Question: Please read the game instructions then fill out the predicted next years financial statement & decision sheet. Thank you! Game instructions: Decision sheet: Financial statement:

Please read the game instructions then fill out the predicted next years financial statement & decision sheet. Thank you!

Game instructions:

Decision sheet:

Financial statement:

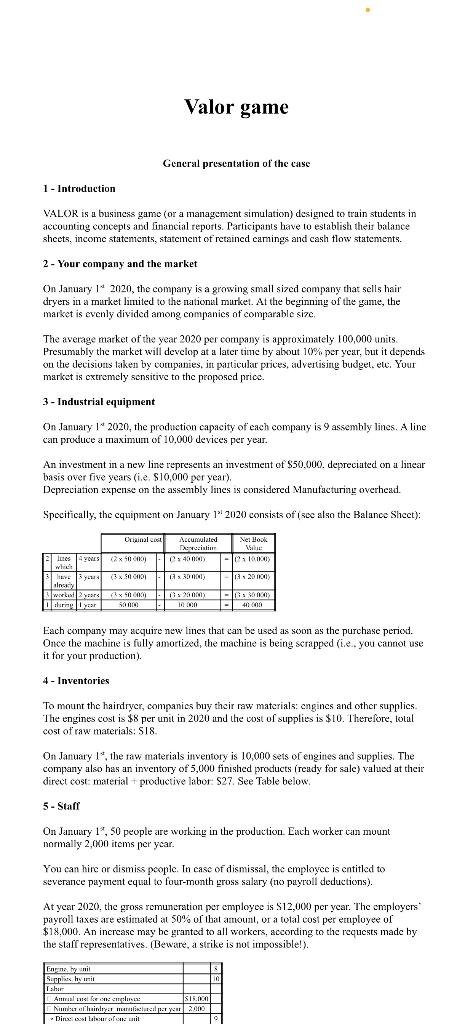

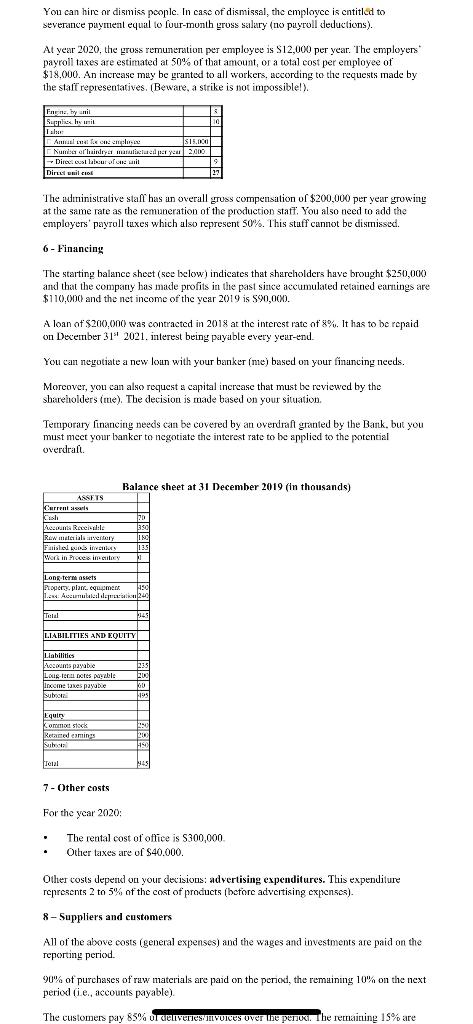

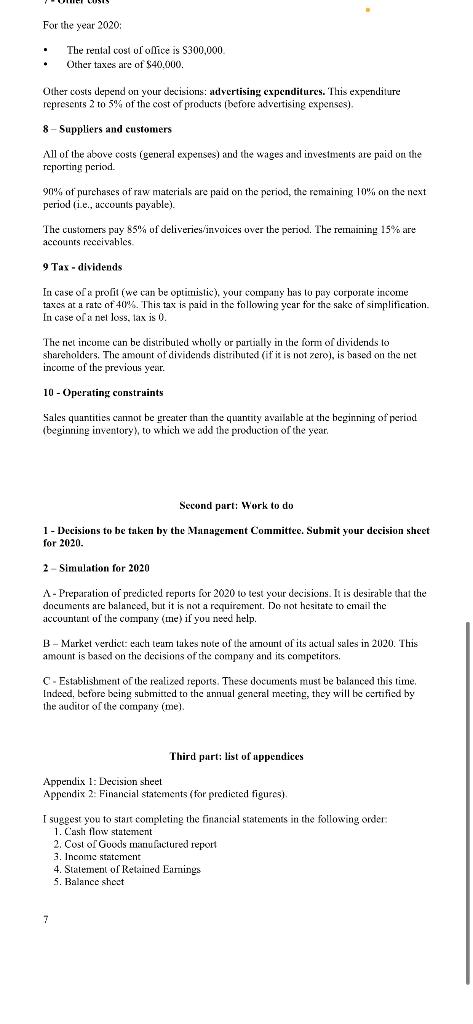

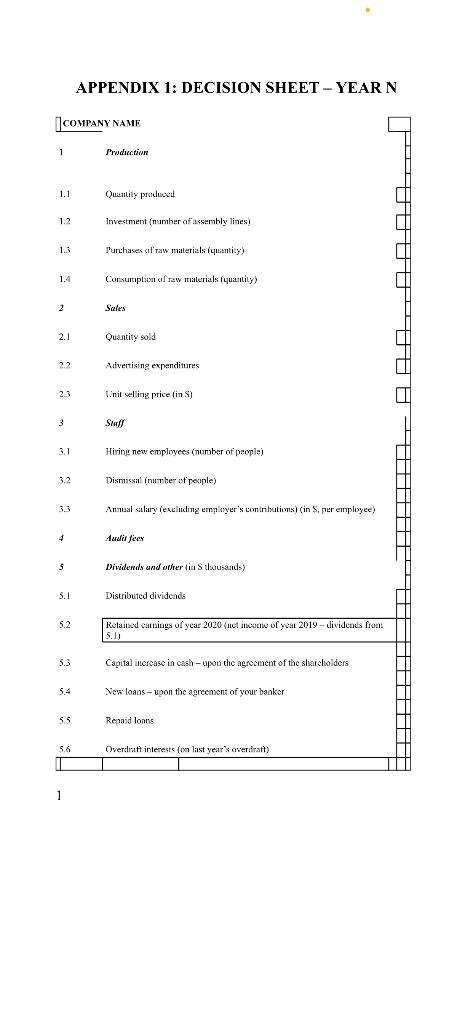

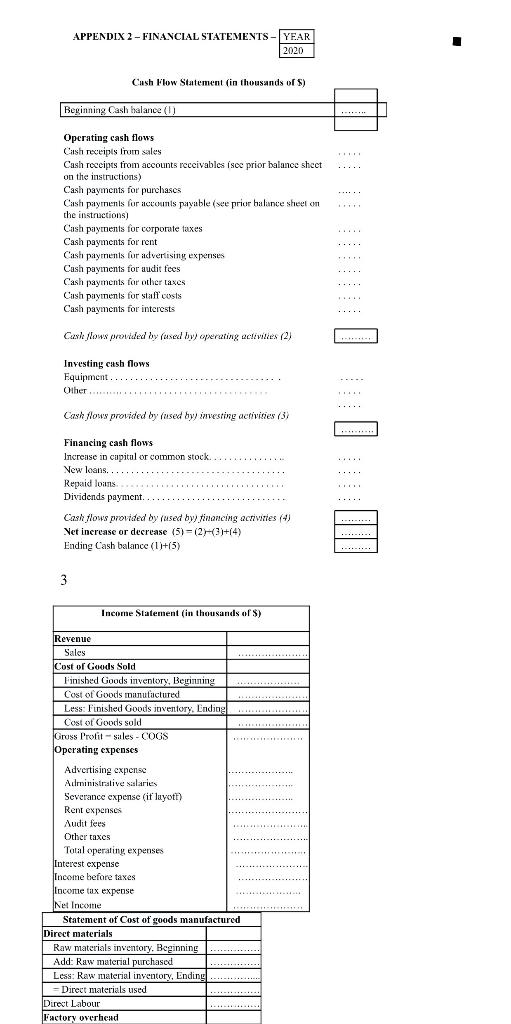

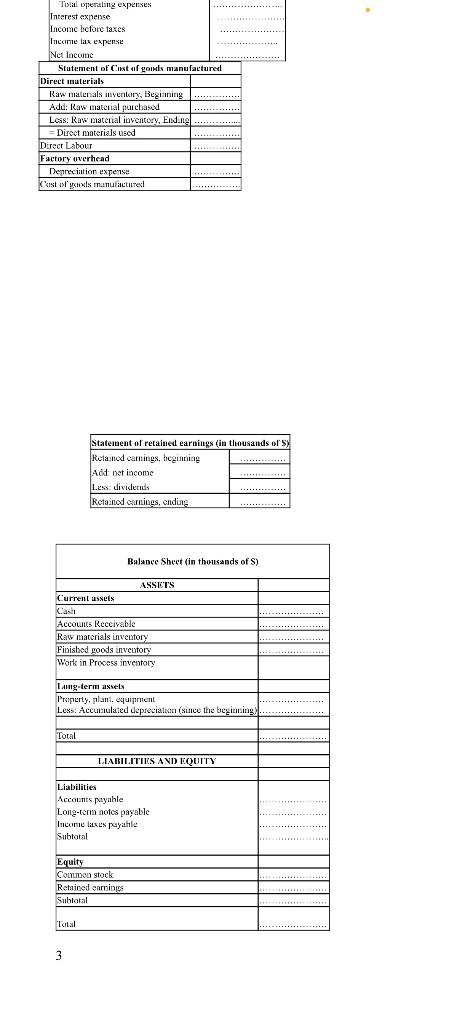

Valor game General presentation of the case 1 - Introduction VALOR is a business game (or a management simulation) designed to train students in accounting concepts and financial reports. Participants have lo establish their balance shects, income statements, statement of retained camings and cash flow statements. 2 - Your company and the market On January 1 2020, the company is a growing small sized company that sells hair dryers in a market limited to the national market. At the beginning of the game, the market is evenly divided among companics of comparable size. The average market of the year 2020 per company is approximately 100,000 units. Presumably the market will develop at a later time by about 10% per year, but it depends on the decisions taken by companies, in particular prices, advertising budget. etc. Your market is extremely sensitive to the proposed price. 3 - Industrial equipment On January 1* 2020, the production capacity of each company is 9 assembly lines. A line can produce a maximum of 10,000 devices per year. An investment in a new line represents an investment of $50.000. depreciated on a linear basis over five years (ie $10,000 per year), Depreciation expense on the assembly lines is considered Manufacturing overhead. Specitically, the cquipment on January 1 2020 consists of sec also the Balance Sheet): Cuinal Accumulated Net Book Descenti 5 14000 ) -100K) G30 ANS 2009 lates 4 YES (2x 50000 which 3 levy 3x0001 ( Indy wird aard x 400 thority LED 5000 ON 10000 -lis - 4100 Each company may acquire new lines that can be used as soon as the purchase period. Once the machine is fully amortized, the machine is being scrapped (.e. you cannot use it for your production) 4 - Inventories To mount the hairdryer, companies buy their raw materials: engines and other supplics. The engines cost is $8 per unit in 2020 und the cost of supplies is $10. Therefore, lolul cost of raw materials: SIS On January 19, the raw materials inventory is 10,000 sets of engines and supplies. The company also has an inventory of 5,000 finished products ready for sale) valued at their direct cost material productive labor: S27. See Table below. 5 - Staff On January 1", 50 people are working in the production. Each worker can mount normally 2,000 items per year. You can hire or dismiss poople. In case of dismissal, the employee is entitled to severance payment equul to four-month gross salary (10 payroll deductions). At year 2020, the gross remuneration per employee is $12,000 per year. The employers payroll taxes are estimated at 50% of that amount, or a total cost per etuployee of $18,000. An increase may be granted to all workers, according to the requests made by the staff representatives. (Beware, a strike is not impossible!). Supplies by nid Tahir Aman Reigns SI5.000 Nun hainly actual per year 2000 Numda Din silaturaful You can hire or dismiss poople. In case of dismissal, the employce is cntitled to severance payment equal to four-month gross salary (no payroll deductions). At year 2020, the gross remuneration per employee is $12,000 per year. The employers payroll taxes are estimated at 50% of that amount, or a total cost per employee of $18,000. An increase may be granted to all workers, according to the requests made by the staff representatives. (Beware, a strike is not impossible!). |Farms, by sril Sunlimit 10 Talen Annas on se $15.000 Numiza orhinder mand pray 2.400 - Direccus lacur of wil Dirut nicio The administrative stal has an overall gruss compensation of $200,000 per year growing at the same rate as the remuneration of the production staff. You also need to add the employers' payroll tuxes which also represent 50%. This stuff cannot be dismissed. 6 - Financing The starting balance sheet (see lxclow) indicates that shareholders have brought $250,000 and that the company has made profits in the past since accumulated retained earnings are $110,000 and the net income of the year 2019 is $90,000. A loan of $200,000) was contracted in 2018 at the interest rate of 8%. It has to be repaid on December 31" 2021. interest being payable every yeur-end. You can negotiate a new loan with your banker (me) based on your financing needs. Moreover, you can also request a capital increase that must be reviewed by the shareholders (te). The decision is made based on your situation. Tertiporary financing needs can be covered by an overdraft granted by the Bank. but you must meet your lanker to negotiate the interest rate to be applied to the potential Overdraft Balance sheet at 31 December 2019 (in thousands) ASSETS Current als Cushi 11 Fhewounts Recodile Es Raw materiale vertory INC Falling 135 Work in Procedimiy Long-term assets 11 Propers. planrcquement 150 1.22. Accumulate: 248 Total ILS LIABILITIES AND EQUITY 1 Liabilities hosounts payabue RES Louers payabi Income taxes payube MU Subota 193 Equiry Koroma stock Retard camins Si 19 ficial 45 7 - Other costs For the year 2020: . The rental cost of office is $300,000 Other taxes are of $40.000. Other costs depend on your decisions: advertising expenditures. This expenditure represents 2 to 5% of the cost of products (before advertising expenses). 8 - Suppliers and customers All of the above costs (general expenses) and the wages and investments are paid on the reporting period. 90% of purchases of raw materials are paid on the period, the remaining 10% on the next period (i.e., accounts payable) The customers pay 85% UL deliveries Voces over he penki. The recruiting 15% are For the year 2020: . The rental cost of office is $300,000 Other taxes are of $40,000. Other costs depend on your decisions: advertising expenditures. This expenditure represents 2 to 5% of the cost of products (before advertising expenses). 8 - Suppliers and customers All of the above costs (general expenses) and the wages and investments are paid on the reporting period 90% of purchases of raw materials are paid on the period, the remaining 10% on the next period (ie, accounts payable). The customers pay 85% of deliveries/invoices over the period. The remaining 15% are accounts receivables 9 Tax - dividends In case of a profit (we can be opticruistic), your company has to pay corporate income taxes at a rate of 40%. This tax is paid in the following year for the sake of simplification. In case of a nel loss, lax is 0. The net income can be distributed wholly or partially in the form of dividends to shareholders. The amount of dividends distributed (if it is not zero), is based on the net income of the previous year. 10 - Operating constraints Sales quantities cannot be greater than the quantity available at the beginning of period (beginning inventory), to which we add the production of the year. Second part: Work to do 1 - Decisions to be taken by the Management Committee. Submit your decision sheet for 2020. 2 - Simulation for 2020 A- A - Preparation of predicted reports for 2020 to test your decisions. It is desirable that the documents are balanced, but it is not a requirement. Do not hesitate to email the accountunt of the company (te) if you need help. B - Market verdict: each team takes nute of the amount of its actual sales in 2020. This amount based on the decisions of the company and its competitors. C-Establishment of the realized reports. These documents must be balanced this time, Indood, liefore being submitted to the annual general meeting, they will be certified by the auditor of the company (me). Third part: list of appendices Appendix 1: Decision sheet Appendix 2. Financial statements (for predicted figures), I suggest you to start completing the financial statements in the following order 1. Cash flow statement 2. Cost of Guols manufactured report 3. Income statement 4. Statement of Retained Earnings 5. Balance sheet 7 APPENDIX 1: DECISION SHEET-YEAR N coMPANY NAME 1 Production 1.1 Qulity produced 1.2 Investment member of assembly lines) 1.3 Purchases of raw materials quantity) Pooooo 1.4 Consumplan fraw materials quantity) 2 Sales 2.1 Quantity sold| Advertising expenditures 2.3 Unit selling price in S) 3 Stall 3.1 Hiring new employees (number of people, 3.2 Dismissal number of sexiple) Annual salary(excluding employer's contributions) (in Sper employee) 4 tudir fees S Dividends and other in thousands) S. Distributed dividcads 52 Retained camnings of year 2020 (nt income of year 2019 -dividcats from 5.1) 5.3 Capital increase in cash-upon the agreement of the shareholders 54 New loans - upon the agreement of your banker 55 Renaid loans Overcraft interests on last year's averiratt) 5.6 I 1 APPENDIX 2 - FINANCIAL STATEMENTS YEAR 2020 Cash Flow Statement (in thousands of S) Beginning Cash balance (1) Operating cash flows Cash receipts from sales Cash receipts from accounts receivables isec prior balance sheet on the instructions) Cash payments for purchaser Cash payments for accounts payable (see prior balance sheet om the instructions) Cash payments for corporate taxes Cash payments for rent Cash payments for advertising expenses Cash payments for audit fees Cash payments for other taxes Cash payments for staff costs Cash payments for interests Cask flows provided by used by operating activities (2) Investing cash flows Equipment. Other Cash flows provided by used by investing activities (3) Financing cash flows Increase in capital or common stock. New loons.......... Repaid loans Dividends payment. Cask flows provided by used by financing activities (4) Net increase or decrease (5)=( 23)+(4) Ending Cash balance (1)+(5) ... 3 3 Income Statement in thousands of S) Revenue Sales Cost of Goods Sold Finished Goods inventory, Bewinning Cost of Goods manufactured Less: Finished Goods inventory. Ending Cost of Goods sold Gross Profit-sales- COGS Operating expenses Advertising expense Administrative salaries Severance expense (if layott) Rent expenses Audit fees Other taxes Total operating expenses Interest expense Income before taxes locotte tax expense Net Income Statement of Cost of goods manufactured Direct materials Raw materials inventory. Beginning Add: Raw material purchased Less: Raw material inventory, Ending - Direct materials used Direct Labour Factory overhead Toslal operating expenses Interest expense Income before taxes Income tax expense Nct Income Stutement of Cost of youis manufactured Direct materials Raw materials inventary, Beginning Add: Raw material purchased Less: Raw material inventory, Ending Diroot materials used Direct Labour Factory overhead Denpreciation expense cost olyanovits manufactured Statement of retained earnings (in thousands of sy Retailed camnines, beginning Add net income Less dividends Retained comings, ending Balance Sheet (in thousands of S) ASSETS Current Net Casa Accounts Reccivable Raw materials inventory Finished goods inveutory Work in Process inventory Lang term assels Property, plant, quipment Less: Accumulated depreciation (since the beginning Total LIABILITIES AND EQUITY Liabilities Accounts payahle Long-term notes payable Inconelaxes payable Subtotal Equity COLLID stock Retained earnings Subtotal Total 3 Valor game General presentation of the case 1 - Introduction VALOR is a business game (or a management simulation) designed to train students in accounting concepts and financial reports. Participants have lo establish their balance shects, income statements, statement of retained camings and cash flow statements. 2 - Your company and the market On January 1 2020, the company is a growing small sized company that sells hair dryers in a market limited to the national market. At the beginning of the game, the market is evenly divided among companics of comparable size. The average market of the year 2020 per company is approximately 100,000 units. Presumably the market will develop at a later time by about 10% per year, but it depends on the decisions taken by companies, in particular prices, advertising budget. etc. Your market is extremely sensitive to the proposed price. 3 - Industrial equipment On January 1* 2020, the production capacity of each company is 9 assembly lines. A line can produce a maximum of 10,000 devices per year. An investment in a new line represents an investment of $50.000. depreciated on a linear basis over five years (ie $10,000 per year), Depreciation expense on the assembly lines is considered Manufacturing overhead. Specitically, the cquipment on January 1 2020 consists of sec also the Balance Sheet): Cuinal Accumulated Net Book Descenti 5 14000 ) -100K) G30 ANS 2009 lates 4 YES (2x 50000 which 3 levy 3x0001 ( Indy wird aard x 400 thority LED 5000 ON 10000 -lis - 4100 Each company may acquire new lines that can be used as soon as the purchase period. Once the machine is fully amortized, the machine is being scrapped (.e. you cannot use it for your production) 4 - Inventories To mount the hairdryer, companies buy their raw materials: engines and other supplics. The engines cost is $8 per unit in 2020 und the cost of supplies is $10. Therefore, lolul cost of raw materials: SIS On January 19, the raw materials inventory is 10,000 sets of engines and supplies. The company also has an inventory of 5,000 finished products ready for sale) valued at their direct cost material productive labor: S27. See Table below. 5 - Staff On January 1", 50 people are working in the production. Each worker can mount normally 2,000 items per year. You can hire or dismiss poople. In case of dismissal, the employee is entitled to severance payment equul to four-month gross salary (10 payroll deductions). At year 2020, the gross remuneration per employee is $12,000 per year. The employers payroll taxes are estimated at 50% of that amount, or a total cost per etuployee of $18,000. An increase may be granted to all workers, according to the requests made by the staff representatives. (Beware, a strike is not impossible!). Supplies by nid Tahir Aman Reigns SI5.000 Nun hainly actual per year 2000 Numda Din silaturaful You can hire or dismiss poople. In case of dismissal, the employce is cntitled to severance payment equal to four-month gross salary (no payroll deductions). At year 2020, the gross remuneration per employee is $12,000 per year. The employers payroll taxes are estimated at 50% of that amount, or a total cost per employee of $18,000. An increase may be granted to all workers, according to the requests made by the staff representatives. (Beware, a strike is not impossible!). |Farms, by sril Sunlimit 10 Talen Annas on se $15.000 Numiza orhinder mand pray 2.400 - Direccus lacur of wil Dirut nicio The administrative stal has an overall gruss compensation of $200,000 per year growing at the same rate as the remuneration of the production staff. You also need to add the employers' payroll tuxes which also represent 50%. This stuff cannot be dismissed. 6 - Financing The starting balance sheet (see lxclow) indicates that shareholders have brought $250,000 and that the company has made profits in the past since accumulated retained earnings are $110,000 and the net income of the year 2019 is $90,000. A loan of $200,000) was contracted in 2018 at the interest rate of 8%. It has to be repaid on December 31" 2021. interest being payable every yeur-end. You can negotiate a new loan with your banker (me) based on your financing needs. Moreover, you can also request a capital increase that must be reviewed by the shareholders (te). The decision is made based on your situation. Tertiporary financing needs can be covered by an overdraft granted by the Bank. but you must meet your lanker to negotiate the interest rate to be applied to the potential Overdraft Balance sheet at 31 December 2019 (in thousands) ASSETS Current als Cushi 11 Fhewounts Recodile Es Raw materiale vertory INC Falling 135 Work in Procedimiy Long-term assets 11 Propers. planrcquement 150 1.22. Accumulate: 248 Total ILS LIABILITIES AND EQUITY 1 Liabilities hosounts payabue RES Louers payabi Income taxes payube MU Subota 193 Equiry Koroma stock Retard camins Si 19 ficial 45 7 - Other costs For the year 2020: . The rental cost of office is $300,000 Other taxes are of $40.000. Other costs depend on your decisions: advertising expenditures. This expenditure represents 2 to 5% of the cost of products (before advertising expenses). 8 - Suppliers and customers All of the above costs (general expenses) and the wages and investments are paid on the reporting period. 90% of purchases of raw materials are paid on the period, the remaining 10% on the next period (i.e., accounts payable) The customers pay 85% UL deliveries Voces over he penki. The recruiting 15% are For the year 2020: . The rental cost of office is $300,000 Other taxes are of $40,000. Other costs depend on your decisions: advertising expenditures. This expenditure represents 2 to 5% of the cost of products (before advertising expenses). 8 - Suppliers and customers All of the above costs (general expenses) and the wages and investments are paid on the reporting period 90% of purchases of raw materials are paid on the period, the remaining 10% on the next period (ie, accounts payable). The customers pay 85% of deliveries/invoices over the period. The remaining 15% are accounts receivables 9 Tax - dividends In case of a profit (we can be opticruistic), your company has to pay corporate income taxes at a rate of 40%. This tax is paid in the following year for the sake of simplification. In case of a nel loss, lax is 0. The net income can be distributed wholly or partially in the form of dividends to shareholders. The amount of dividends distributed (if it is not zero), is based on the net income of the previous year. 10 - Operating constraints Sales quantities cannot be greater than the quantity available at the beginning of period (beginning inventory), to which we add the production of the year. Second part: Work to do 1 - Decisions to be taken by the Management Committee. Submit your decision sheet for 2020. 2 - Simulation for 2020 A- A - Preparation of predicted reports for 2020 to test your decisions. It is desirable that the documents are balanced, but it is not a requirement. Do not hesitate to email the accountunt of the company (te) if you need help. B - Market verdict: each team takes nute of the amount of its actual sales in 2020. This amount based on the decisions of the company and its competitors. C-Establishment of the realized reports. These documents must be balanced this time, Indood, liefore being submitted to the annual general meeting, they will be certified by the auditor of the company (me). Third part: list of appendices Appendix 1: Decision sheet Appendix 2. Financial statements (for predicted figures), I suggest you to start completing the financial statements in the following order 1. Cash flow statement 2. Cost of Guols manufactured report 3. Income statement 4. Statement of Retained Earnings 5. Balance sheet 7 APPENDIX 1: DECISION SHEET-YEAR N coMPANY NAME 1 Production 1.1 Qulity produced 1.2 Investment member of assembly lines) 1.3 Purchases of raw materials quantity) Pooooo 1.4 Consumplan fraw materials quantity) 2 Sales 2.1 Quantity sold| Advertising expenditures 2.3 Unit selling price in S) 3 Stall 3.1 Hiring new employees (number of people, 3.2 Dismissal number of sexiple) Annual salary(excluding employer's contributions) (in Sper employee) 4 tudir fees S Dividends and other in thousands) S. Distributed dividcads 52 Retained camnings of year 2020 (nt income of year 2019 -dividcats from 5.1) 5.3 Capital increase in cash-upon the agreement of the shareholders 54 New loans - upon the agreement of your banker 55 Renaid loans Overcraft interests on last year's averiratt) 5.6 I 1 APPENDIX 2 - FINANCIAL STATEMENTS YEAR 2020 Cash Flow Statement (in thousands of S) Beginning Cash balance (1) Operating cash flows Cash receipts from sales Cash receipts from accounts receivables isec prior balance sheet on the instructions) Cash payments for purchaser Cash payments for accounts payable (see prior balance sheet om the instructions) Cash payments for corporate taxes Cash payments for rent Cash payments for advertising expenses Cash payments for audit fees Cash payments for other taxes Cash payments for staff costs Cash payments for interests Cask flows provided by used by operating activities (2) Investing cash flows Equipment. Other Cash flows provided by used by investing activities (3) Financing cash flows Increase in capital or common stock. New loons.......... Repaid loans Dividends payment. Cask flows provided by used by financing activities (4) Net increase or decrease (5)=( 23)+(4) Ending Cash balance (1)+(5) ... 3 3 Income Statement in thousands of S) Revenue Sales Cost of Goods Sold Finished Goods inventory, Bewinning Cost of Goods manufactured Less: Finished Goods inventory. Ending Cost of Goods sold Gross Profit-sales- COGS Operating expenses Advertising expense Administrative salaries Severance expense (if layott) Rent expenses Audit fees Other taxes Total operating expenses Interest expense Income before taxes locotte tax expense Net Income Statement of Cost of goods manufactured Direct materials Raw materials inventory. Beginning Add: Raw material purchased Less: Raw material inventory, Ending - Direct materials used Direct Labour Factory overhead Toslal operating expenses Interest expense Income before taxes Income tax expense Nct Income Stutement of Cost of youis manufactured Direct materials Raw materials inventary, Beginning Add: Raw material purchased Less: Raw material inventory, Ending Diroot materials used Direct Labour Factory overhead Denpreciation expense cost olyanovits manufactured Statement of retained earnings (in thousands of sy Retailed camnines, beginning Add net income Less dividends Retained comings, ending Balance Sheet (in thousands of S) ASSETS Current Net Casa Accounts Reccivable Raw materials inventory Finished goods inveutory Work in Process inventory Lang term assels Property, plant, quipment Less: Accumulated depreciation (since the beginning Total LIABILITIES AND EQUITY Liabilities Accounts payahle Long-term notes payable Inconelaxes payable Subtotal Equity COLLID stock Retained earnings Subtotal Total 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts