Question: * * * Please read. Last expert did not read at all. * * * * * * Set this up in excel. You should

Please read. Last "expert" did not read at all.

Set this up in excel. You should be able to change values and figure out different answers.

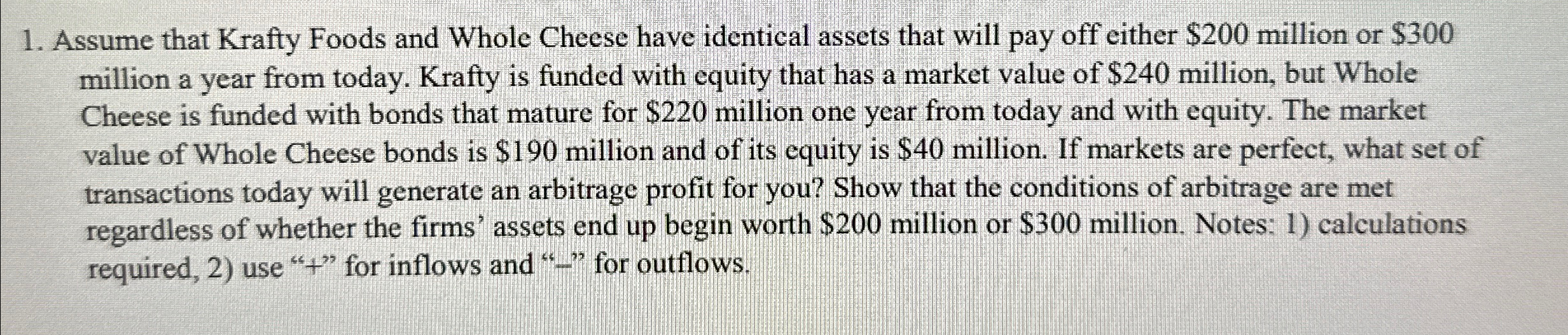

Assume that Krafty Foods and Whole Cheese have identical assets that will pay off either $ million or $ million a year from today. Krafty is funded with equity that has a market value of $ million, but Whole Cheese is funded with bonds that mature for $ million one year from today and with equity. The market value of Whole Cheese bonds is $ million and of its equity is $ million. If markets are perfect, what set of transactions today will generate an arbitrage profit for you? Show that the conditions of arbitrage are met regardless of whether the firms' assets end up begin worth $ million or $ million. Notes: calculations required, use for inflows and for outflows.

This problem is meant to be solved in excel. Please show all formulas in excel. Also, it should be able to change any values of the problem to get slightly different answers outside of the problem

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock