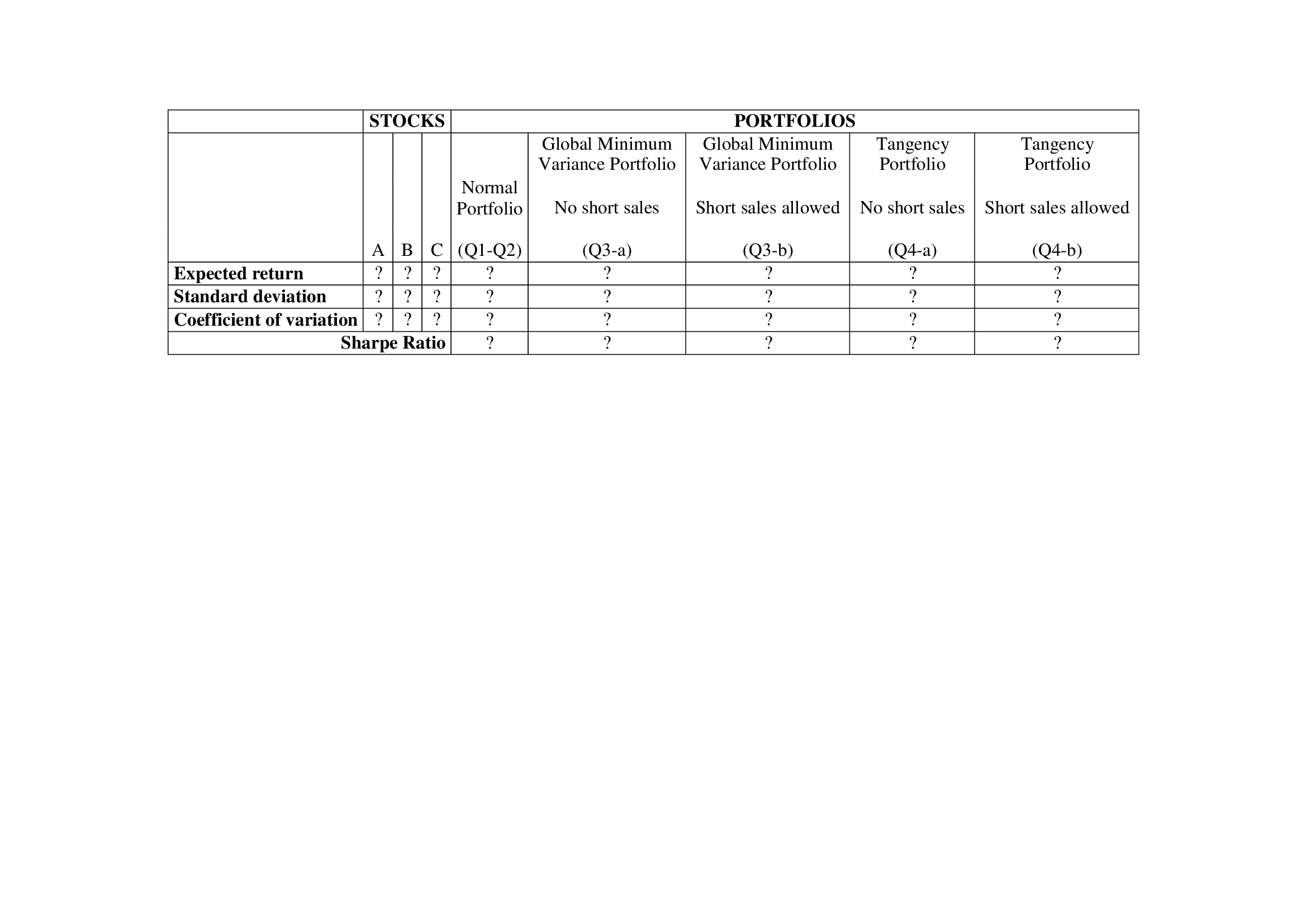

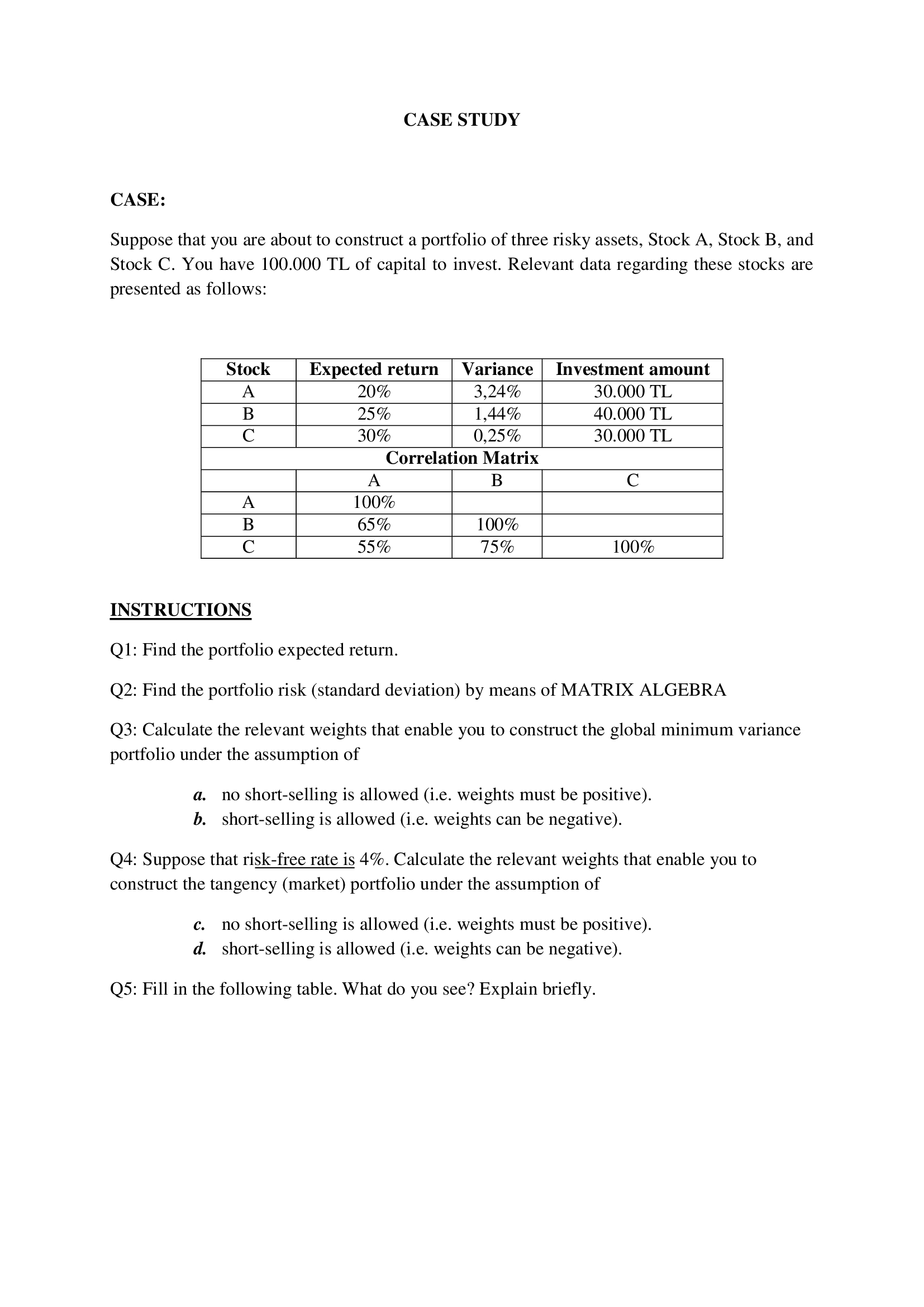

Question: please read the instructions in the document and below as well! STOCKS PORTFOLIOS Global Minimum Global Minimum Tangency Tangency Variance Portfolio Variance Portfolio Portfolio Portfolio

please read the instructions in the document and below as well!

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock