Question: Please read below case study and write one-page bullet-point report summarizing your recommendations and rationale. The NPVs are attached: Economic/Financial Case Study: Steel Freight Lines:

Please read below case study and write one-page bullet-point report summarizing your recommendations and rationale. The NPVs are attached:

Economic/Financial Case Study: Steel Freight Lines:

Suppose that you are the CEO of a small steel freight line operating on the Mississippi River. You have twelve freight boats that haul steel scrap to the mills.

The price for you to haul the scrap is $0.23 per lb; the railroad charges 100% more and the trucking lines (your primary competitors) charges 200% more.

For your inland customers, you estimate that local shipping charges raise their costs by another 1-2 cents.

There is one other competing boat line with five boats - but due to the owner's health problems, there is no fleet expansion planned by that family-owned company.

You also estimate that you are currently handling about ten percent of all the scrap being shipped in your area. Moreover, there appears to be a backlog in current scrap shipments, and the backlog is expected to grow.

You have four 15-year old boats that are in need of an immediate overhaul, the cost for each boat will be $6 million, and it will extend their service life by five years.

The overhaul for each will take approximately 6 months and they can be done two at a time.

(Alternatively, you could purchase four new boats, two of which will be ready in 1 month. The others will be built per your specification and will be available in two years.

A new freight boat will cost you $15 million, will last 15 years, and it takes one year(s) to build (there is only one builder in the area with limited capacity that can deliver two boats per year; the builder has other commitments for the next year).

Your cost of capital (a bank loan) is 8%; assume payment is delivered for both options.

You estimate that each boat produces $7500000 in revenues annually, and has the following costs: $3000000 crew salaries/benefits, $800000 fuel expenses, and $650000 in maintenance.

Your marginal tax rate is 40% and you use the straight-line depreciation for tax reporting.)

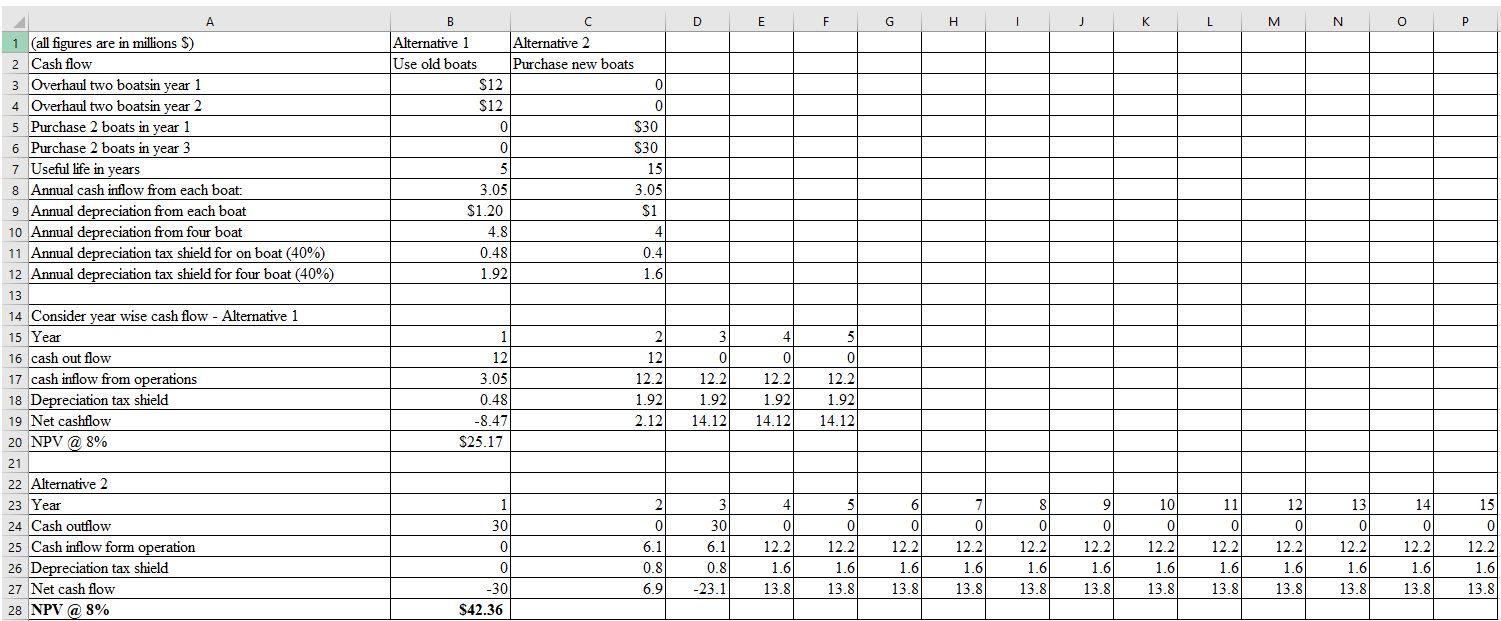

D E F G H 1 K L M N 0 P B Alternative 1 Alternative 2 Use old boats Purchase new boats $12 0 $12 0 0 $30 0 $30 5 15 3.05 3.05 $1.20 S1 4.8 4 0.48 0.4 1.92 1.6 A (all figures are in millions S) 2 Cash flow 3 Overhaul two boatsin year 1 4 Overhaul two boatsin year 2 5 Purchase 2 boats in year 1 6 Purchase 2 boats in year 3 7 Useful life in years 8 Annual cash inflow from each boat: 9 Annual depreciation from each boat 10 Annual depreciation from four boat 11 Annual depreciation tax shield for on boat (40%) 12 Annual depreciation tax shield for four boat (40%) 13 14 Consider year wise cash flow - Alternative 1 15 Year 16 cash out flow 17 cash inflow from operations 18 Depreciation tax shield 19 Net cashflow 20 NPV @ 8% 21 22 Alternative 2 23 Year 24 Cash outflow 25 Cash inflow form operation 26 Depreciation tax shield 27 Net cash flow 28 NPV @ 8% 5 1 12 3.05 0.48 -8.47 $25.17 2 12 12.2 1.92 2.12 3 0 12.2 1.92 14.12 4 0 12.2 1.92 14.12 0 12.2 1.92 14.12 7 11 1 301 0 0 -301 $42.36 2 0 6.1 0.8 6.9 3 30 6.1 0.8 -23.1 4 01 12.2 1.6 13.8 5 0 12.2 1.6 13.8 61 12.2 1.6 0 12.2 1.6 8 0 12.2 1.6 91 12.2 1.6 13.8 10 12.2 1.6 13.8 12.2 1.6 12 0 12.2 1.6 13.8 13 0 12.2 1.6 14 0 12.2 1.6 13.8 15 0 12.2 1.6 13.8 13.8 13.8 13.8 13.8 13.8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts