage in the past has been its technical expertise. It's technical staff have developed a patented process for cutting and forming performance textile fabrics. However, the company has recognized that delivery problems have surfaced in the past, due to the lack of a formal manufacturing and capacity planning system. As with many smaller enterprises, the company has taken on substantial debt, in order to expand facilities, increase hiring, and upgrade software systems. Financial planners have determined that all new business must include a 15% profit margin to effectively serve this debt. It is therefore very important to obtain new business for 2001 through 2003 which meets these objectives. Currently, you have enough capacity for 175,500 additional yards per year, pending additional capacity expansion next year. Duke Corporation is a firm that you have done business with regularly over time, but orders have generally been less than $100,000. You have, however, recently quoted on a large order which would represent approximately $1,282,000 in sales annually. Your initial quoted price was $1.41 / yard with total designing costs of $20,000 0 You are aware that your prices are comparable to your competitors. However, Medusa's reputation for quality, delivery, and technical support are well known in the industry. You have provided similar quotes to the other three companies as well. O Quality and delivery performance of several of your competitors have been improving steadily over the past several years. You are unsure about how your performance is compared to them. Your full costs to produce specified fabric quoted to Duke are $10.92 / yard with design costs of $20,000. The profit percentage target of your firm is in the 13-17% range. 0 cost data for the manufacture of the Duke textile order is presented below: Direct material $ 5.40 Direct labor 2.00 Manufacturing overhead (120% of direct labor $) Variable overhead 0.60 Fixed overhead 1.80 Sales, general, and administrative expenses (9% of selling price) 1.12 Profit (13% of selling price) 1.70 Selling price $ 12.62 You know that product quality and cost are extremely important to Duke. Furthermore, you perceive that Duke intends to do business with fewer suppliers than in the past , and is seeking to expand its business with DaimlerChrysler Corp. (its major customer) in the future. 1 The product appears to be a repeat buy for several years, and volume may increase. Therefore, bid options for multiple consecutive years might be considered by Duke. If you don't get this order, there is the potential that you will be locked out of future business with Duke, who is seeking to co-develop a number of new model platforms with DalmlerChrysler 0 You know the buyer has to place the business almost immediately to meet plant requirements. Your firm's management wants you to get this contract to support growth and increase market share. To obtain the order, you must reach agreement within 1 hour. Buyer Specific Information - Duchess Corporation 0 You are the buyer of automotive fabrics at Duchess Corporation for all corporate divisions and are responsible for supply base optimization. Recently, the focus of this effort has been on increasing quality and reducing costs for products sold to your major customer, General Motors. Duchess is a relatively well-known second tier automotive supplier, and has supplied GM for a number of years. GM purchasing has empasized cost reductions objectives since its director, Jose Ignacio Lopez, was head of purchasing several years ago. One major initiative aimed at achieving this objective has been to reduce the cost of commodity-like materials such as textile fibers/fabrics through single sourcing, while continually seeking value analysis savings suggestions from suppliers. 0 You have received a purchase requisition for a new production item, a luxury automotive fabric. Estimated annual requirements for 2001 is 200,000 yards. The product you are producing is for a GM model year that is expected to gradually phase out in the next two years. GM has emphasized that they value supplier-generated cost savings suggestions in awarding new business, and that they will be significantly reducing their supply base in doing so. 0 The fabric is relatively easy to make to your firm's specifications and uses well-established manufacturing technology. However, quality problems can (and do) occur. Buyer Specific Information - Duke Corporation 0 You are the buyer of luxury textile fabics at Duke Corporation for all corporate divisions and are responsible for supply base optimization. Recently, the focus of this effort has been on increasing volume and market share for new business being generated by your primary customer, DaimlerChrysler Corporation. Duke is a relatively small player in the second tier automotive supply chain, but has grown rapidly due to its innovative product line being introduced in recent model years. In order to grow and become a single source for DaimlerChrysler, Duke will need to generate increasing margins on new business in order to invest in new plant and equipment. One major initiative aimed at achieving this objective has been to reduce the cost of commodity-like materials such as textile fibers/fabrics through single sourcing, while maintaining a technical advantage. 1 You have received a purchase requisition for a new production item, a luxury textile fabric. Estimated annual requirements for 2001 is 100,000 yards. The product you are producing is for a DaimlerChrysler model year that is expected to be double or triple in the next two years. DaimlerChrysler has emphasized that they value supplier-generated cost savings suggestions and technological solutions in awarding new future business. The fabric is relatively easy to make to your firm's specifications and uses well-established manufacturing technology. However, quality problems can (and do) occur. I There are a number of acceptable suppliers for the product in the Mid-West and Southeast. However, since your plant is located in Cleveland, OH, you have initiated discussions with the closest supplier, Medusa Corp., located in Columbus, OH You have obtained unit pricing and design quotes from four interested suppliers, who have provided the following quotes: Price / Yard Redesign costs Lead-time Orion Corp $14.40 $13,000 5 weeks Athena Corp. $13.80 $15,000 4 weeks Medusa Corp. $14.20 $20,000 3 weeks Cybaris Corp. $15.00 $18,000 2 weeks The Duke Corporation estimated cost of manufacture (including profit) is $13.00 / yard with design costs totaling approximately $13,000. The estimated supplier cost structure is as follows: Medusa Good quality (200 ppm) and delivery (95% ontime), capacity uncertain, excellent technical support, financially unstable. Cybaris Very good quality (50 ppm), acceptable delivery (93% ontime), poor technical resources and service, stable financially. 0 Orion and Medusa provide the best technical support. They provide design suggestions and will assist on technical problems when necessary, and are willing to co-locate technicians temporarily on-site to support their product line. 0 Cibaris has the best delivery cycle time, due to their integrated information system which directly links customers to their MRP planning and scheduling system. Athena, however, has indicated their willingness to provided a dedicated sales person to serve your needs. 0 You and your team believe that Medusa can support your needs, but do want to negotiate a better contract. You have therefore asked the Medusa sales team to meet and further discuss their quotation. 0 Prior to the meeting, your boss told you that a decision had to be reached today. You also have an important appointment in 1 hour with the division vice president that you found out about earlier today. He will be expecting a decision. Direct material $ 5.20 Direct labor 2.08 Manufacturing overhead (150% of direct labor $) Variable overhead 1.12 Fixed overhead 2.00 Sales, general, and administrative expenses (12% of selling price) 1.56 Profit (8% of selling price) 1.04 Estimated selling price $ 13.00 Quality, delivery to schedule, and technical support are critical to the Duke Corporation. Moreover, because you deliver JIT to the DaimlerChrysler plant in Toledo, you are required to tightly control supplier quality and delivery to prevent line shutdowns. Cost pressures are increasing. As mentioned, DaimlerChrysler is emphasizing cost savings suggestions. However, it has been willing to pay a premium for new technological solutions that are designed to improve customer satisfaction. Duke has frequently worked with DaimlerChrysler engineers in developing such new technology, and these engineers have also discussed the possibility of involving suppliers to a greater extent. Transportation terms offered by all suppliers are FOB seller's plant, freight collect All suppliers have adequate available capacity currently. However, future capacity requirements may fill up quickly, meaning that suppliers may need to expand production in the future, and will require a solid balance sheet to be able to do so. The supplier performance history and current considerations follow: Orion Excellent delivery (99% ontime), marginal quality (500 ppm). good technical support, manufacturing capability is good. Athena Acceptable quality (300 ppm). sometimes poor delivery (80% ontime), marginal technical support, capacity uncertain. Duke Corporation is a firm that you have done business with regularly over time, but orders have generally been less than $100,000. You have, however, recently quoted on a large order which would represent approximately $1,282,000 in sales annually. Your initial quoted price was $1.41 / yard with total designing costs of $20,000 0 You are aware that your prices are comparable to your competitors. However, Medusa's reputation for quality, delivery, and technical support are well known in the industry. You have provided similar quotes to the other three companies as well. O Quality and delivery performance of several of your competitors have been improving steadily over the past several years. You are unsure about how your performance is compared to them. Your full costs to produce specified fabric quoted to Duke are $10.92 / yard with design costs of $20,000. The profit percentage target of your firm is in the 13-17% range. 0 cost data for the manufacture of the Duke textile order is presented below: Direct material $ 5.40 Direct labor 2.00 Manufacturing overhead (120% of direct labor $) Variable overhead 0.60 Fixed overhead 1.80 Sales, general, and administrative expenses (9% of selling price) 1.12 Profit (13% of selling price) 1.70 Selling price $ 12.62 You know that product quality and cost are extremely important to Duke. Furthermore, you perceive that Duke intends to do business with fewer suppliers than in the past , and is seeking to expand its business with DaimlerChrysler Corp. (its major customer) in the future. 1 The product appears to be a repeat buy for several years, and volume may increase. Therefore, bid options for multiple consecutive years might be considered by Duke. If you don't get this order, there is the potential that you will be locked out of future business with Duke, who is seeking to co-develop a number of new model platforms with DalmlerChrysler 0 You know the buyer has to place the business almost immediately to meet plant requirements. Supplier Specific Information - Medusa Corporation 0 Medusa Corporation your firm) is a small, family-owned producer of luxury a automotive fabrics to the automotive industries. Founded by a former DaimlerChrysler manufacturing engineer, Medusa sells primarily to the automotive industry, and has hired a number of engineers from the Big Three. 0 Medusa's primary advantage in the past has been its technical expertise. It's technical staff have developed a patented process for cutting and forming performance textile fabrics. However, the company has recognized that delivery problems have surfaced in the past, due to the lack of a formal manufacturing and capacity planning system. As with many smaller enterprises, the company has taken on substantial debt, in order to expand facilities, increase hiring, and upgrade software systems. Financial planners have determined that all new business must include a 15% profit margin to effectively serve this debt. It is therefore very important to obtain new business for 2001 through 2003 which meets these objectives. Currently, you have enough capacity for 175,500 additional yards per year, pending additional capacity expansion next year. Duke Corporation is a firm that you have done business with regularly over time, but orders have generally been less than $100,000. You have, however, recently quoted on a large order which would represent approximately $1,282,000 in sales annually. Your initial quoted price was $1.41 / yard with total designing costs of $20,000 0 You are aware that your prices are comparable to your competitors. However, Medusa's reputation for quality, delivery, and technical support are well known in the industry. You have provided similar quotes to the other three companies as well. O Quality and delivery performance of several of your competitors have been improving steadily over the past several years. You are unsure about how your performance is compared to them. Your full costs to produce specified fabric quoted to Duke are $10.92 / yard with design costs of $20,000. The profit percentage target of your firm is in the 13-17% range. 0 cost data for the manufacture of the Duke textile order is presented below: Direct material $ 5.40 Direct labor 2.00 Manufacturing overhead (120% of direct labor $) Variable overhead 0.60 Fixed overhead 1.80 Sales, general, and administrative expenses (9% of selling price) 1.12 Profit (13% of selling price) 1.70 Selling price $ 12.62 You know that product quality and cost are extremely important to Duke. Furthermore, you perceive that Duke intends to do business with fewer suppliers than in the past , and is seeking to expand its business with DaimlerChrysler Corp. (its major customer) in the future. 1 The product appears to be a repeat buy for several years, and volume may increase. Therefore, bid options for multiple consecutive years might be considered by Duke. If you don't get this order, there is the potential that you will be locked out of future business with Duke, who is seeking to co-develop a number of new model platforms with DalmlerChrysler 0 You know the buyer has to place the business almost immediately to meet plant requirements. Your firm's management wants you to get this contract to support growth and increase market share. To obtain the order, you must reach agreement within 1 hour. Buyer Specific Information - Duchess Corporation 0 You are the buyer of automotive fabrics at Duchess Corporation for all corporate divisions and are responsible for supply base optimization. Recently, the focus of this effort has been on increasing quality and reducing costs for products sold to your major customer, General Motors. Duchess is a relatively well-known second tier automotive supplier, and has supplied GM for a number of years. GM purchasing has empasized cost reductions objectives since its director, Jose Ignacio Lopez, was head of purchasing several years ago. One major initiative aimed at achieving this objective has been to reduce the cost of commodity-like materials such as textile fibers/fabrics through single sourcing, while continually seeking value analysis savings suggestions from suppliers. 0 You have received a purchase requisition for a new production item, a luxury automotive fabric. Estimated annual requirements for 2001 is 200,000 yards. The product you are producing is for a GM model year that is expected to gradually phase out in the next two years. GM has emphasized that they value supplier-generated cost savings suggestions in awarding new business, and that they will be significantly reducing their supply base in doing so. 0 The fabric is relatively easy to make to your firm's specifications and uses well-established manufacturing technology. However, quality problems can (and do) occurStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts