Question: Please read the article below and answer the following questions Q1. What is aftermarket lifetime value? Why CEOs at industrial OEMs are increasing their focus

Please read the article below and answer the following questions

Q1. What is aftermarket lifetime value? Why CEOs at industrial OEMs are increasing their focus on aftermarket services?

Q2. To help OEMs develop a strategy that suits their needs, discuss the aftermarket lifetime value in detail

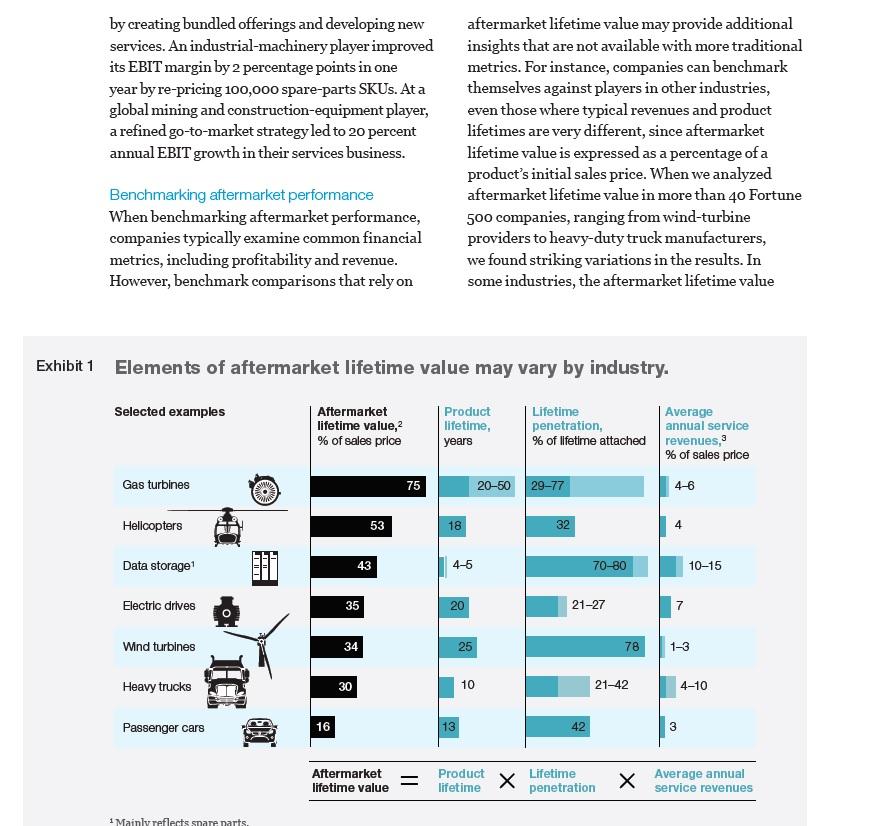

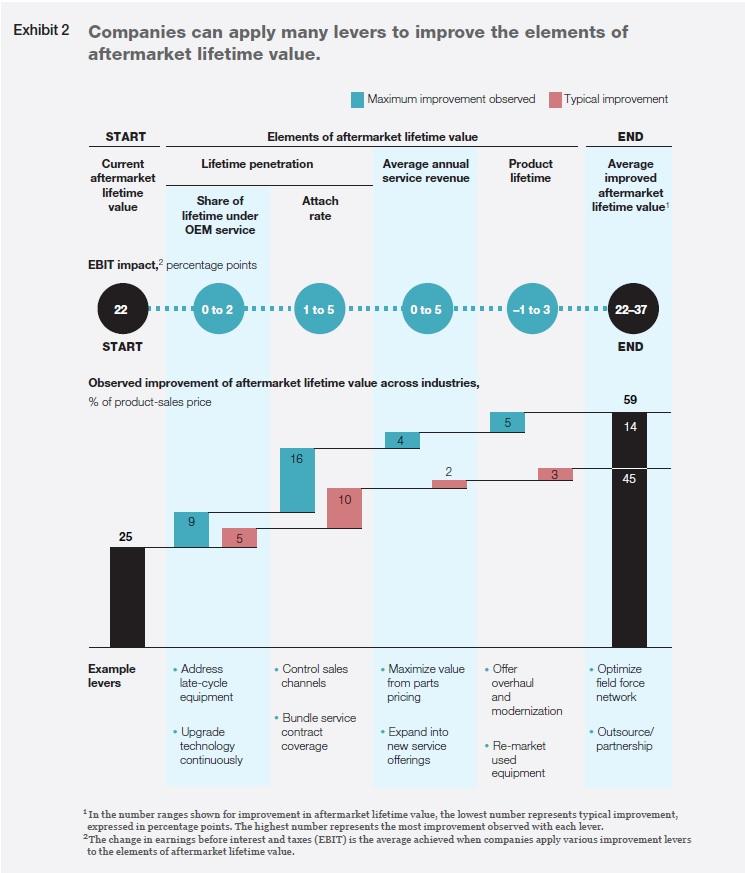

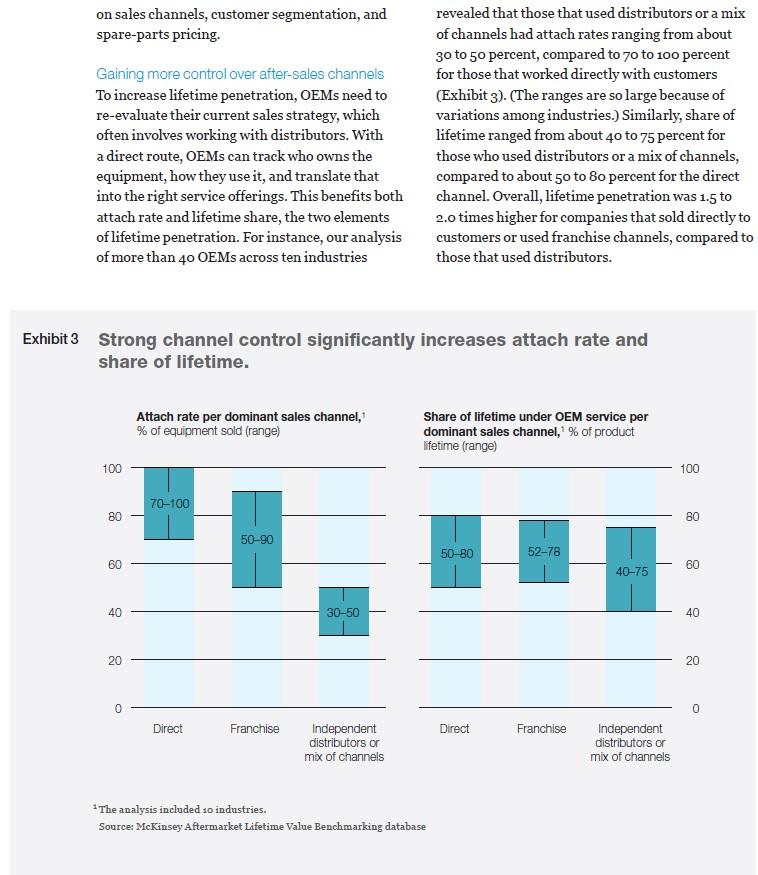

Industrial aftermarket services: Growing the core Advanced Electronics July 2017 OS Aditya Ambadipudi Alexander Brotschi Markus Forsgren Florent Kervazo James Xing Industrial aftermarket services: Growing the core OEMs may find untapped goldmines in aftermarket services by strengthening their core business in parts, repair, and maintenance. In many industrial sectors, original-equipment To gain clarity and remain competitive, they manufacturers (OEMs) face a challenging and must undertake a more detailed examination of uncertain future. In recent years, input prices aftermarket lifetime value-the total revenue they have fallen and growth in emerging markets receive from servicing their installed base. This has slowed, decreasing new-equipment sales in measure, which is typically calculated for each industries ranging from oil and gas to agriculture product line, provides a more comprehensive view to commercial aerospace. In response, CEOs at of aftermarket value than commonly used metrics, industrial OEMs are increasing their focus on such as service revenue captured per customer. aftermarket servicesthe provision of parts, repair, maintenance, and digital services for the Companies that examine aftermarket lifetime equipment they sold. The appeal of this strategyis value closely may find that certain services, simple: services provide stable revenue-and often including core offerings, contribute more to the higher margins-than sales of new equipment. One bottom line than expected. For instance, one OEM McKinsey analysis across 30 industries showed that closely examined aftermarket lifetime value and average earnings-before-interest-and-taxes (EBIT) realized that 90 percent of its near-term growth margin for aftermarket services was 25 percent, would come from core services, even though initial compared to 10 percent for new equipment. estimates suggested that digital solutions would be the main driver. When exploring aftermarket value pools, industrial OEMs are often tempted to prioritize data-driven Other OEMs that analyzed aftermarket lifetime advanced services enabled by digital innovation value have identified specific weaknesses in their and the Internet of Things (IoT). For instance, strategy, such as a low number of long-term service many hope to gain a competitive edge through contracts, and launched improvement efforts. e-commerce platforms and increased automation- They have also been able to benchmark their digital strategies that are already common at B2C performance against competitors and companies companies but less developed in B2B. OEMs may in other industries more accurately an exercise feel more pressure to develop digital capabilities that often prompts them to reassess their than most B2B players because digital natives aftermarket strategy. have recently entered the industrial aftermarket, offering parts and services at low prices. To help OEMs develop a strategy that suits their needs, this article discusses aftermarket lifetime Despite the rise of digital initiatives, core value in detail. First, we examine the three aftermarket services-the provision of parts, repair, factors that can influence value: product lifetime, and maintenance-are also critical to success. lifetime penetration, and average-annual services Under these circumstances, it can be difficult for revenue. We then discuss how companies can use OEMs to identify the best opportunities. aftermarket lifetime value to benchmark their performance against their industry peers. Finally, provider. In many cases, industrial OEMS we look at strategies for increasing aftermarket lose aftermarket business after a product's lifetime value that can help boost the core business. warranties and initial contracts expire. However, the most successful OEMs have What is aftermarket lifetime value? found ways to extend their business beyond a Industrial OEMs are often in the best position to product's first 10 to 15 years. For instance, some capture aftermarket value, since they understand sell tailored, low-price contracts covering long- their products better than third-party providers, term maintenance. have partnerships within their channels, and can collect proprietary data about their equipment Average annual services revenue is the from their large installed base. In many cases, amount an OEM receives each year for each however, OEMs lose ground to third-party parts unit of equipment under service contract. It is manufacturers or independent service providers, expressed as percentage, making it possible who offer less expensive or used parts for aging to compare products with different selling equipment. In this competitive market, OEMS prices. For instance, an OEM could sell a must identify potential areas for improvement by machine for $1 million and generate $100,000 breaking aftermarket lifetime value into three in aftermarket revenues for each year under elements and analyzing their performance on contract. In this case, the average annual each one: services revenue would be 10 percent. Product lifetime refers to the period during Aftermarket lifetime value is expressed as a which equipment is in use, which may be longer percentage of a product's initial sales price. For or shorter than the manufacturer specified. For example, a civilian helicopter has a lifetime of instance, OEMs design gas turbines to last 30 about 20 years. If the helicopter OEM received years, but some customers have used them for service revenues equal to half the product's up to 50 years, even though their performance original sales value over that period, the may be suboptimal after the intended lifespan. aftermarket lifetime value would be 50 percent. Since aftermarket lifetime value does not provide Lifetime penetration refers to the percent of insight into profitability, OEMs must continue to an OEM's installed base that it serves during examine the EBIT of aftermarket services to obtain a product's lifetime. Two factors determine a comprehensive view of their finances. Moreover, lifetime penetration. The first is the attach aftermarket lifetime value is undiscounted (for rate-the percent of new equipment sold simplicity) and does not consider the time value" with warranty or with service contracts (for of money. instance, a parts-supply contract or a repair and maintenance contract). Overall, the attach As noted earlier, several companies have already rate reflects how well an OEM is marketing taken a detailed look at aftermarket lifetime value its service capabilities at the beginning and used their insights to improve performance of a product's lifetime. The second factor often by enhancing core-service offerings. One influencing lifetime penetration is share of power-equipment manufacturer achieved a lifetime, which is the percent of a product's 20 percent increase in aftermarket revenue and lifetime in which an OEM is the primary service 30 percent growth in long-term contract penetration by creating bundled offerings and developing new services. An industrial-machinery player improved its EBIT margin by 2 percentage points in one year by re-pricing 100,000 spare parts SKUs. At a global mining and construction-equipment player, a refined go-to-market strategy led to 20 percent annual EBIT growth in their services business. aftermarket lifetime value may provide additional insights that are not available with more traditional metrics. For instance, companies can benchmark themselves against players in other industries, even those where typical revenues and product lifetimes are very different, since aftermarket lifetime value is expressed as a percentage of a product's initial sales price. When we analyzed aftermarket lifetime value in more than 40 Fortune 500 companies, ranging from wind-turbine providers to heavy-duty truck manufacturers, we found striking variations in the results. In some industries, the aftermarket lifetime value Benchmarking aftermarket performance When benchmarking aftermarket performance, companies typically examine common financial metrics, including profitability and revenue. However, benchmark comparisons that rely on Exhibit 1 Elements of aftermarket lifetime value may vary by industry. Selected examples Aftermarket lifetime value, 2 % of sales price Product lifetime, years Lifetime penetration, % of lifetime attached Average annual service revenues, % of sales price Gas turbines 75 20-50 29-77 4-6 Helicopters 53 18 32 4 Data storage 43 4-5 70-80 10-15 Electric drives 35 20 21-27 7 Wind turbines 34 25 78 1-3 Heavy trucks 30 10 21-42 4-10 Passenger cars 16 13 42 3 Aftermarket lifetime value Product lifetime Lifetime penetration Average annual service revenues 1 Mainly reflects spare parts. of the aftermarket was almost equal to the price constraints in the aftermarket, they can take steps of the initial product; in other industries, players to increase lifetime penetration, annual services struggled to capture any aftermarket revenue. The revenue, and product lifetime. The first step highest industry aftermarket lifetime value was involves creating a comprehensive digital tool that five times that of the lowest. The differences within models the installed base and analyzes individual industries were equally significant, with the best pieces of equipment. One aircraft-equipment OEM performers capturing three times the aftermarket designed such a tool to estimate aftermarket lifetime lifetime value as the lowest performers. These value for individual planes. After determining findings suggest that many companies could product lifetime, lifetime penetration, and average learn from their peers or from the leaders in other annual services revenue for individual elements of industries that may be taking more innovative or the installed base, OEMs can calculate aftermarket aggressive approaches to aftermarket. lifetime value and apply various improvement levers-there are usually about 40 to 60 possibilities, A caveat: Industry-specific constraints depending on the industry. Most of these levers While all OEMs have opportunities to improve our focus on improving the core aftermarket business analysis of 40 companies also showed that certain (Exhibit 2). For instance, OEMs could try to increase industry-specific constraints influence their product lifetime by re-marketing used equipment, products' aftermarket lifetime value. Consider re-pricing spare parts more dynamically, or two different sectors: heavy-duty trucks and offering to overhaul and modernize a customer's gas turbines (Exhibit 1). In both industries, the existing equipment through hardware or software equipment has high utilization, sometimes under upgrades. OEMs must often implement multiple tough operating conditions, requiring regular improvement levers simultaneously because they inspection, maintenance, and repair. But the are interdependent. Some levers, such as those 30 percent aftermarket lifetime value associated related to modernizing systems, may induce extra with heavy-duty trucks is much lower than the costs and reduce EBIT. 75 percent for power-generation equipment for several reasons. First, the impact on lost revenue Typically, companies achieve the greatest impact of a broken gas turbine is generally much higher from boosting lifetime penetration, especially if than that of a broken truck. Power companies are they can increase the number of contracts related thus more likely to pay a premium to guarantee to servicing aging equipment-an important source prompt service and constant uptime. Second, truck of revenue and one that is often overlooked. In our parts are more readily available than power-grid experience, OEMs that have applied appropriate components, and competition from third-party levers have doubled their aftermarket lifetime providers is higher, driving aftermarket prices value within three to five years, despite intense down. Finally, the lifetime of a gas turbine is two competition from third-party parts manufacturers to five times that of heavy-duty trucks. Companies and independent service providers. They also that keep such differences in mind will not be increased EBIT. confounded if their aftermarket lifetime value is much higher or lower than that of businesses in Given the number of possible levers that OEMs other industries. can apply to aftermarket lifetime value, it would be impractical to describe them all in detail. To How can OEMs expand aftermarket lifetime value? appreciate the variety of strategies available, While OEMs cannot eliminate industry-specific consider the following three examples, which focus Exhibit 2 Companies can apply many levers to improve the elements of aftermarket lifetime value. | Maximum improvement observed Typical improvement START Current aftermarket lifetime value Elements of aftermarket lifetime value Lifetime penetration Average annual service revenue Share of Attach lifetime under rate OEM service Product lifetime END Average improved aftermarket lifetime value EBIT impact,? percentage points 22 0 to 2 + 1 to 5 0 to 5-1 to 32237 START END Observed improvement of aftermarket lifetime value across industries, % of product-sales price 59 14 16 2 3 45 10 9 25 5 Example levers Address late-cycle equipment Control sales channels Optimize field force network Maximize value. Offer from parts overhaul pricing and modernization Expand into new service Re-market offerings used equipment Bundle service contract coverage Upgrade technology continuously Outsource/ partnership *In the number ranges shown for improvement in aftermarket lifetime value, the lowest number represents typical improvement, expressed in percentage points. The highest number represents the most improvement observed with each lever. 2 The change in earnings before interest and taxes (EBIT) is the average achieved when companies apply various improvement levers to the elements of aftermarket lifetime value. on sales channels, customer segmentation, and spare-parts pricing. Gaining more control over after-sales channels To increase lifetime penetration, OEMs need to re-evaluate their current sales strategy, which often involves working with distributors. With a direct route, OEMs can track who owns the equipment, how they use it, and translate that into the right service offerings. This benefits both attach rate and lifetime share, the two elements of lifetime penetration. For instance, our analysis of more than 40 OEMs across ten industries revealed that those that used distributors or a mix of channels had attach rates ranging from about 30 to 50 percent, compared to 70 to 100 percent for those that worked directly with customers (Exhibit 3). (The ranges are so large because of variations among industries.) Similarly, share of lifetime ranged from about 40 to 75 percent for those who used distributors or a mix of channels, compared to about 50 to 80 percent for the direct channel. Overall, lifetime penetration was 1.5 to 2.0 times higher for companies that sold directly to customers or used franchise channels, compared to those that used distributors. Exhibit 3 Strong channel control significantly increases attach rate and share of lifetime. Attach rate per dominant sales channel, % of equipment sold (range) Share of lifetime under OEM service per dominant sales channel, % of product lifetime (range) 100 100 70-100 80 80 50-90 50-80 52-78 60 60 40-75 40 30-50 40 20 20 0 Direct Franchise Direct Franchise Independent distributors or mix of channels Independent distributors or mix of channels * The analysis included 10 industries. Source: McKinsey Aftermarket Lifetime Value Benchmarking database In some markets, such as those where OEMs are In addition to maximizing lifetime penetration, trying to reach numerous residential customers, the company also improved its cross-selling or distributors may be the only feasible sales-channel upselling efforts, since it now had deeper insights option. But this does not mean OEMs should give about client needs. them complete freedom. Instead, they should set stringent rules that allow them to keep some Optimizing parts pricing control of their customer base. At most OEMs, parts sales typically provide gross margins of over 30 percent, compared Segmenting customers by need and securing with an average of 10 percent for maintenance their business with tailored contracts services and that means they often make the By segmenting customers and creating tailored most substantial contribution to average annual contracts for parts or maintenance, OEMs can services revenues. In consequence, many OEMs effectively increase lifetime penetration for offer maintenance services at no profit to increase the entire installed base at each company that part sales. But these OEMs hesitate to ask for price they serve. For example, customers with older increases for parts, since margins are already equipment are more cost sensitive than those with high and they fear that their customers will object. new equipment, since repairs or parts may equal Some OEMs also struggle to set the right price for or exceed the value of a machine. To increase the SKUs that are not sold frequently, since it is more share of lifetime at such customers, OEMs could difficult to estimate what customers are willing offer refurbished parts or even provide a buy-back to pay for them. The benchmark analysis across guarantee for spare parts. ten industries showed that OEMs can typically improve EBIT margins by 3 to 10 percent by As another example, consider how aircraft-engine increasing prices, even when they are already high. and aircraft-equipment manufacturers can They may score particularly high gains if they use maximize lifetime penetration by offering long- a data-based approach to pricing their numerous term service contracts that guarantee engine long-tail products-parts for aged equipment for uptime-a critical consideration for airlines. To which demand is low but constant. generate customer interest in such contracts, manufacturers need to make tailored offerings. For instance, one large aircraft-equipment provider segmented its customers based on The first step OEMs must take to transform the age of their equipment and also considered their aftermarket business is to understand the other unique needs, such as the predictability of elements of aftermarket lifetime value and create maintenance costs or the need to have aircraft a tool to measure them. But that is just one part of available at all times. For customers with older a successful aftermarket transformation. At the aircraft operating short routes, it drafted contracts organizational level, OEMs must also establish that offered low prices but also specified that the and measure key performance indicators for OEM would assume minimal risk. These strategies aftermarket sales, such as the attach rate for a helped the aircraft-equipment provider increase particular product, and increase back-office its long-term service contract penetration rate support. Finally, companies must focus on from about 15 to over 50 percent over five years. execution, since even the best strategies may falter without a careful plan to implement changes, Aditya Ambadipudi is a senior knowledge analyst in monitor impact, and achieve high growth. Together, McKinsey's North American Knowledge Center, where these tactics will turn aftermarket services into a Alexander Brotschi is a knowledge specialist and major source of value. James Xing is a senior research analyst. Markus Product lifetime is generally more difficult to improve than Forsgren is a partner in the Stockholm office and lifetime penetration or annual services revenue. Florent Kervazo is a partner in the New York office

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts