Question: Please Read Carefully Before start answering this question. Please follow the instructions. This Question is from 'BSBFIM501 Manage budgets and financial plans' course. There are

Please Read Carefully Before start answering this question. Please follow the instructions.

This Question is from 'BSBFIM501 Manage budgets and financial plans' course. There are no parts missing for this Question; guaranteed!. This is the original Screenshot direct from the question. Therefore, there are nothing any further information can be provided. Thanks for your understanding and Cooperation. Please be advised that here the entire question 2 is for reference. No work required for Question 2. Just need to use this question to workout Question 3.

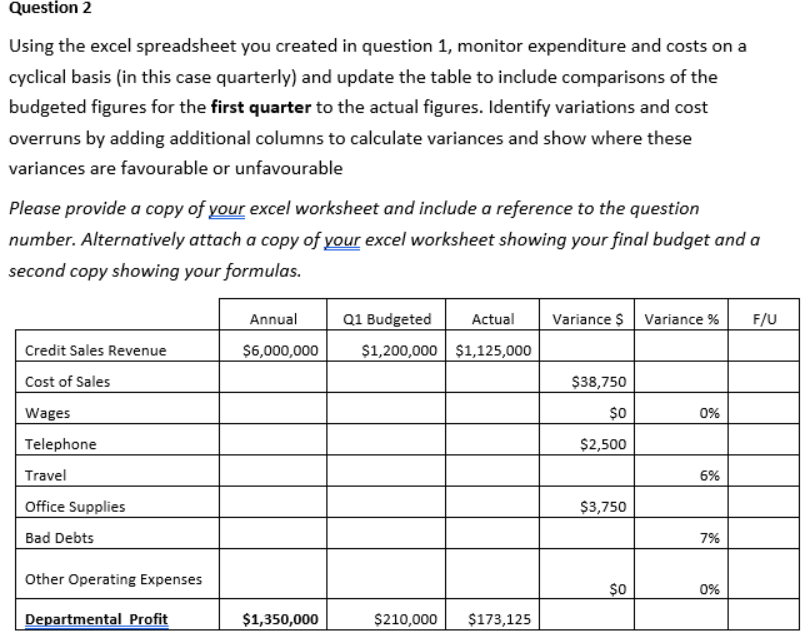

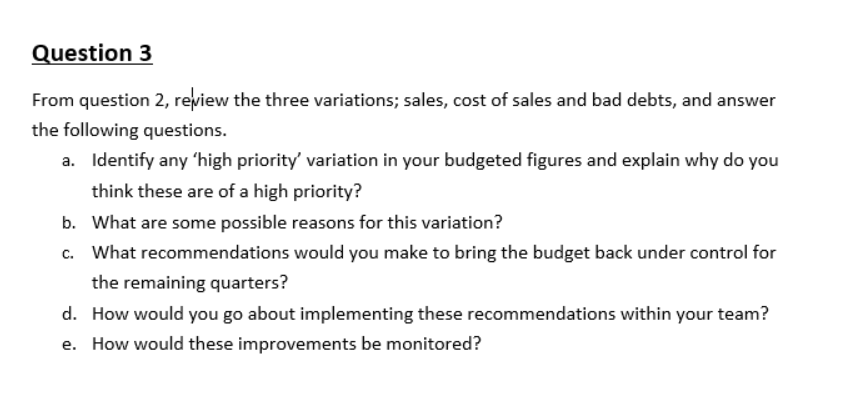

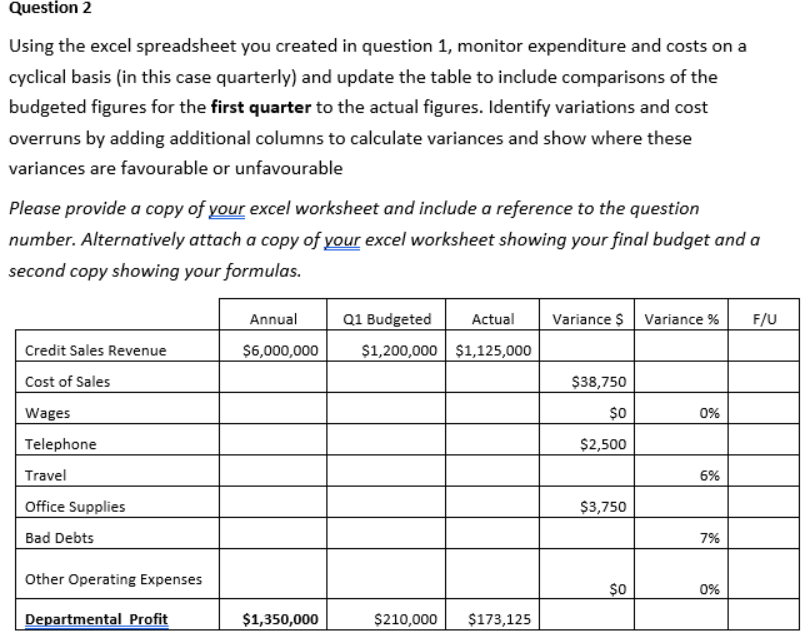

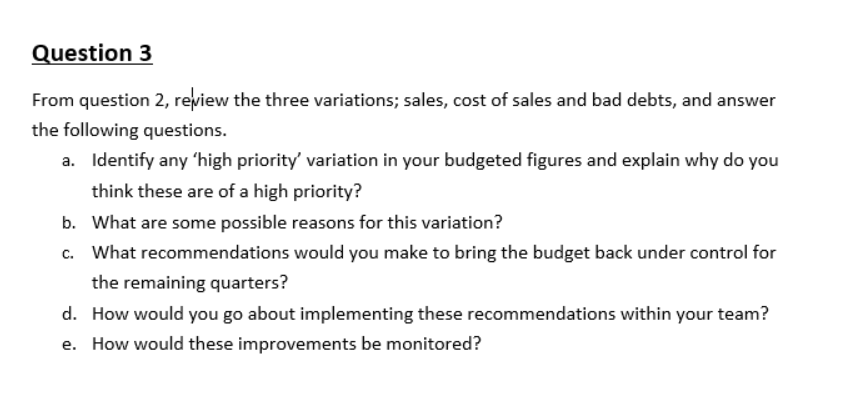

Question 2 Using the excel spreadsheet you created in question 1, monitor expenditure and costs on a cyclical basis (in this case quarterly) and update the table to include comparisons of the budgeted figures for the first quarter to the actual figures. Identify variations and cost overruns by adding additional columns to calculate variances and show where these variances are favourable or unfavourable Please provide a copy of your excel worksheet and include a reference to the question number. Alternatively attach a copy of your excel worksheet showing your final budget and a second copy showing your formulas. Annual Variance $ Variance % F/U Q1 Budgeted Actual $1,200,000 $1,125,000 $6,000,000 $38,750 $0 0% Credit Sales Revenue Cost of Sales Wages Telephone Travel Office Supplies Bad Debts $2,500 6% $3,750 7% Other Operating Expenses $0 0% Departmental Profit $1,350,000 $210,000 $173,125 Question 3 From question 2, review the three variations; sales, cost of sales and bad debts, and answer the following questions. a. Identify any 'high priority' variation in your budgeted figures and explain why do you think these are of a high priority? b. What are some possible reasons for this variation? C. What recommendations would you make to bring the budget back under control for the remaining quarters? d. How would you go about implementing these recommendations within your team? e. How would these improvements be monitored? Question 2 Using the excel spreadsheet you created in question 1, monitor expenditure and costs on a cyclical basis (in this case quarterly) and update the table to include comparisons of the budgeted figures for the first quarter to the actual figures. Identify variations and cost overruns by adding additional columns to calculate variances and show where these variances are favourable or unfavourable Please provide a copy of your excel worksheet and include a reference to the question number. Alternatively attach a copy of your excel worksheet showing your final budget and a second copy showing your formulas. Annual Variance $ Variance % F/U Q1 Budgeted Actual $1,200,000 $1,125,000 $6,000,000 $38,750 $0 0% Credit Sales Revenue Cost of Sales Wages Telephone Travel Office Supplies Bad Debts $2,500 6% $3,750 7% Other Operating Expenses $0 0% Departmental Profit $1,350,000 $210,000 $173,125 Question 3 From question 2, review the three variations; sales, cost of sales and bad debts, and answer the following questions. a. Identify any 'high priority' variation in your budgeted figures and explain why do you think these are of a high priority? b. What are some possible reasons for this variation? C. What recommendations would you make to bring the budget back under control for the remaining quarters? d. How would you go about implementing these recommendations within your team? e. How would these improvements be monitored