Question: Please read the case first, then help with the question below. Thank you. Investment Case Firm: JAKE Investment Management, LLC. Client: Braeburn University. Background Braeburn

Please read the case first, then help with the question below.

Thank you.

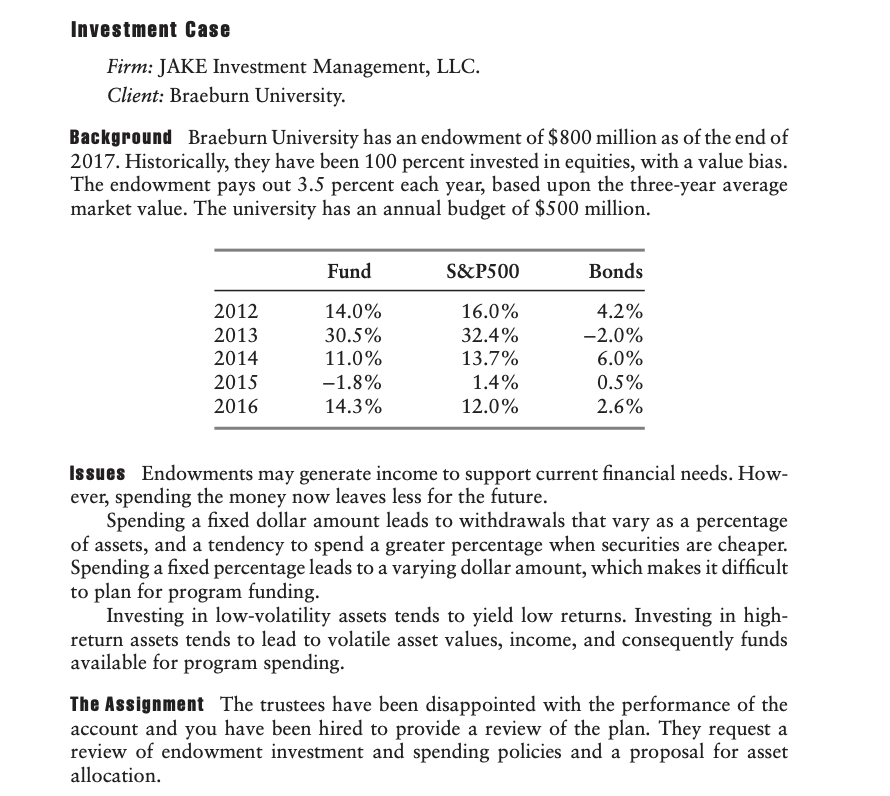

Investment Case Firm: JAKE Investment Management, LLC. Client: Braeburn University. Background Braeburn University has an endowment of $800 million as of the end of 2017. Historically, they have been 100 percent invested in equities, with a value bias. The endowment pays out 3.5 percent each year, based upon the three-year average market value. The university has an annual budget of $500 million. Fund S&P500 Bonds 2012 2013 2014 2015 2016 14.0% 30.5% 11.0% -1.8% 14.3% 16.0% 32.4% 13.7% 1.4% 12.0% 4.2% -2.0% 6.0% 0.5% 2.6% Issues Endowments may generate income to support current financial needs. How- ever, spending the money now leaves less for the future. Spending a fixed dollar amount leads to withdrawals that vary as a percentage of assets, and a tendency to spend a greater percentage when securities are cheaper. Spending a fixed percentage leads to a varying dollar amount, which makes it difficult to plan for program funding. Investing in low-volatility assets tends to yield low returns. Investing in high- return assets tends to lead to volatile asset values, income, and consequently funds available for program spending. The Assignment The trustees have been disappointed with the performance of the account and you have been hired to provide a review of the plan. They request a review of endowment investment and spending policies and a proposal for asset allocation. 2. Using terminology from Chapters 7 and 8 of the text, how would you describe JAKE Investment Management's strategy? 3. What are the investment strategies used by Jake Investment Management? 4. What are the strengths and weaknesses of the investment strategies? 5. In January 2018 when this evaluation took place, do you think that the Braeburn University endowment would be better off with a passive management strategy? Explain. 6. Do you think that JAKE Investment Management accurately captured the state of financial markets at the time that they wrote the report? Investment Case Firm: JAKE Investment Management, LLC. Client: Braeburn University. Background Braeburn University has an endowment of $800 million as of the end of 2017. Historically, they have been 100 percent invested in equities, with a value bias. The endowment pays out 3.5 percent each year, based upon the three-year average market value. The university has an annual budget of $500 million. Fund S&P500 Bonds 2012 2013 2014 2015 2016 14.0% 30.5% 11.0% -1.8% 14.3% 16.0% 32.4% 13.7% 1.4% 12.0% 4.2% -2.0% 6.0% 0.5% 2.6% Issues Endowments may generate income to support current financial needs. How- ever, spending the money now leaves less for the future. Spending a fixed dollar amount leads to withdrawals that vary as a percentage of assets, and a tendency to spend a greater percentage when securities are cheaper. Spending a fixed percentage leads to a varying dollar amount, which makes it difficult to plan for program funding. Investing in low-volatility assets tends to yield low returns. Investing in high- return assets tends to lead to volatile asset values, income, and consequently funds available for program spending. The Assignment The trustees have been disappointed with the performance of the account and you have been hired to provide a review of the plan. They request a review of endowment investment and spending policies and a proposal for asset allocation. 2. Using terminology from Chapters 7 and 8 of the text, how would you describe JAKE Investment Management's strategy? 3. What are the investment strategies used by Jake Investment Management? 4. What are the strengths and weaknesses of the investment strategies? 5. In January 2018 when this evaluation took place, do you think that the Braeburn University endowment would be better off with a passive management strategy? Explain. 6. Do you think that JAKE Investment Management accurately captured the state of financial markets at the time that they wrote the report

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts